The US30 market continues to relinquish its gathered gains in the ongoing session. Nevertheless, looking at the market, price action is still retaining a significant part of the profit from three sessions ago, and technical indicators keep telling us that price action still has some upside propensity.

Important Price Marks:

Resistance: $33,252, $33,300, $33,350

Support: $33,202, $33,150, $33,100

Bearish Dominance in the US30 May Be Weakening

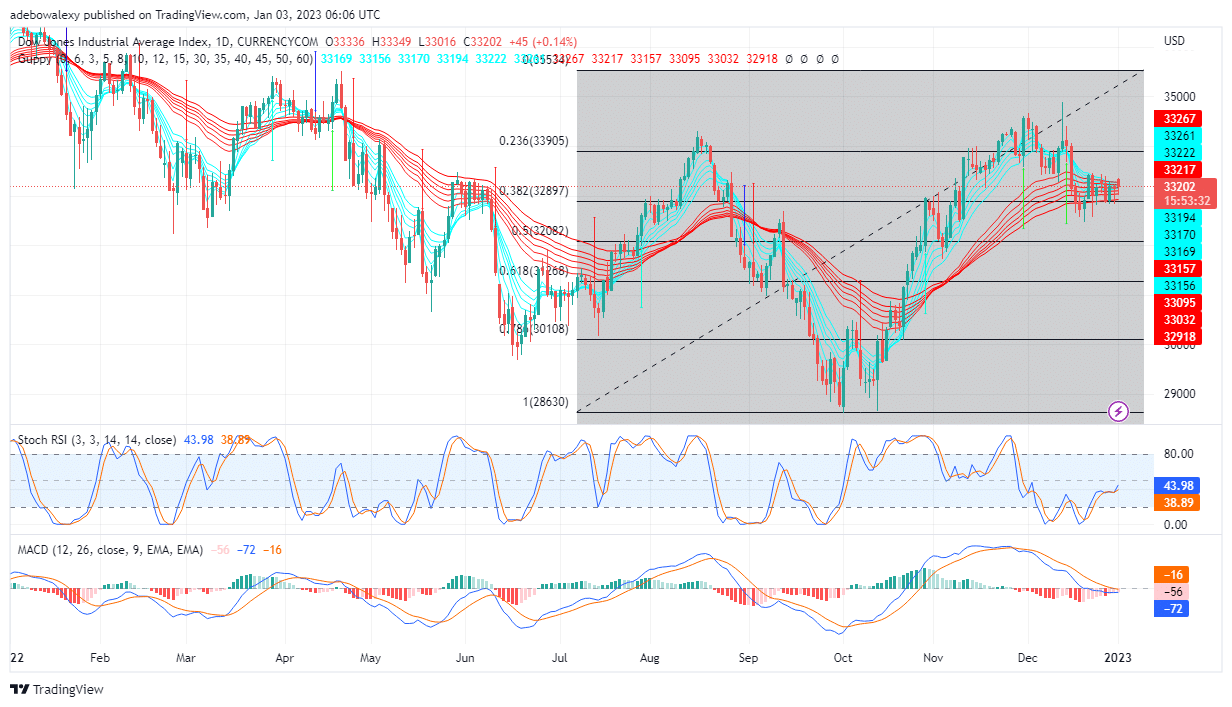

On the 24-hour US30 market, bears were able to snatch control out of the grip of bulls. This could be seen as the price in the current trading session appearing to be higher than the previous, even though the bears have been in control since then. In addition, the lines of the Stochastic RSI indicator portrayed that buying is steadily increasing. This could be observed as the curve of the indicator appears to have resumed moving toward the 50 level. Meanwhile, despite the appearance of a bearish price candle for this session, the MACD indicator continues to indicate that selling pressure is weakening. The lines of the MACD can be seen coming together for a bullish crossover just below the equilibrium level. Consequently, buyers can regain dominance in this market.

US30 May Soon Gain Significant Upside Momentum

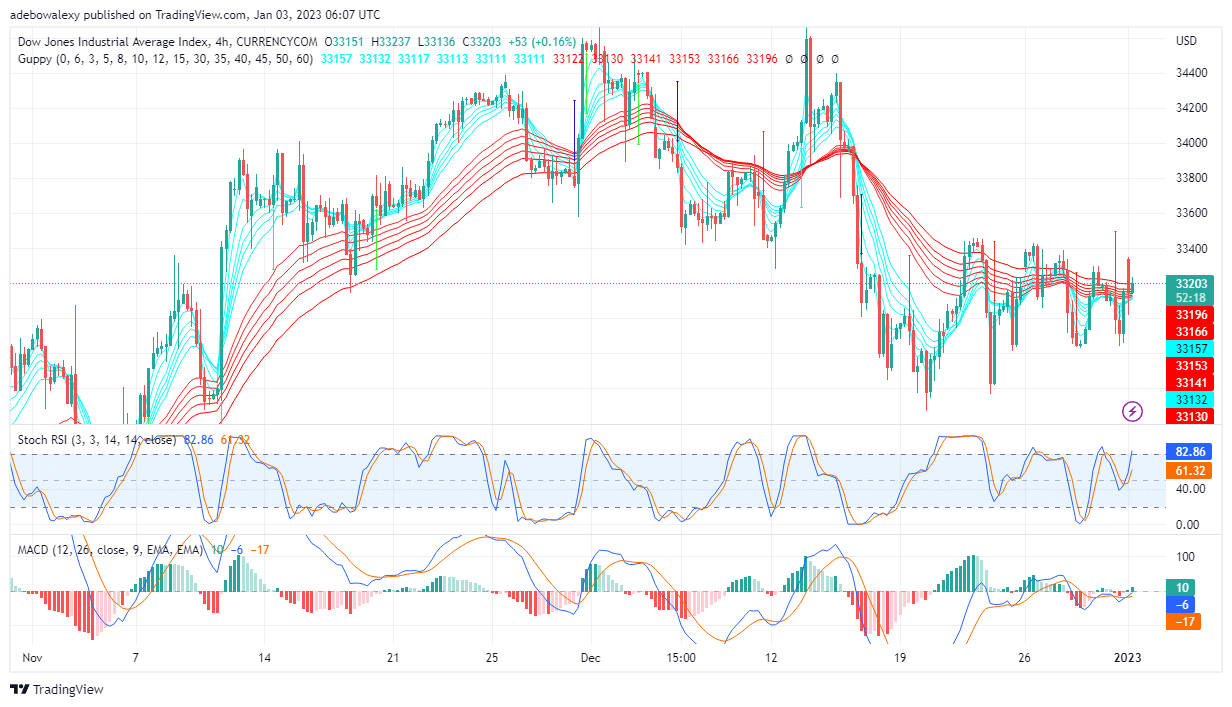

Moving to the 4-hour market, we can see that the current price of US30 is now at the same level as the last GMMA curve. Moreover, based on technical indicators, traders may soon gain significant buying confidence. Most of the two sets of GMMA curves are now converging under the last green price candle on this chart. Eventually, if the GMMA successfully performs a crossover, traders may gain significant confidence to go long. At the same time, the RSI curves are still rising into the overbought area. Meanwhile, the MACD lines are also indicating an increase in the market’s upside forces. Therefore, traders can anticipate that the price may increase toward the $33,300 level, as indicated by trading indicators.

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.