Bearish pressure continues in Uniswap market

Uniswap Price Analysis – 28 August

If buying pressure increases at $9.0, it can break through the $10.0 resistance level and reach the $11.0 to $12.0 potential. Merchandisers can attempt to reassess the $8.0 and $7.0 prospects if they are able to overcome the $9.0 opposing perspective.

UNI/USD Market

Key Levels:

Resistance levels: $10.0, $11.0, $12.0

Support levels: $9.0, $8.0, $7.0

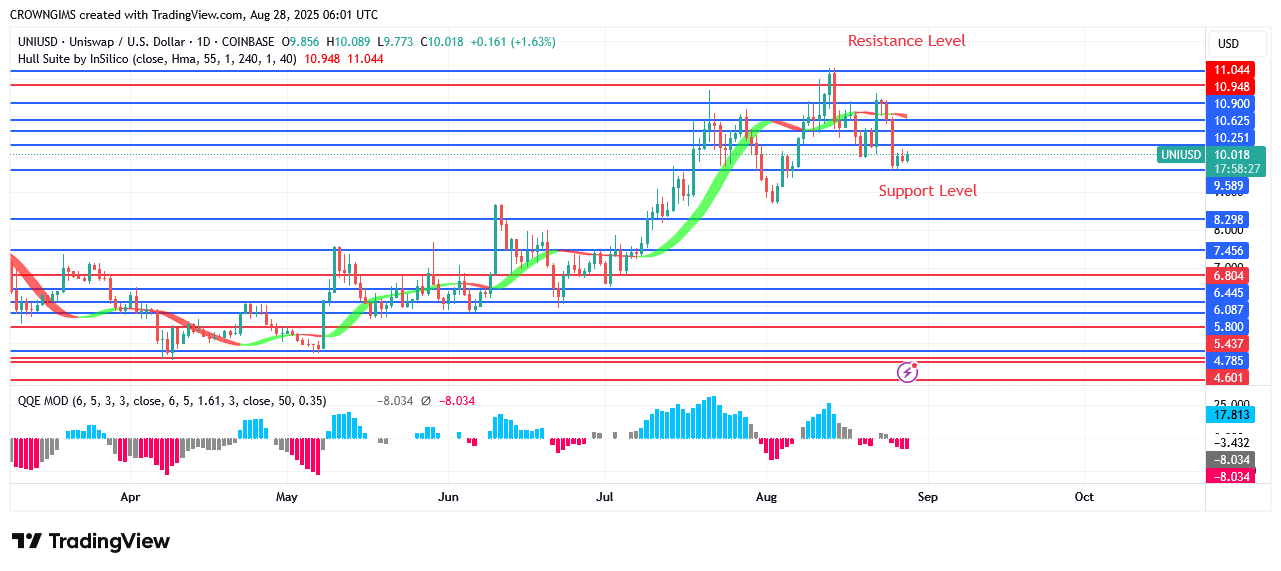

UNI/USD Long-term Trend: Bearish

The Uniswap daily chart’s $12.0 zone shows a lot of bearish momentum. On May 8, the cryptocurrency bottomed very close to the $5.4 support level and established a double bottom chart pattern. This set off a bullish run that eventually hit the $11.0 barrier level. As the price increases once more, the bulls hold onto their gains. The price of Uniswap dropped to roughly $10.0 last week. After then, it kept declining until it hit $9.0.0. Once bulls have fought bears at the proper level, they fall. It is currently making an effort to break below the $9.0 mark.

A downward trend is indicated by Uniswap’s trading below the Hull Suite cryptocurrency signal indicator. If buying pressure increases at $9.0, it can break through the $10.0 resistance level and reach the $11.0 to $12.0 potential. Merchandisers can attempt to reassess the $8.0 and $7.0 prospects if they are able to overcome the $9.0 opposing perspective.

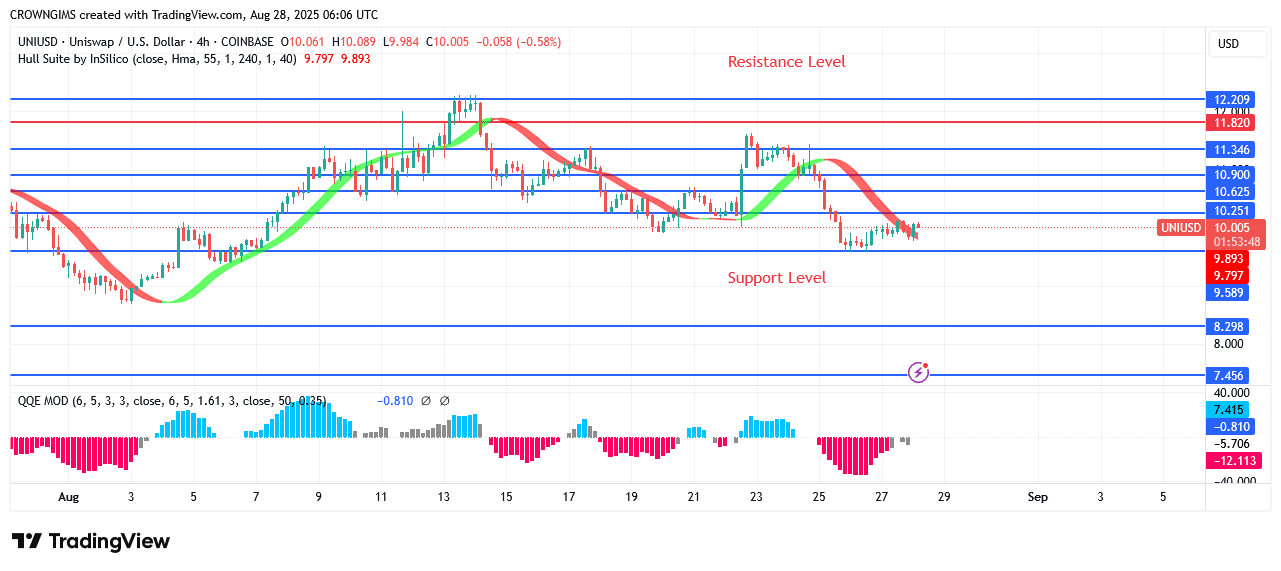

UNI/USD Medium-term Trend: Bearish

Uniswap’s 4-hour chart displayed a bearish reversal trend. When the companies reached the $9.5 barrier, the price increase started. Charges increased to $10.5 a few days after the price increase was confirmed. As merchants put more pressure on their demands, this happened. Prices rose to the predetermined level as trade became more cautious; the Uniswap touched $10.5 before testing $12.0. The coin starts a negative trend after bouncing off the previously noted high.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.