Bullish reversal envisaged in Uniswap market

Uniswap Price Analysis – 07 September

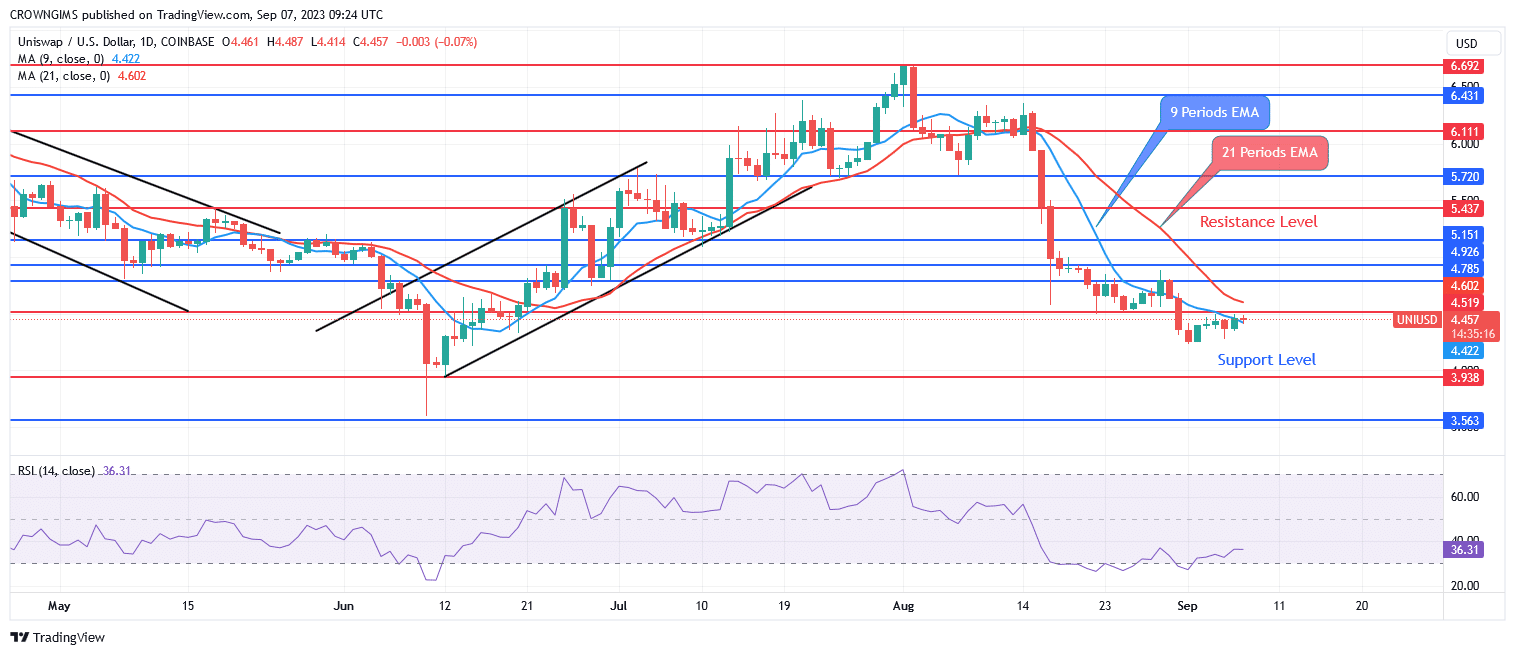

If there is sufficient buying pressure to move past the $4.7 resistance level, the $4.9 and $5.4 resistance levels might be broken. If sellers are successful in driving the price below the $4.5 support level, the price levels of $3.9 and $3.5 will be put to the test.

UNI/USD Market

Key Levels:

Resistance levels: $4.7, $4.9, $5.4

Support levels: $4.5, $3.9, $3.5

UNI/USD Long-term Trend: Bearish

Uniswap is bearish on the daily Chart. At the moment, buyers are trying to prevent further decrease at $4.5 level. Last month, the cryptocurrency was under favorable pressure. Uniswap had to increase to overcome the $6.4 resistance level. When the $6.6 high was contested, the bullish drive diminished. A significant bearish daily candle formed on August 2 and the price started to fall. The previous support levels of $5.7, $5.4, and $4.7 were breached by the downturn. Currently, the $4.5 support level is coming under increasing assault.

Trading below the two EMAs on Uniswap indicates a downward trend. If there is sufficient buying pressure to move past the $4.7 resistance level, the $4.9 and $5.4 resistance levels might be broken. If sellers are successful in driving the price below the $4.5 support level, the price levels of $3.9 and $3.5 will be put to the test. The period 14 relative strength indicator curves upward at level 36, indicating a buy.

UNI/USD Medium-term Trend: Bearish

Uniswap 4-hour chart indicates a bearish bias. The cryptocurrency overcame multiple barriers, including those at $6.1 and $6.4, before hitting resistance at a price of $6.6. When the sellers maintained the $6.6 barrier level, the price started to decline. Due to greater vendor pressure, the price has decreased to $4.7. Currently, bulls are battling bears, which caused ranging movement.

Buyers are currently exerting price pressure. The Uniswap price exponential 9- and 21-period moving averages are currently above them, indicating a buy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.