Raydium is an automated market maker (AMM) and decentralized exchange (DEX) built on the Solana blockchain. It leverages the high-speed, low-cost capabilities of Solana to offer users lightning-fast trades, ample liquidity, and attractive yield farming opportunities.

In this comprehensive guide, we’ll cover what Raydium is, how it works, and what sets it apart in the competitive landscape of decentralized finance (DeFi).

Understanding Raydium

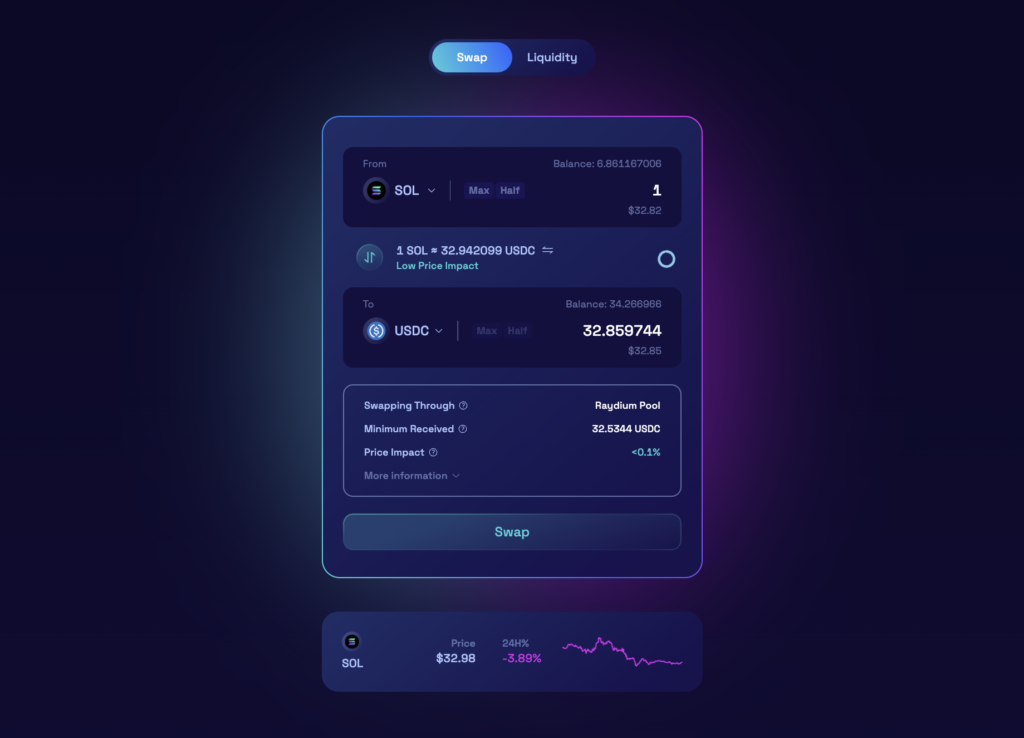

At its core, Raydium functions as an AMM, allowing users to swap tokens seamlessly without relying on traditional order books. Instead, this project utilizes liquidity pools, where users can deposit their tokens and earn a share of the trading fees. This model ensures there’s always sufficient liquidity for traders to execute swaps quickly and efficiently.

One of Raydium’s standout features is its integration with Serum, a decentralized order book-based exchange also built on Solana.

By tapping into Serum’s central limit order book, this blockchain project can access and share liquidity across the entire Serum ecosystem. This unique symbiosis provides Raydium users with the best of both worlds: the flexibility and ease of use of an AMM, combined with the deep liquidity and advanced trading features of an order book exchange.

Yield Farming and Staking on Raydium

Beyond its core swapping functionality, Raydium offers lucrative yield farming opportunities for liquidity providers. When users deposit tokens into a Raydium liquidity pool, they receive LP tokens representing their share of the pool.

