Key Takeaways and Highlights

Miner revenue for Bitcoin’s Halving block reached $4.7M, driven by record transaction fees and the sale of a collectable “Epic Sat.” The launch of the Runes protocol triggered a surge in OP_RETURN transactions, peaking at 799K on April 23. Adjusted for power consumption, miner revenue per megawatt now stands at $1.3K, nearing post-FTX collapse lows.

Introduction

Bitcoin’s 4th Halving at block 840,000 reduced block rewards from 6.25 BTC to 3.125 BTC, significantly impacting miner economics and the broader Bitcoin ecosystem. This event is critical for understanding the future landscape of Bitcoin mining and the entire network.

Halving Shrugged

Halving Shrugged

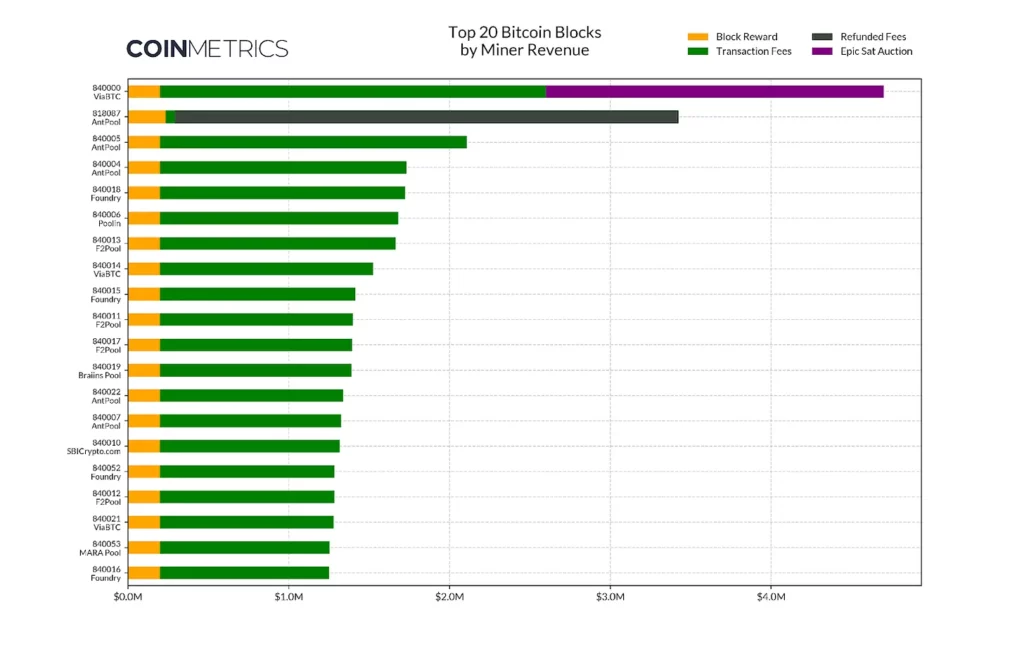

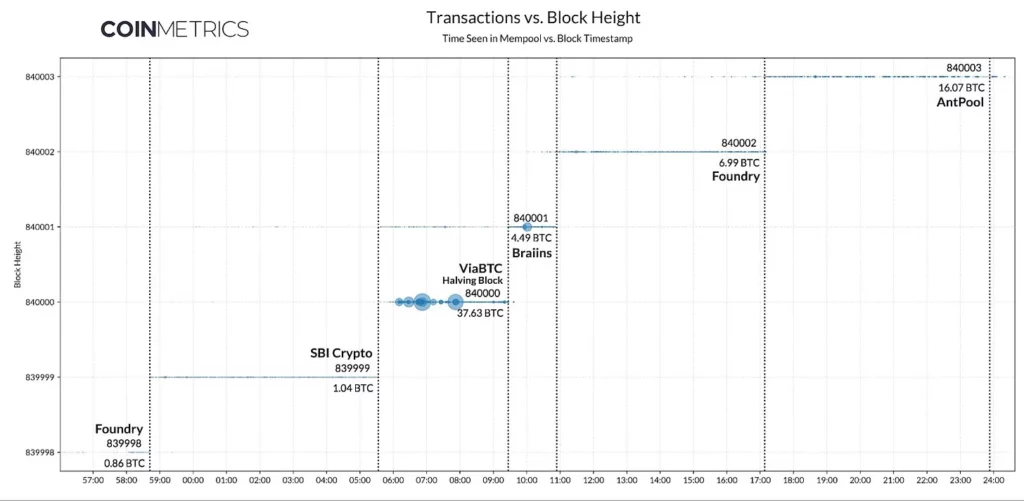

Bitcoin’s Halving is a predictable event with a hard-coded emissions schedule. However, it raises questions about the mining industry’s resilience and the potential for transaction fees to offset reduced mining revenue. Despite the block reward halving, a surge in transaction fees temporarily alleviated revenue concerns. ViaBTC, a mining pool, secured the Halving block, earning 37.63 BTC in transaction fees due to high bidding for early block allocations.

