Sellers increase pressure on Uniswap market

Uniswap Price Analysis – 03 April

It can overcome the $6.5 resistance level and rise to the $6.8 to $7.4 levels if buying pressure picks up around $5.8. If sellers are able to break through the $5.8 support level, they may try to reassess the $5.4 and $5.1 levels.

UNI/USD Market

Key Levels:

Resistance levels: $6.5, $6.8, $7.4

Support levels: $5.8, $5.4, $5.1

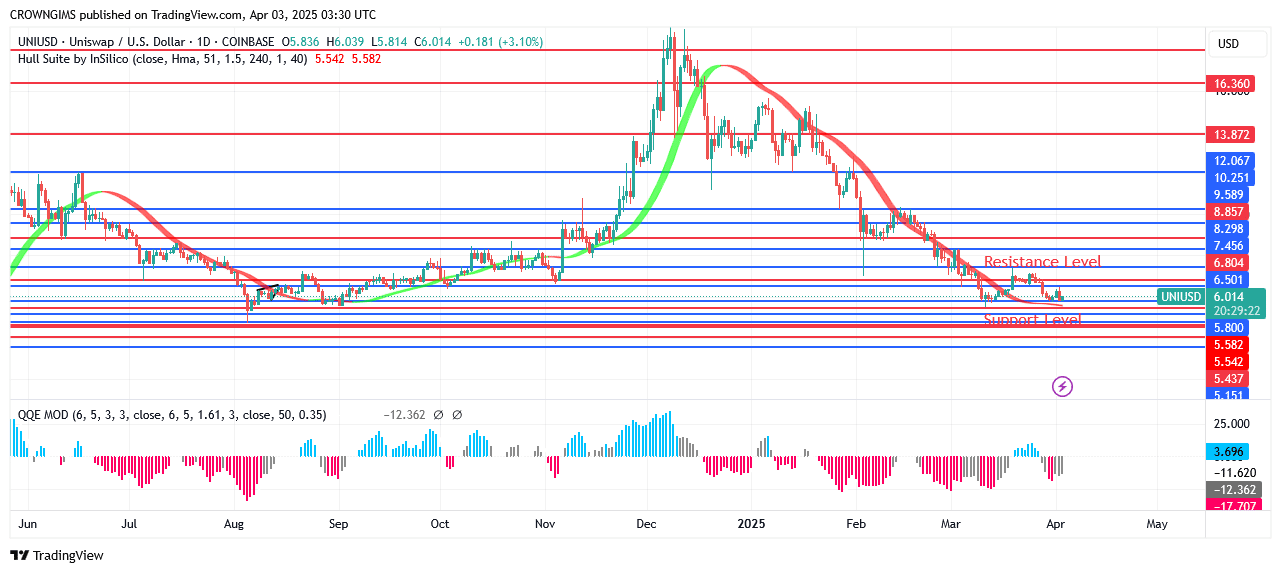

UNI/USD Long-term Trend: Bearish

The bearish reversal indicator known as the “Double top” is clearly visible on the Uniswap daily chart. It was predicted on December 8 that the currency will rise above the resistance level of $18.0 and fall to the support level of $8.2. The bears held onto their market as the price fell below $7.4. In recent weeks, Uniswap’s pricing has dropped to about $6.5. After that, it started to decrease and approach the $5.8 support level.

Uniswap’s trading below the Hull Suite cryptocurrency signal indication indicates a negative trend. It can overcome the $6.5 resistance level and rise to the $6.8 to $7.4 levels if buying pressure picks up around $5.8. If sellers are able to break through the $5.8 support level, they may try to reassess the $5.4 and $5.1 levels.

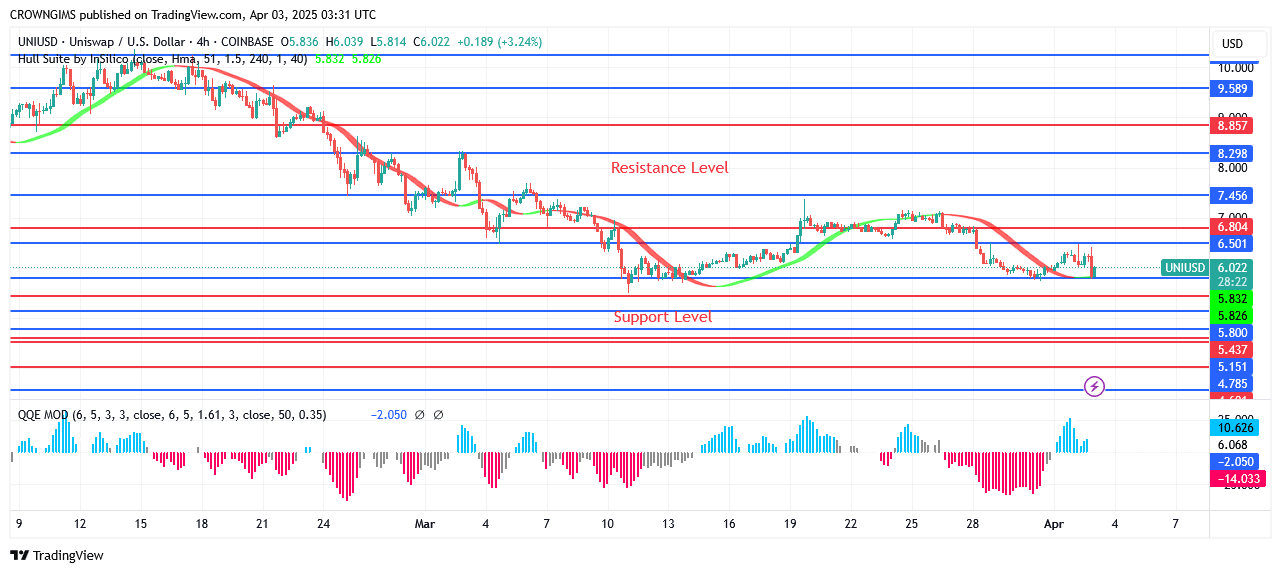

UNI/USD Medium-term Trend: Bearish

The 4-hour chart for Uniswap shows a downward trend. Price cuts began as soon as the buyers hit the $16.3 threshold. Prices dropped to $6.8 after the major refurbishment was completed a few days ago. This is what happened when sellers put more pressure on their market. As selling grows more cautious, prices decrease to the predefined level; the Uniswap followed the bears’ example and decline to $5.8.

The price is currently below the dynamic support level. The market is down at Uniswap. A selling position is indicated by a negative QQE MOD signal histogram.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.