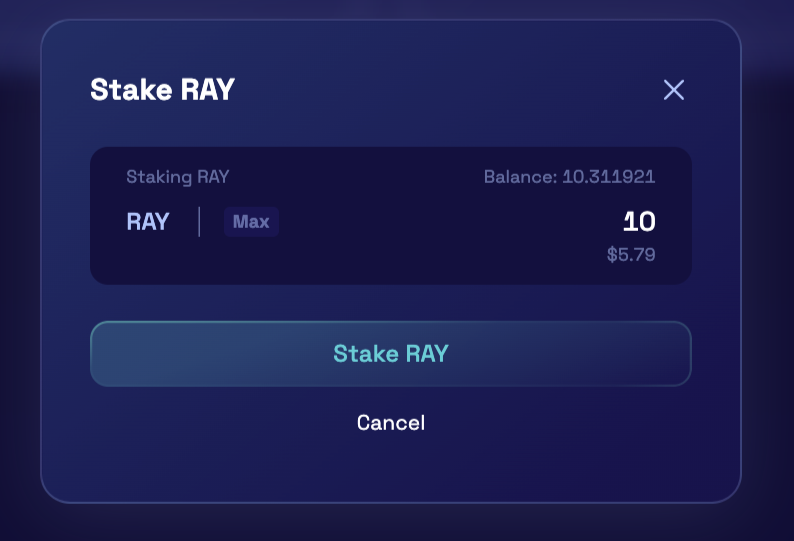

These LP tokens can then be staked in Raydium’s farms to earn RAY, the platform’s native utility token, as an additional reward on top of the regular trading fees.

This project takes yield farming a step further with its innovative AcceleRaytor feature. AcceleRaytor serves as a launchpad for new Solana projects, allowing users to stake their RAY tokens to participate in initial DEX offerings (IDOs).

This not only provides a secure and decentralized fundraising platform for promising projects but also gives RAY holders early access to potentially high-growth tokens.

The Power of the RAY Token

The RAY token lies at the heart of the Raydium ecosystem, serving multiple purposes. As mentioned earlier, RAY is distributed as a reward for liquidity providers and stakers. However, its utility extends beyond mere incentivization.

RAY token holders will eventually have governance rights, allowing them to propose and vote on changes to the Raydium protocol. This decentralized governance model ensures that the platform remains community-driven and aligned with the interests of its users.

Moreover, a portion of the trading fees generated on this project is used to buy back and burn RAY tokens, creating deflationary pressure that potentially increases the token’s value over time.

RAY has a hard cap supply of 555 million tokens, of which 262 million are in circulation. With a retail price of $1.74, RAY has a market capitalization of $458 million, making it the 158th largest cryptocurrency on the market.

Raydium’s Competitive Advantages

In the rapidly evolving world of DeFi, Raydium stands out for several reasons.

- Firstly, by building on Solana, Raydium inherits the blockchain’s high throughput, low latency, and minimal transaction fees. This enables Raydium to offer a user experience that rivals centralized exchanges in terms of speed and cost-effectiveness.

- Raydium’s partnership with Serum gives it a unique edge. The ability to tap into Serum’s order book liquidity and advanced trading features sets Raydium apart from other AMMs that rely solely on liquidity pools.

- Raydium’s focus on user experience and innovation is evident in its intuitive interface, a diverse range of yield farming options, and the AcceleRaytor launchpad. By continuously pushing the boundaries of what’s possible in DeFi, Raydium has positioned itself as a pioneer in the Solana ecosystem and beyond.

Wrap Up

Raydium is a powerful DeFi protocol that combines the best aspects of AMMs and order book exchanges. Built on the high-performance Solana blockchain and deeply integrated with Serum, Raydium offers users lightning-fast trades, deep liquidity, and attractive yield farming opportunities.

With its native RAY token serving as the backbone of the ecosystem, Raydium is well-positioned to continue innovating and driving the growth of decentralized finance on Solana and beyond. Whether you’re a seasoned DeFi user or just starting your journey, this project is definitely worth exploring.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.