The Rune Saga

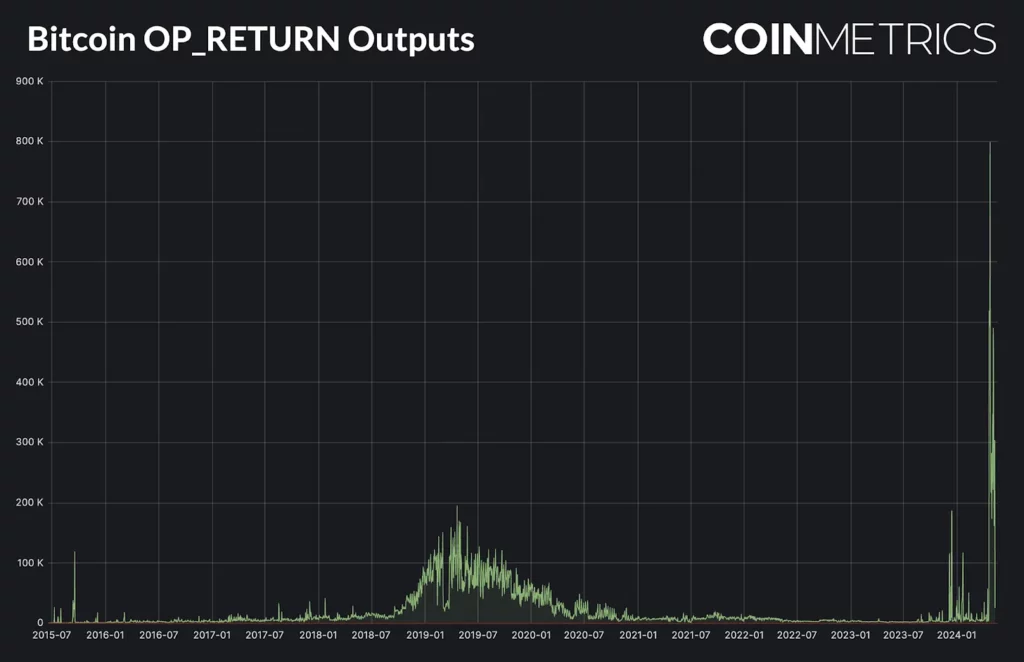

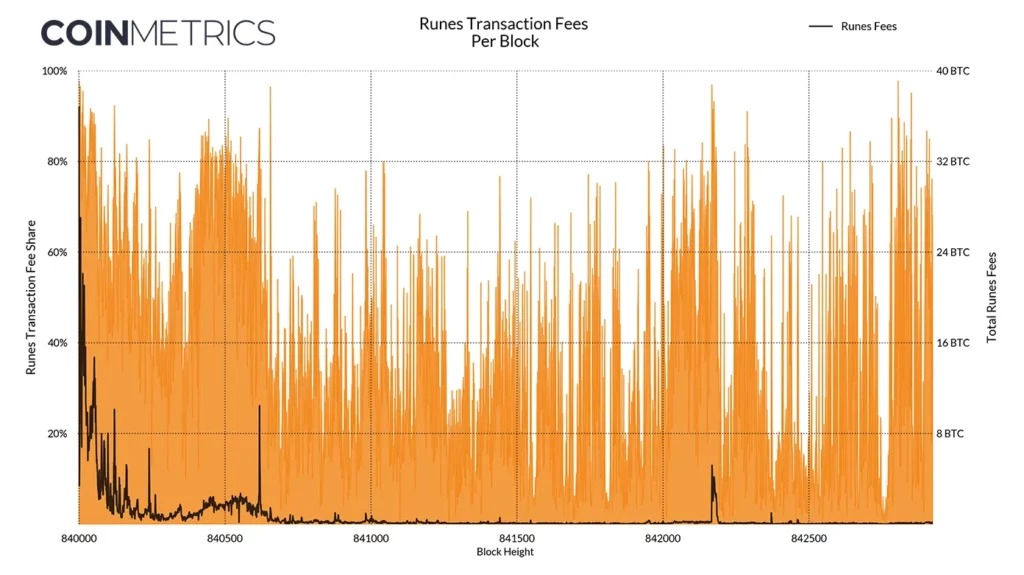

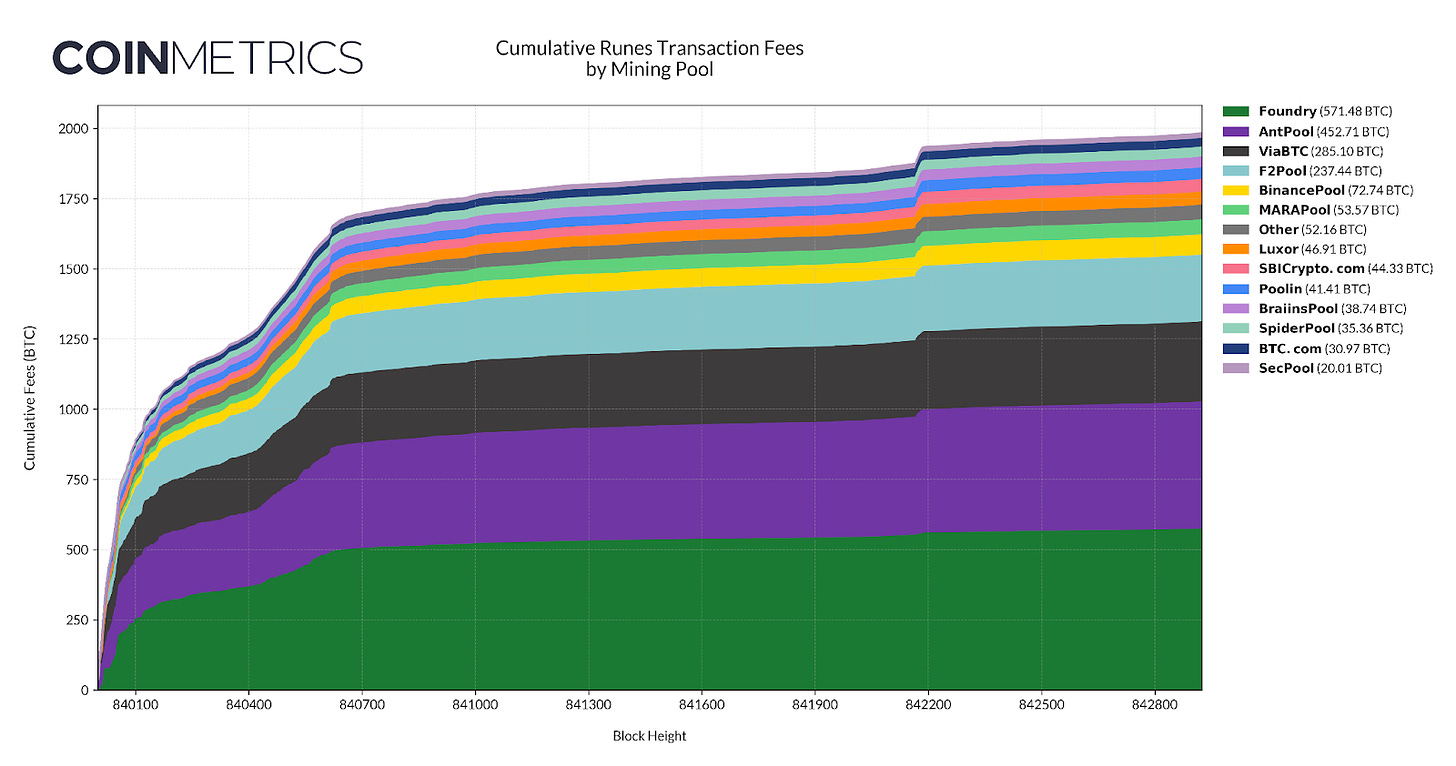

Ordinals and Inscriptions have driven miner transaction fee revenues since 2023. However, the Halving block saw the introduction of the Runes token standard, which sparked on-chain speculation. Runes, an enhancement of previous token standards on Bitcoin, utilizes the OP_RETURN field to encode token protocol messages. Following the launch, OP_RETURN transactions hit a record high of 799K on March 23.

