According to a Coingecko report released last Thursday, South Korea, Singapore, and Japan are the nations most harmed by the demise of the cryptocurrency exchange FTX. Based on data from SimilarWeb from January to October, the study analyzes FTX.com’s monthly unique visitors and traffic by nation.

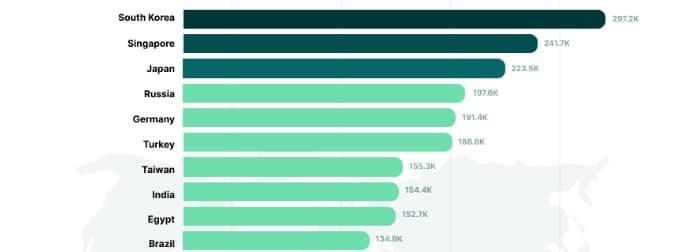

The data, reported by News.Bitcoin shows that South Korea is the country most affected by the effects of FTX, with 297,229 unique visitors from it visiting FTX.com on a monthly average. This accounted for 6.1% of all visitors to the website.

Singapore, which accounted for 241,675 unique visitors per month and 5% of the site’s global traffic, is the next most negatively affected nation on the list. Users of Binance are said to have transferred to FTX when Binance shut down its Singapore operations in December last year.

Japan is the third-most affected nation on the list, with 223,513 unique users visiting the FTX website each month, making up 4.6% of all website traffic. Japanese company Softbank contributed $100 million to FTX earlier this year.

Top Ten Worse Hit Nations by FTX Meltdown: Coingecko

Along with the three nations stated above, Russia, Germany, Turkey, Taiwan, India, Egypt, and Brazil were among the top 10 nations affected the most by the FTX disaster. Only 92,935 of the visitors to the FTX website were Americans, according to the research. However, since FTX US uses a different domain, it excludes visits to that site.

FTX is now being looked into in several nations. The exchange is being looked into by the US Department of Justice (DOJ), Securities and Exchange Commission (SEC), and Commodity Futures Trading Commission (CFTC) for improper handling of customer funds. Also, the financial intelligence division of Turkey began looking into FTX last week. The Bahamas Securities Commission has been attempting to take the digital assets belonging to FTX.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.