We have covered most of the important technical chart patterns in our strategy section. There are still some strategies left though. “Triangles” and “Wedges” are two of the 10 most important chart patterns and in this article we´ll explain how to trade them. It´s true that they are different patterns, but they are very similar so we´ll teach both of them in one article.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Apart from special occasions which are very rare, we all know that the price doesn´t go up or down in a straight line. Instead, it forms trends following different types of waves, as we have explained in the “Elliot Wave Strategy”. In an uptrend, the first leg goes up and then consolidates before starting the second leg, and vice versa for the downtrend.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

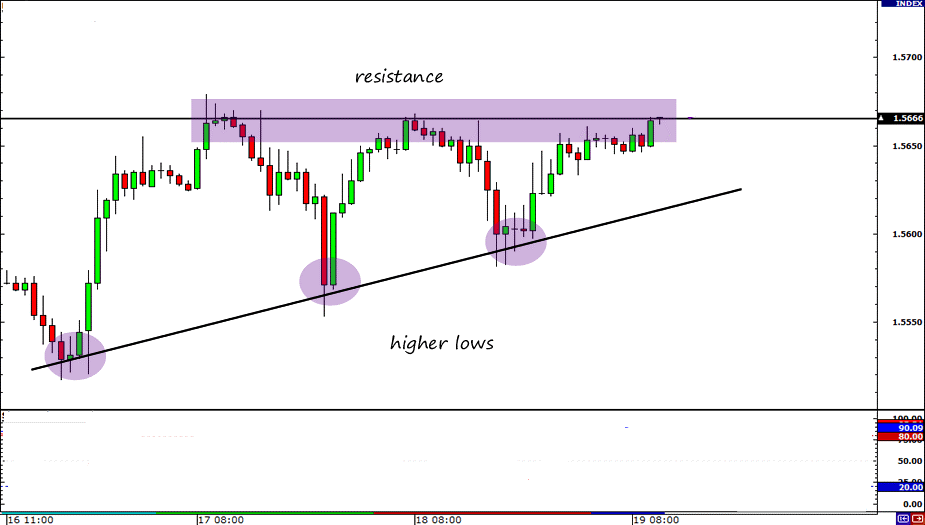

During the consolidation period, the price forms a triangle or a wedge. In order to have a better view, you should change the charts to a smaller time frame.

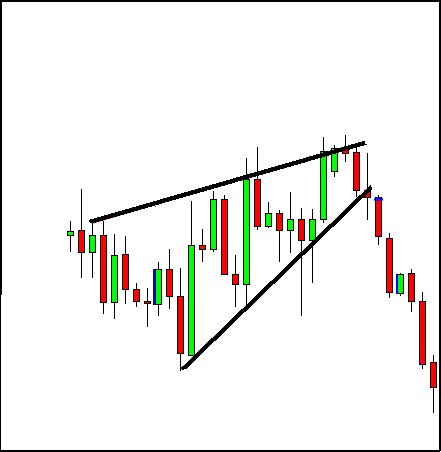

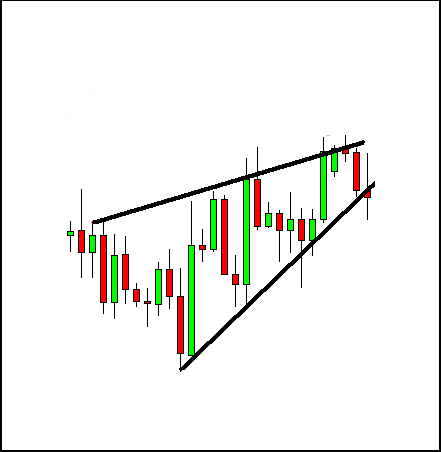

If you are trading 1-hour charts, when the consolidation begins to take place change to 5 or 15-minute charts and draw a trend line connecting the tops and another one connecting the bottoms of the price range during that consolidation. As the name indicates, a triangle is formed when the top and the bottom trend lines culminate in a single point, confining the price in between them. In a wedge, the price breaks out in either direction before the two trend lines meet. In the images below you can see a triangle and a wedge being formed.

Rising wedge

Asymmetrical rising wedge

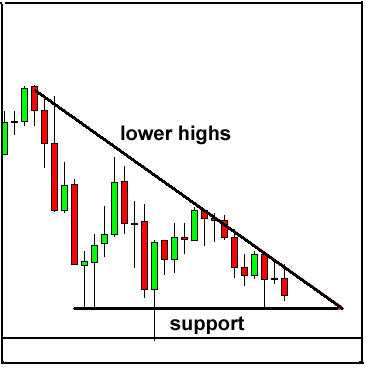

Descending triangle

You can start trading a wedge or a triangle while it is being formed. As you can see from the first picture, the top and the bottom lines are providing resistance and support respectively.

You can draw the resistance line once the price has formed two peaks and you can draw the support line once the price has formed two lows. The second low should be higher than the first one in order to be considered a wedge or a triangle. The simplest and most obvious way to trade a wedge or a triangle is to trade between those two lines. You basically sell at the top line with a stop above the resistance and buy at the bottom line with a stop below the support.

This strategy works best in bigger time frame charts, like daily or 4-hour charts, because there´s more room between the lines. This way the profit target can be bigger and the reward/risk ratio is bigger too. If you trade smaller timeframe charts, you should choose a broker with small spreads and a fast execution.

That´s one way to take advantage of these chart formations, but the wedges and the triangles are most famous for indicating breakouts. In order to predict which way the breakout is going to happen, we should know the types of these chart patterns. There are three types of wedges and triangles: ascending wedge/triangle, descending wedge/triangle and symmetrical wedge/triangle.

Ascending Wedge/Triangle

The price is forming an ascending wedge

Price breaks the top line which turns into resistance

Descending Wedge/Triangle

The descending wedges and triangles are the opposite of the ascending ones and become valid after a downtrend. So instead of selling after the break of the bottom line, you buy after the top line gives way. When you trade these patterns, the profit target you aim for should be as big as the space between the first top and the first bottom of the range, as shown in the second chart below. The reason I´m saying the first top and the first bottom is because there are occasions when neither of the two lines of the wedge is horizontal, like the ascending one above.

Descending wedge is being formed after a downtrend

After the break to the upside the target is as big as the space between the first top and the first bottom.

Symmetrical Wedge/Triangle

In a symmetrical triangle, you can trade between the two lines and after the breakout

During these formations, the bulls and the bears are putting up a bitter fight, until one side eventually gives up. It doesn´t matter if this consolidation takes place after an uptrend or a downtrend. When you use ascending and descending wedge or triangle chart patterns for trading, you know which way the price will go after the breakout, but symmetrical wedges and triangles don´t give you a clear direction. That doesn´t mean you cannot trade them though; you can trade them in the same way you trade rising and falling wedges/triangles. You buy and sell while the price is bouncing inside the two lines of the triangle. And of course, you can trade the breakout in either side by placing a stop buy or a stop sell order above and below the triangle.

I personally fancy opening a trade after the price breaks and retests one of the lines.