Withering Hashes

Withering Hashes

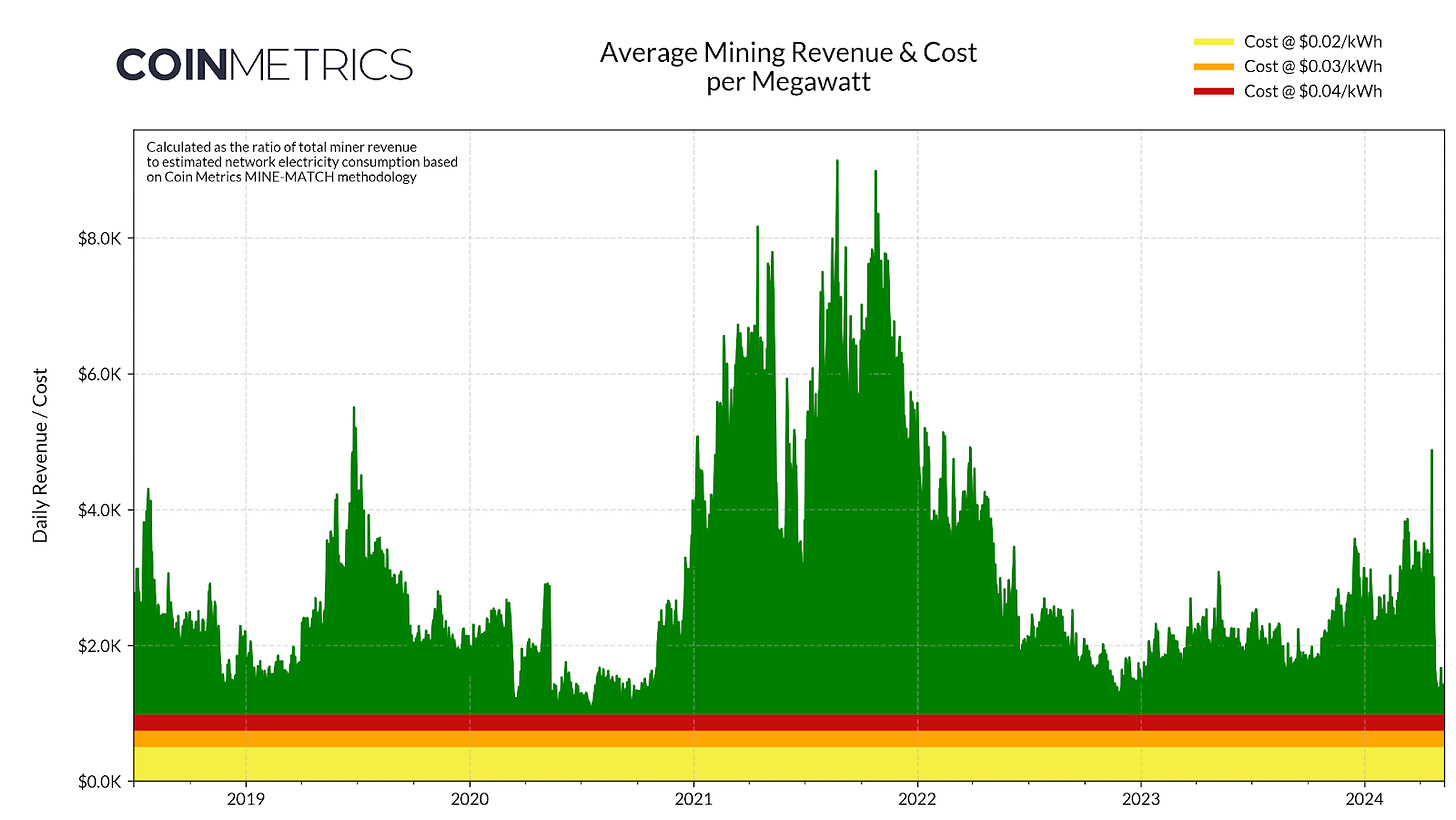

Post-Halving, miner revenue remains relatively high at about $30M per day, but power consumption has surged to 21.5 GW. Mining revenue per megawatt (MRPM) now stands at $1.3K daily, barely outpacing daily electricity costs. This tight margin reflects conditions similar to those post-FTX collapse, placing immense financial strain on miners.

