Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

This week’s list of trending coins features mostly new coins, or perhaps they are making their debut today. Nevertheless, they have dethroned more of the older and more popular tokens in the crypto market to claim the top spots on this week’s list.

Arkham (ARKM)

Major Bias: Bullish

Arkham comes first on this week’s list of trending coins and has dethroned XRP from the top spot from last week’s analysis. This token has witnessed a price decline of 0.49% and 15.87% today and in the past 7 days, respectively. Nevertheless, it has a 24-hour trading volume of $44,375,415 and a market capitalization of $94,349,413.

Meanwhile, the 1-hour chart reveals that price action in this market still has some upside potential. This is because the last price candle here remains above the 9- and 21-day Moving Average MA lines. This happened despite the price decline of 0.49% that was seen today. Additionally, the Relative Strength Index (RSI) lines continue to trend upward toward the overbought region. This suggests that price action may still reach the 0.6400 mark.

Current Price: $0.6304

Market Capitalization: $94,349,413

Trading Volume: $44,375,415

7-Day Gain/Loss: 15.87%

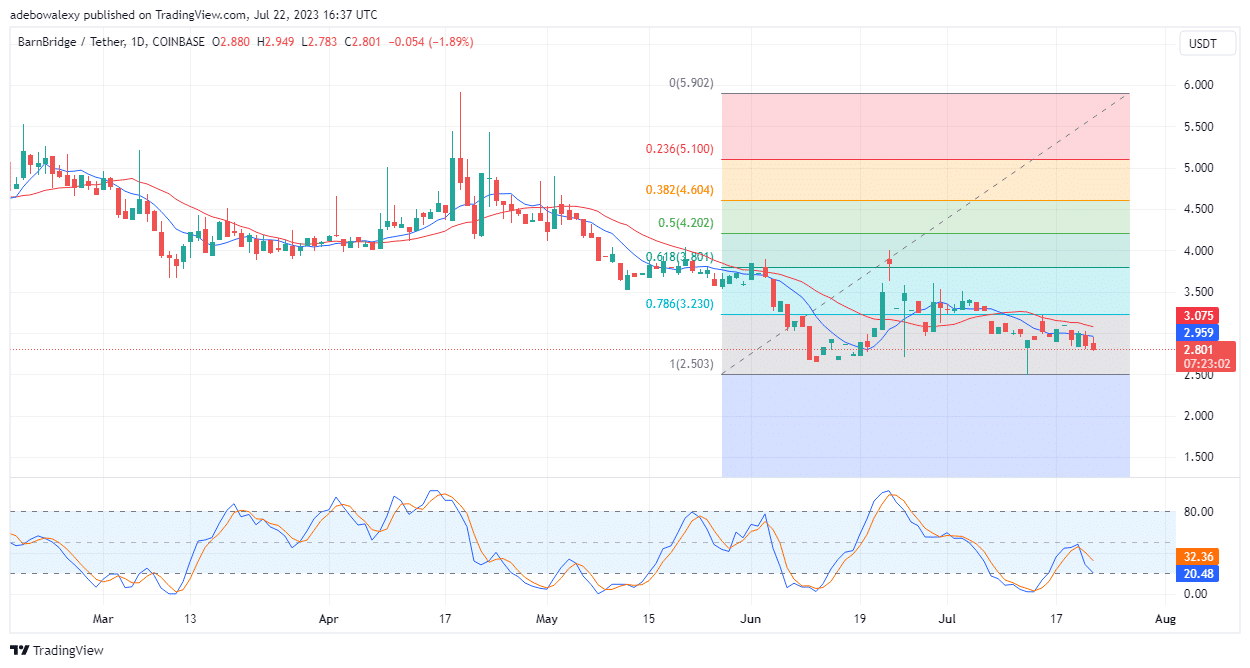

BarnBridge (BOND)

Major Bias: Bearish

One will wonder how the BarnBridge token made it to the second spot on this week’s list of trending coins. This is because this token has only extended its mild downward correction, despite how trendy it is. BOND has a 24-hour trading volume of $2,261,412 and a market capitalization of $22,713,302. Furthermore, it has experienced a price decline of 0.88% today and a 6.12% decline over the past 7 days.

The daily chart shows that price action in this market has a downside propensity. This is because since price action tested the resistance formed by the 9-day MA line during two trading sessions ago, price candles have been forming below the 9- and 21-day MA lines. Even the last price candle on this chart can be seen falling below the MA lines. Furthermore, the RSI indicator curves are trending toward the overbought zone of the indicator. Consequently, this is an indication that prices may fall to $2.600.

Current Price: $2.801

Market Capitalization: $22,713,302

Trading Volume: $2,261,412

7-Day Gain/Loss: 6.12%

WhiteBIT Token (WBT)

Major Bias: Bullish

This token has arrived at the third spot on this week’s list of trending crypto. Unlike its superiors on this list, this token has managed to continue approaching higher price marks despite low volatility. WBT has a self-reported market capitalization of $341,025,324 and a trading volume of $10,546,762. It has also witnessed a price decline of 0.16% today while seeing a 0.24% price decline over the past 7 days.

The daily chart reveals price action retracing higher levels despite lower volatility. Also, recently, price action can be seen turning almost flat sideways. Despite this, price action stays around the 9-day MA line, which lies above the 21-day MA. Also, an upside crossover can be seen on the RSI indicator. Consequently, this suggests that price action may continue at the upside retracement, towards the $5.650 mark.

Current Price: $5.520

Market Capitalization: $341,025,324

Trading Volume: $10,546,762

7-Day Gain/Loss: 0.24%

XRP

Major Bias: Bearish

XRP has descended from its top spot on the trending coin list from last week to take a lowly 4th position on this week’s list. This token has seen a price reduction of 1.05% today but a price increase of 5.92% over the past 7 days. Consequently, this shows that the past 7 days have been good for this token. Also, it has a market capitalization of $40,220,971,825 and a trading volume of $1,455,665,067.

The daily chart revealed that this token had faced rejection when its price action poked through the $0.8000 mark. However, it can be perceived that the downward correction seems to be wearing out, given the size of the last price candle. Nevertheless, the lines of the RSI keep moving slightly towards the oversold region. This suggests that price action may fall through the support at the 9-day MA curve to the $0.7600 mark.

Current price: $0.7669

Market capitalization: $40,220,971,825

Trading volume: $1,455,665,067

7-Day Gain/Loss: 7-days

Bitcoin (BTC)

Major Bias: Bearish

Bitcoin has resiliently held on to the fifth position for about 2-3 weeks in a row. Nevertheless, its marker has seen a price decline of 1.36% over the past 7 days and an increase of 0.18% today. The king of crypto also has a market capitalization of $580,863,985,400 and has traded today with a trading volume of $1,455,665,067. Studying the daily market shows that bears have eventually broken the support at $30,000, as BTC now trades at $29,990.

Additionally, price action in this market can be seen below the middle limit of the Bollinger Bands, which indicates that this market is Bearish and may proceed toward lower price marks. Also, the RSI lines reveal that momentum is low in this market, considering the closeness of the lines of this indicator. Also, the last price candle is a bearish one, though with a small body. Therefore, traders should brace for the impact that the price may have on falling towards 29,900.

Current price: $29,903

Market capitalization: $580,863,985,400

Trading volume: $1,455,665,067

7-Day Gain/Loss: 0.18%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.