Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

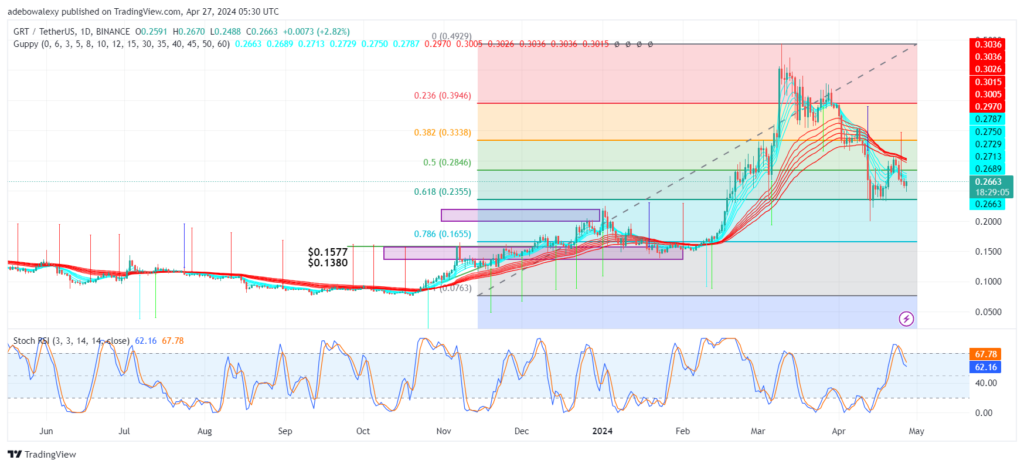

Price action in The Graph’s market has undergone a consistent downward correction in recent times. This trend emerged after the price action surged past the $0.2500 mark. The mentioned upside surge concluded on March 9th, following which the market has generally retraced to lower levels. Let’s delve deeper into this market to ascertain potential outcomes.

GRT Statistics:

Current The Graph Value: $0.2663

GRT Market Cap: $2,522,212,177

The Graph Circulating Supply: 9,482,990,575

GRT Total Supply: 10,797,198,102

The Graph CoinMarketCap Rank: 44

Key Price Levels:

Resistance: $0.2700, $0.2900, and $0.3100

Support: $0.2600, $0.2400, and $0.2200

GRT Rebounds Off the $0.2500 Baseline

While the recent rebound in price action in The Graph’s market may not be extraordinary, similar occurrences have been witnessed in recent times. However, it’s worth noting that this rebound is transpiring at a psychological support level.

Consequently, the latest price candle has begun to push the price through the green Guppy Multiple Moving Average (GMMA) lines. Additionally, although the Stochastic Relative Strength Index (SRSI) lines still exhibit a downward trajectory, the leading line of this indicator is displaying a slight deflection. Nevertheless, this only reflects a rebound and hasn’t instilled much bullish hope.

The Graph’s Upside Correction May Gain More Strength

Turning to the GRT 4-hour market, one can observe that price action is surpassing significant milestones. The recent price candle has positioned the current token price above the green GMMA lines. Consequently, this has provided upside forces with an advantage over downward pressures, as traders may derive buying confidence from this development.

Similarly, the SRSI indicator lines are ascending from the overbought region. How the SRSI lines are rising at this juncture suggests that volatility may ensue, leading to more significant price movements. Therefore, traders can still employ bullish crypto signals with targets towards the $0.3000 mark, as they may present formidable resistance to price fluctuations.

Trade crypto coins on AvaTrade

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.