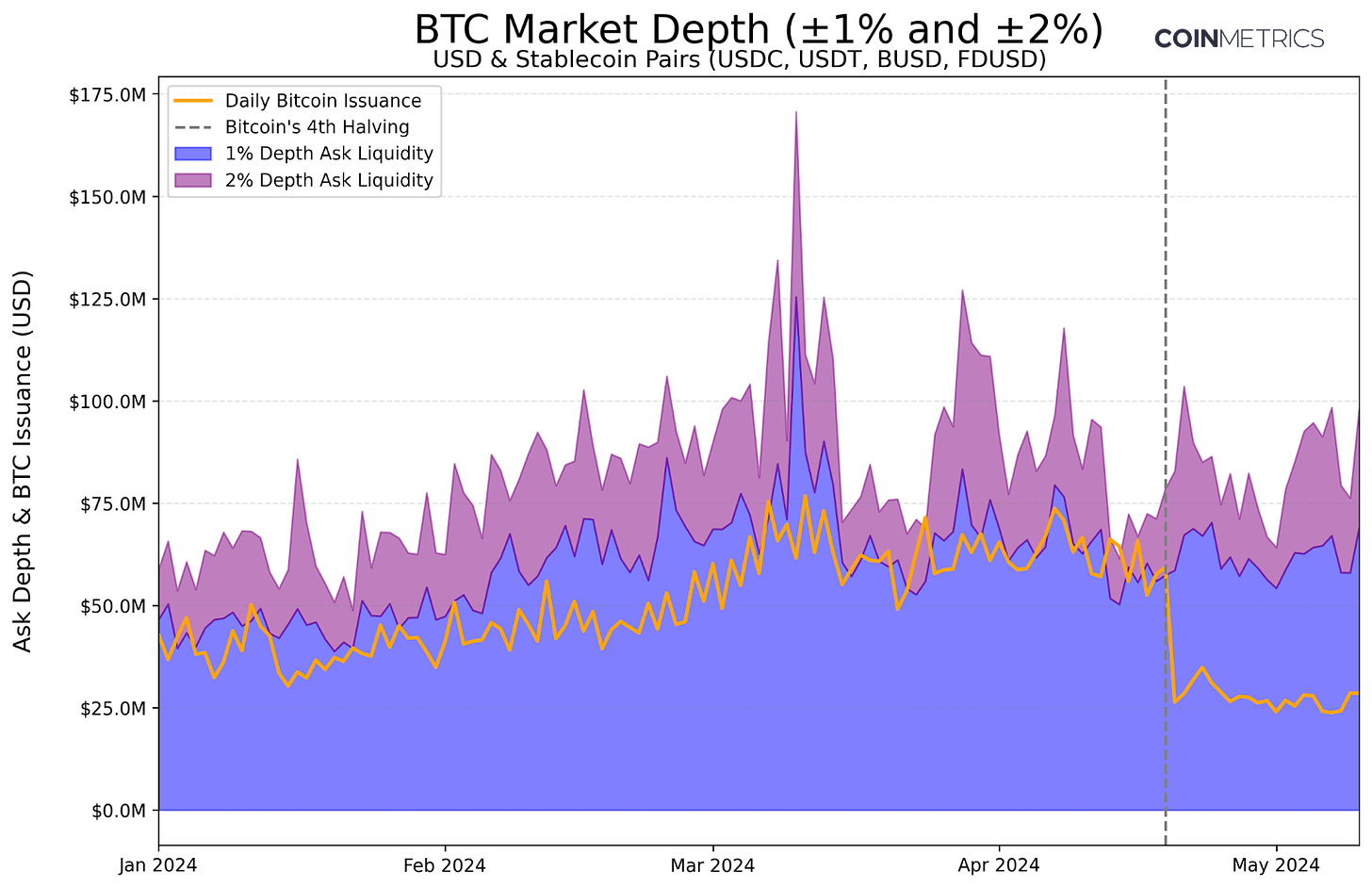

Halving reduces daily Bitcoin issuance, lowering miner sell pressure on the market. Pre-Halving issuance aligned with Bitcoin’s 1% ask liquidity, suggesting the market can absorb miner sell-offs. Reduced issuance post-Halving supports this stability, but ongoing financial pressure is evident in the 11.2% weekly hashrate drop from 650 EH/s to 577 EH/s.

A recent -5.62% difficulty adjustment, the largest since late 2022, will slightly ease mining challenges, but the broader outlook remains challenging.

Conclusion

Bitcoin’s 2024 halving marks a significant event with substantial implications. Despite increased scale in mining operations, fees have not compensated for reduced block subsidies, threatening the viability of large-scale miners. New protocols like Runes show potential for revenue boosts but remain immature. Halving’s market impact appears priced in, with miner sell pressure subdued and issuance below levels that would significantly affect BTC prices. Long-term effects on Bitcoin’s appreciation are yet to be seen, with demand-side factors now taking precedence.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

Halving Shrugged

Halving Shrugged Withering Hashes

Withering Hashes