USDCHF Price Analysis – December 31

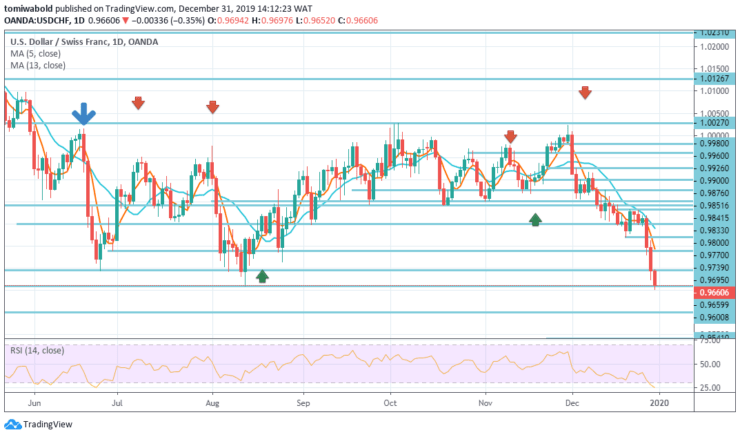

After the Asian session, moving sideways near the level of 0.9695, the USDCHF pair lost its movement in the last hour and touched the lowest level since early November at 0.9662. At the time of writing, the pair fell by 0.23% per day at 0.9660 level.

Key Levels

Resistance Levels: 1.0231, 0.9833, 0.9695

Support Levels: 0.9659, 0.9600, 0.9541

USDCHF Long term Trend: Bearish

In a broader context, the long-term outlook stays bearish, as USD / CHF is in the range of 0.9659 / 1.0231. In any case, a decisive breakthrough of 0.9659 level is required to indicate the resumption of a downtrend.

Otherwise, more side trading may be recorded with the risk of another rebound. Meanwhile, a breakthrough of the level at 0.9695 support may aim at the level at 0.9541 support.

USDCHF Short term Trend: Bearish

The intraday bias in USDCHF stays on the downside at this phase. At the moment, a plunge from the level of 1.0027 may break below the support level of 0.9659.

On the other hand, a slight break of resistance above the level at 0.9739 may change the neutrality of the intraday bias and lead to consolidation first, before starting another decline.

Instrument: USDCHF

Order: Sell

Entry price: 0.9659

Stop: 0.9739

Target: 0.9541

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.