Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Stablecoins, the unsung heroes of the ever-evolving digital asset ecosystem, have recently witnessed a noteworthy resurgence. In this deep dive into Coin Metrics’ latest State of the Network report, we uncover the signs of returning liquidity, shedding light on the market cap, supply trends, adoption patterns, and emerging trends that collectively shape the stablecoin landscape.

As mentioned at the outset, stablecoins have proven to be a reliable pillar, offering a stable store of value amid the unpredictable tides of volatility. Beyond their utility in mature markets, these digital currencies play a pivotal role in emerging economies, acting as a beacon of stability in regions grappling with high inflation and limited access to traditional financial infrastructure.

The Market Cap and Supply Dynamics of Stablecoins

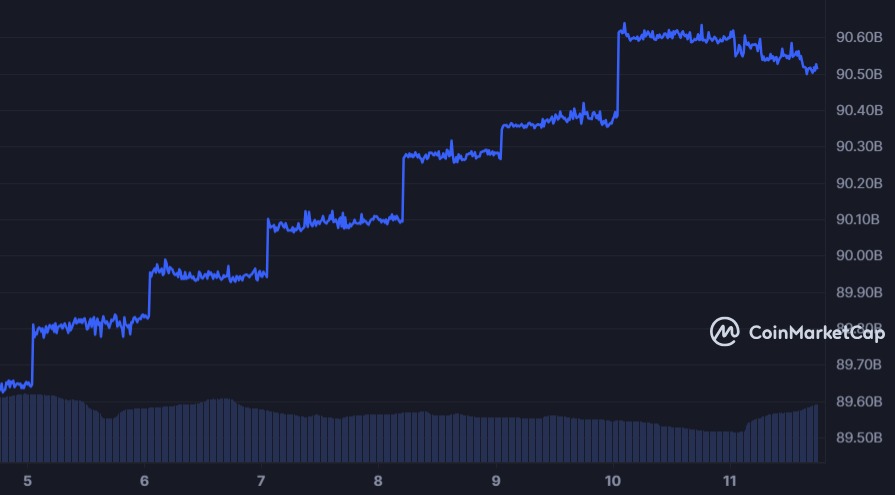

At the heart of the stablecoin resurgence is market capitalization, primarily dominated by USDT and USDC. The recent upswing is fueled by the robust growth of Tether (USDT) on the Ethereum and Tron networks, propelling Tether’s market cap to an all-time high of $90.6 billion. Meanwhile, Circle’s USDC stands strong at $24.5 billion.

The landscape, once dominated by fiat-collateralized stablecoins, now sees a diverse array, including those collateralized by cryptoassets and off-chain securities.

Despite setbacks like the Luna collapse and the Silicon Valley Bank crisis, the aggregate stablecoin supply has been on an upward trajectory since October 2023. This trend signals a potential return of on-chain liquidity, indicating a more robust environment for capital deployment.

Adoption of Stablecoins: Tron Takes the Lead

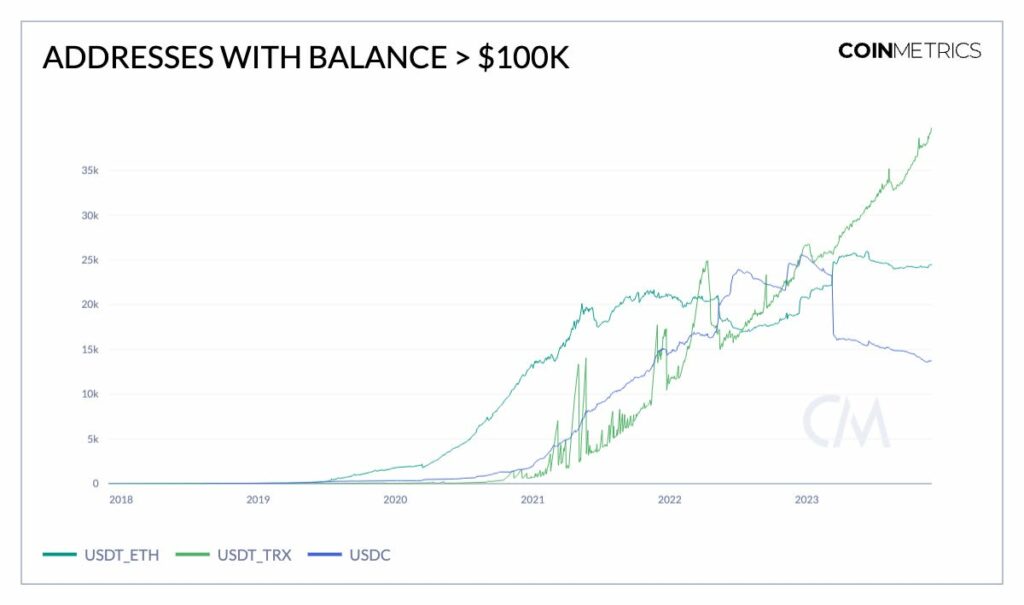

While Ethereum-based USDC and USDT addresses show stability, Tether on the Tron network emerges as a star, experiencing consistent growth, per the Coin Metrics report. With nearly 40,000 addresses holding over $100,000, Tether on Tron gains traction, potentially driven by lower transaction fees and increased use in economies facing inflation and financial service barriers.

The Growing Trend of Stablecoin Usage in DeFi Markets

Stablecoins are not just stable stores of value; they are the lifeblood of decentralized finance (DeFi). In lending markets, stablecoins act as stable collateral, enabling users to earn interest on their digital assets.

Aave’s utilization rates for major stablecoins reflect the demand for stablecoin collateralized loans, reaching levels not seen since 2021. The relationship between pool utilization and interest rates underscores the dynamic nature of these markets, where ample capital leads to lower interest rates and vice versa.

Stablecoin Usage in Spot Trading on the Rise

Stablecoins are not merely static assets; they are dynamic players in spot trading. With volumes reaching $18.8 billion for USDT and $2.5 billion for USDC in November, according to Coin Metrics, stablecoins emerged as popular quote assets on both centralized and decentralized exchanges. This surge in trading volumes indicates a growing appetite among traders and investors seeking exposure to crypto assets amidst the broader market rally.

Emerging Trends for Stablecoin

Looking at overarching trends, the quest for yield plays a central role. The rise in US Treasury yields prompts a capital rotation out of on-chain markets, giving rise to tokenized treasuries and interest-bearing stablecoins. Examples like Maple Finance’s USDC Cash Management Pool showcase a growing trend, offering yields sourced from US Treasury bills.

The diversification of stablecoin collateral bases into real-world assets and the growth of stablecoin supply rates on platforms like Aave provide alternative avenues for capital rotation into DeFi applications.

Conclusion: The Unwavering Role of Stablecoins

In the face of regulatory challenges and a complex political landscape, stablecoins have demonstrated remarkable resilience. Their expanding supply is not just a numerical growth; it’s a testament to their wide-ranging utility across DeFi pools, exchanges, and diverse yield-generating opportunities.

As the crypto economy experiences a broader market rally, stablecoins not only signify growing usage but also affirm their central role in navigating the complexities of the digital asset landscape.

In conclusion, the resurgence of stablecoins paints a promising picture for the future, where these digital stalwarts continue to play a crucial role in providing stability, facilitating transactions, and bridging the gap between traditional and decentralized finance. As we navigate through evolving market regimes, stablecoins stand as a beacon of stability in an otherwise dynamic and unpredictable landscape.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.