The cryptocurrency has been weakening ahead of the event and has plunged by about 3.5% at the close of the London session on Tuesday, after recording an $11,823 high in the early Asian session yesterday. Traders have been hesitant to take long positions on Bitcoin frankly because of the upcoming event.

The Federal Reserve’s Jackson Hole Symposium

The US Federal Reserve Chair, Jerome Powell, will be speaking virtually at the symposium later this week and will be shedding more light on how the Fed plans to tackle the weak economic growth.

In the minutes of the Fed’s July meeting, they gave a detailed overview of what their long-term plans were and hinted that they were ready to tolerate higher inflation rates given the condition of the times. While that should have caused a frenzy for safe-haven assets like Bitcoin, the prevailing uncertainty among investors kept a lid on any significant gains in Bitcoin.

Meanwhile, the US dollar (DXY) has been significantly strong following recent positive developments around the Coronavirus crisis and the US-China relations.

Traders are now looking towards Powell’s speech on Thursday for clues. Bitcoin is expected to recover fully or continue on its bearish correction depending on whether the Fed Chair’s comments are dovish or hawkish.

Key Levels to Watch

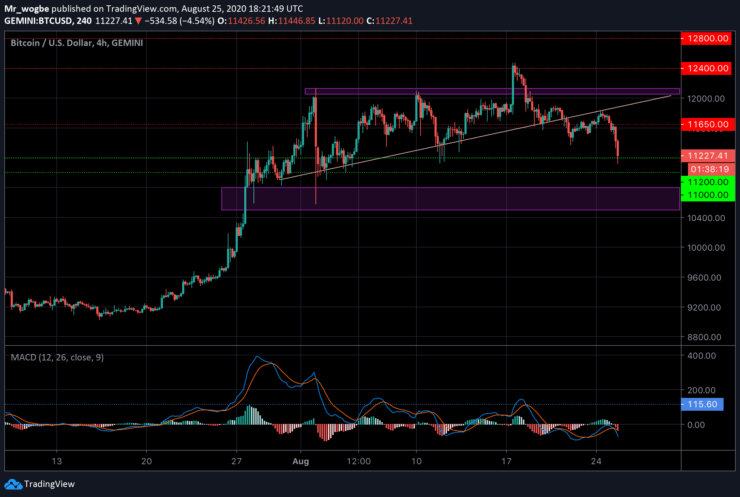

Bitcoin remains in a strong corrective mode and is quickly approaching the $11,000 psychological line. The benchmark cryptocurrency is now contending with the $11,200 key support, which if broken, could send Bitcoin to $11,000 and subsequently to the $10,800 strong support. However, a further decline from that level is not ruled out with $10,500 being the last possible base of this correction in the meantime.

For Bitcoin to regain its bullish standing, it has to take back the $11,800 resistance.

Total market capital: $349 billion

Bitcoin market capital: $207 billion

Bitcoin dominance: 59.3%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.