TRON may decrease to $0.101 level

TRON Price Analysis – 30 May

The $0.117 and $0.120 barriers may be overcome by the price of TRON if the purchasing trend stays above $0.114. However, if the decreasing trend persists below $0.108, the price could drop to $0.101 and $0.097.

Key Levels:

Resistance levels: $0.114, $0.117, $0.120

Support levels: $0.108, $0.101, $0.097

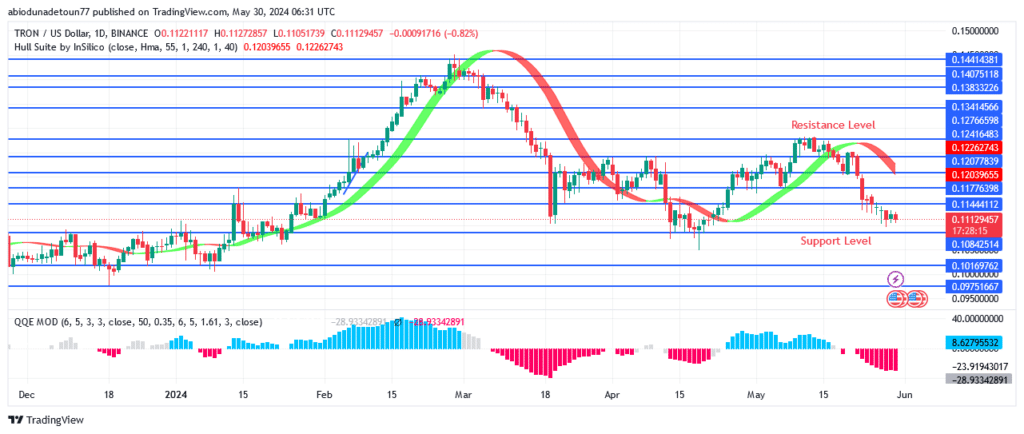

TRX/USD Long-term Trend: Bearish

The daily chart for TRON is decreasing. On April 19, the coin’s price broke above the $0.101 barrier after a protracted downward trend. At $0.101, buyers were able to hold a steady line. For TRON, the previously described support barrier proved to be insurmountable. The cost is going up. Over the past two weeks, there has been less buying and a decrease in price following a brief fall below $0.114. The bearish engulfing candle that appeared on the chart shows the momentum of the sellers. There may be less profitable transactions this week that surpass the $0.108 barrier.

The $0.114 resistance level is being held by bears. When the price of TRON is below the Hull Suite forex signals indicator, bears are in the driver’s seat. Given that it is lower than zero, the QQE MOD Crypto signaling indicator displays a negative trend. The $0.117 and $0.120 barriers may be overcome by the price of TRON if the purchasing trend stays above $0.114. However, if the decreasing trend persists below $0.108, the price could drop to $0.101 and $0.097.

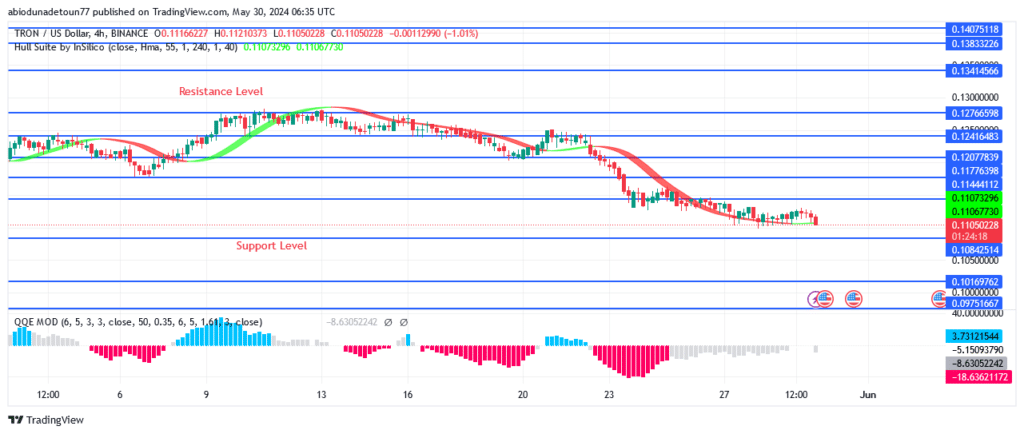

TRX/USD Medium-term Trend: Bearish

The first four hours of the image demonstrate TRON’s persistence. Now that TRON is trading below $0.114, the zeal of the bulls has diminished. It steadily fallen for more than a week before surpassing the $0.117 and $0.114 barrier levels. Sellers defend the level as the price breaks through the prior barrier and approaches the $0.108 support level. Bears may attempt to drive the currency lower if it breaks below $0.108.

You can purchase crypto coins here: Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.