The dollar (USD) fell across the board for the second day in a row on Friday, as investors favored riskier currencies in the aftermath of lower-than-expected US inflation data, which bolstered the case for the Federal Reserve to scale back its aggressive interest rate hikes.

The dollar fell further on Friday as a result of Thursday’s data, which showed that consumer inflation in the United States rose 7.7% year on year in October, the slowest rate since January and below forecasts of 8%.

The dollar’s long rally over the last two years drew a slew of bulls, resulting in crowded positioning, and Thursday’s data left many of them looking for a quick exit, according to strategists.

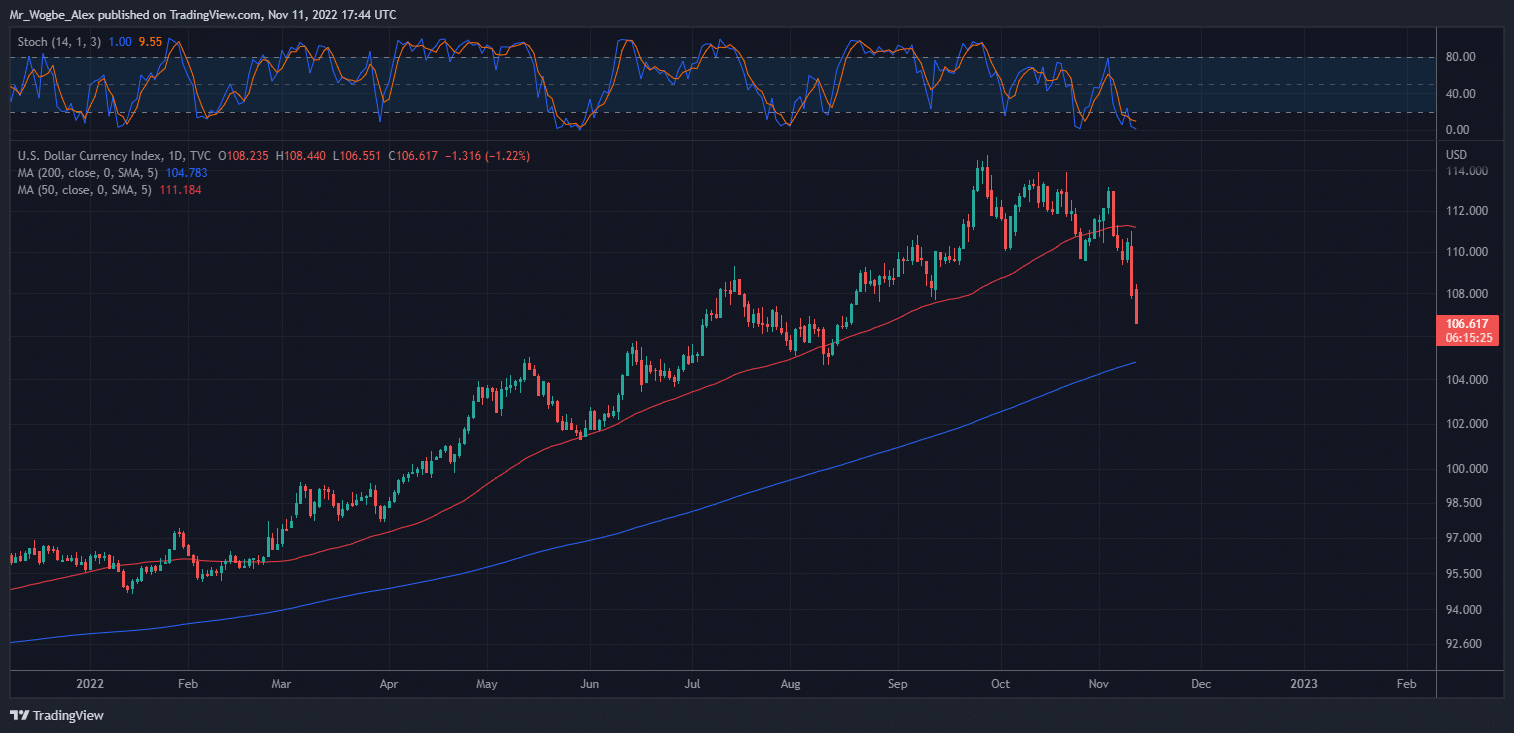

US Dollar Index on Track to Record Worst Two-Day Session since 2009

US Dollar Index on Track to Record Worst Two-Day Session since 2009

The dollar fell 1.51% against the Japanese yen (JPY) to 138.82 yen, while the euro (EUR) rose 1.30% to $1.0340 against the greenback.

The dollar received little support from survey data released on Friday, which showed that consumer sentiment in the United States fell in November, weighed down by persistent concerns about inflation and higher borrowing costs.

The risk-averse Australian (AUD) and New Zealand (NZD) dollars both gained more than 1% against the US dollar.

The dollar index (DXY) was down almost 4% against a basket of currencies over two sessions, on track for its biggest two-day percentage loss since March 2009. Regardless, the index is up about 19% year-to-date (YTD).

The Chinese health authorities’ relaxation of parts of the nation’s severe COVID-19 requirements, such as cutting the length of quarantine periods for people who are in close contact with patients and foreign travelers, helped investors’ appetite for risk.

Investors are now pricing in a 71.5% likelihood of a 50-basis-point increase in US interest rates next month, up from a 50/50 chance a week ago, according to the futures market.n

In other news, while still entering what is likely to be a protracted recession, the UK economy did not drop as much as anticipated in the three months to September, according to figures released by the country. As a result, Sterling increased 0.70% against the dollar to 1.17900.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

US Dollar Index on Track to Record Worst Two-Day Session since 2009

US Dollar Index on Track to Record Worst Two-Day Session since 2009