Sellers exert more pressure in Uniswap market

Uniswap Price Analysis – 29 August

Should buying pressure reappear around $5.8, it could breach both resistance levels at $6.5 and $6.8. Should sellers manage to breach the $5.4 support level, they could attempt to reevaluate the $5.1 and $4.7 levels.

UNI/USD Market

Key Levels:

Resistance levels: $5.8, $6.5, $6.8

Support levels: $5.4, $5.1, $4.7

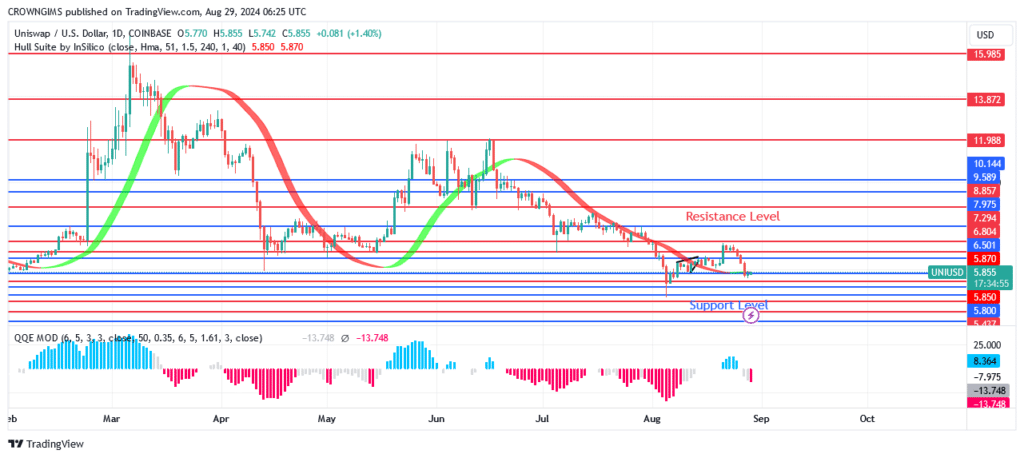

UNI/USD Long-term Trend: Bearish

The daily chart of Uniswap clearly shows a bearish reversal indicator. The coin was intended to move to the $6.8 resistance level during the August 21 test of the resistance level at $7.2. Bears held this level while the price dropped to $5.1. Prices for cryptocurrencies have decreased over the last two weeks, coming to $5.1. Following that, it began to fall and challenge the $4.7 support level. The suppliers followed the earlier directive. The previously mentioned level is still being tested by the market. It is now ranging at the $5.4 threshold.

A falling trend is indicated by Uniswap’s trading below the Hull Suite indicator for cryptocurrency signals. Should buying pressure reappear around $5.8, it could breach both resistance levels at $6.5 and $6.8. Should sellers manage to breach the $5.4 support level, they could attempt to reevaluate the $5.1 and $4.7 levels.

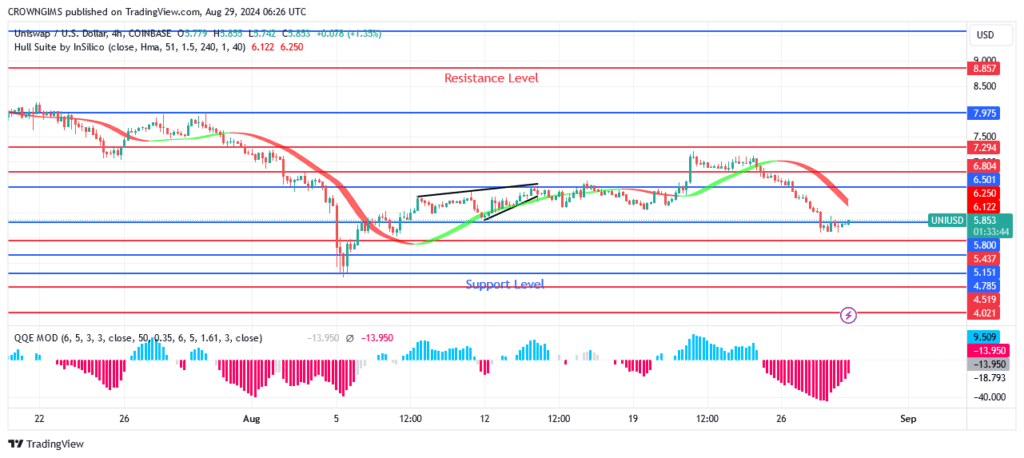

UNI/USD Medium-term Trend: Bearish

Uniswap’s 4-hour chart indicates a decreasing trend. As soon as the sellers kept the $6.8 barrier level, price reductions started. Significant work was finished a few days ago, and pricing values were as low as $5.4. When retailers increased the pressure on their customers, this is what transpired. Prices dropped as buyers became irritated close to the previously specified level, while bears remained at the previously indicated level. The bears gained speed, and the Uniswap started to slope. However, it has since reducing testing $4.7 level, indicating a bearish trend.

Right now, the price is reducing below the dynamic support level by a considerable amount. In Uniswap, there is market volatility. A selling position is indicated by the negative QQE MOD signal histogram.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.