The dynamic world of cryptocurrencies is driven by catalysts—powerful events that shape market movements. Understanding these catalysts is crucial for savvy investors.

Pantera, a key player in this space, is at the forefront of identifying and leveraging these catalysts to drive growth and value in the digital asset market.

Tokens as One of the Major Catalysts for Crypto

Tokens, a novel form of capital formation, are poised to revolutionize traditional equity listings for businesses. With the potential to replace equity for a generation of companies, tokens offer a unique way to align incentives among management teams, employees, token holders, and other stakeholders. This paradigm shift highlights the transformative power of tokens in the digital asset space.

Currently, there are approximately 300 publicly traded liquid tokens with market capitalizations exceeding $100 million. This investible universe is expected to expand as the digital asset industry grows and matures.

The emergence of protocols with strong product use cases, revenue models, and solid fundamentals further underscores the potential for growth and innovation in the space.

Examples like Lido and GMX, which were non-existent just a few years ago, demonstrate the rapid pace of development and adoption in the digital asset market.

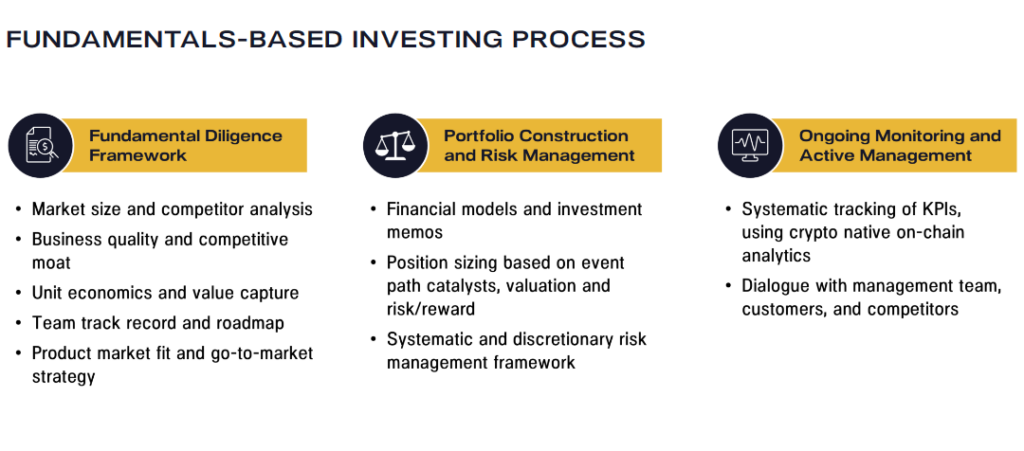

Pantera’s strategic focus on protocols exhibiting a strong product-market fit and backed by competent management teams underscores a notable shift towards traditional investing frameworks within the digital asset realm.

This strategic alignment reflects a parallel with major inflection points witnessed in equity markets and emerging market investing, signaling a pivotal moment in the maturation of the crypto industry.

Connecting the Dot Between Digital Asset Investing and Traditional Equity Investing

The parallels between digital asset investing and traditional equity investing are striking. Much like the early days of fundamental value investing in equities, digital asset investing is undergoing a similar evolution.

Warren Buffett’s early adoption of Benjamin Graham’s principles in the 1960s paved the way for a new era of equity investing. Similarly, in the digital asset space, discerning investors who can identify protocols with strong fundamentals amidst market volatility and uncertainty stand to reap significant rewards.

Investing in digital assets also shares similarities with investing in emerging markets. Just as investors in the 2000s faced criticism and uncertainties when investing in Chinese equities, today’s digital asset investors must navigate similar challenges.

However, as was the case with emerging markets, there are quality projects in the digital asset space with strong growth prospects and attractive investment opportunities for those willing to do the research and take the risk.

Fundamental-based investing is gaining traction in the digital asset space, with more investors applying traditional valuation frameworks to assess the value of digital assets.

This shift towards fundamentals-based investing is a positive development, as it suggests that digital asset prices will increasingly be driven by underlying fundamentals rather than market speculation.

Even data service providers in the digital asset space are beginning to resemble their counterparts in traditional finance. Platforms such as Etherscan, Dune, Token Terminal, and Artemis serve a similar purpose to traditional financial data providers like Bloomberg and M-Science, tracking key performance indicators, P&Ls, and management team actions.

Anticipating a seismic shift in investor demographics, Pantera predicts that the next trillion-dollar influx into digital assets will originate from institutional investors equipped with sophisticated fundamental valuation techniques.

By strategically positioning themselves to capitalize on this burgeoning trend, Pantera aims to remain at the vanguard of the evolving crypto landscape.

Enter Arbitrum, a preeminent layer 2 solution operating atop the Ethereum blockchain, emblematic of the fundamentals-based investing ethos championed by Pantera.

Offering expedited and cost-effective transactions, Arbitrum has garnered widespread acclaim, attracting a burgeoning user base and fostering a vibrant developer ecosystem.

Its profitability, derived from transaction fees, underscores a sustainable business model poised for continued growth and innovation.

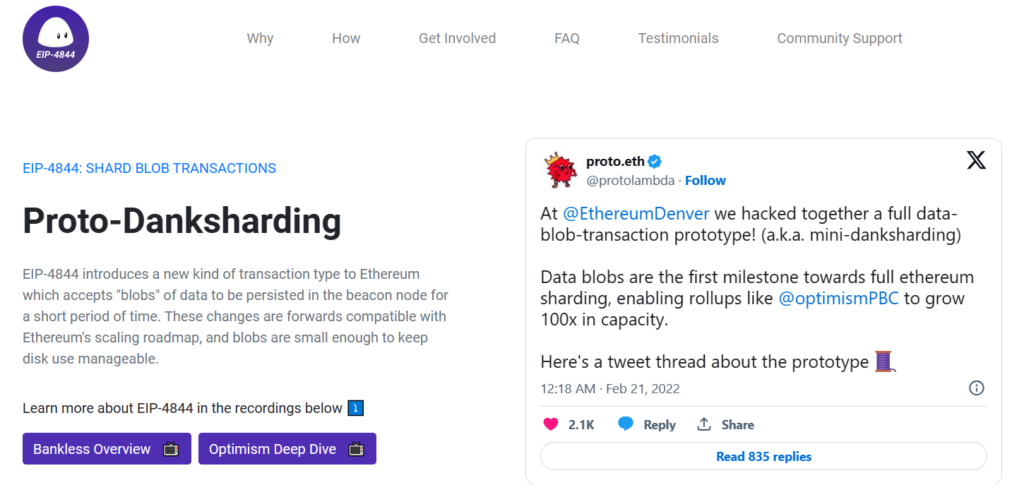

Looking ahead, Arbitrum’s forthcoming adoption of EIP-4844 holds the promise of substantially reducing transaction costs, thereby potentially catalyzing further adoption and propelling the platform to new heights of success.

Despite its current $2.6 billion market capitalization, Arbitrum’s valuation appears judicious when juxtaposed against its meteoric growth trajectory and industry peers, presenting an attractive investment proposition for discerning investors.

Other “big picture” catalysts include the ongoing rise of Bitcoin ETF adoption and investment in the US, much-needed regulatory clarity in the crypto industry, and what Pantera calls the crypto “dial-up-to-broadband moment.”

As the digital asset industry continues to mature, investors who can identify and leverage these catalysts stand to benefit significantly from the growth and innovation in the digital asset space.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.