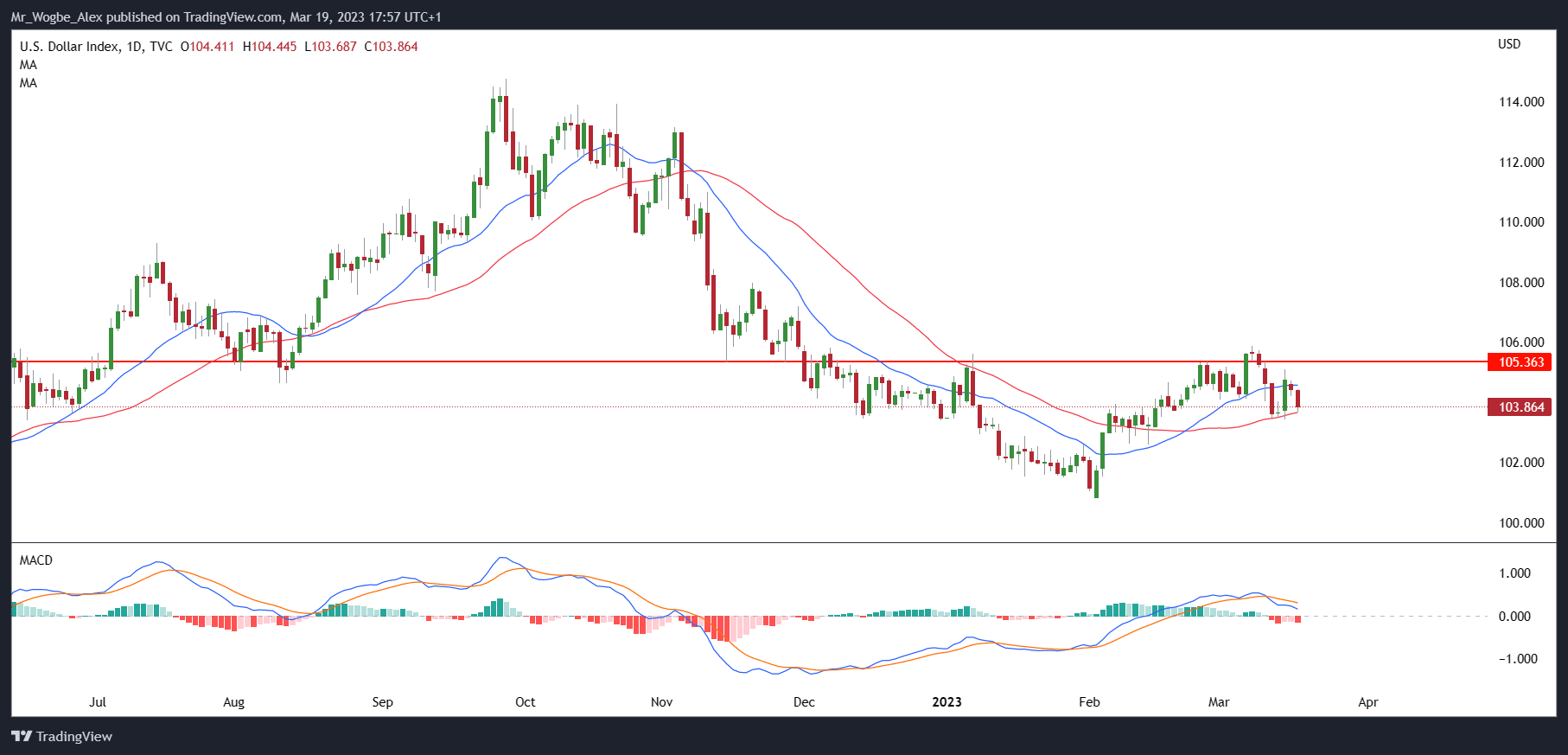

The US dollar is like a rollercoaster these days, going up one minute and down the next. This week, it’s been tumbling down like a wild ride, slipping by about 0.8% to settle just below the 104.00 level on Friday. And, as always, there are some culprits behind this drop in value.

The steep decline in US bond yields has got traders all riled up, as they’ve repriced lower the Federal Reserve’s tightening path. The turmoil in the banking sector doesn’t help matters either, thanks to the collapse of two mid-size US regional banks that have everyone worried about a financial apocalypse.

The Fed Steps In, US Dollar Buckles

In the wake of these worrying events, the Federal Reserve has had to intervene by launching emergency measures to support depository institutions facing liquidity constraints. This, in turn, has shifted bets about the outlook for monetary policy in a dovish direction.

All of this means that the path of least resistance is likely to be lower for the US dollar, provided the current situation doesn’t escalate into a full-blown financial crisis. So, if you’re a forex trader, make sure to keep your seatbelt on tight and brace yourself for some wild rides ahead.

Traders are eagerly waiting for the Fed’s March policy decision, due this Wednesday, to get a better sense of the greenback’s prospects. Market pricing now leans towards a quarter-point interest rate hike, which would take borrowing costs to the highest level since 2007. But, as always, there’s uncertainty ahead, and anything could happen between now and Wednesday.

The Fed’s Guidance to be Dovish

Whatever the Fed decides next week, its guidance will likely be dovish. The FOMC is expected to stress the importance of preserving financial stability and its readiness to act to prevent systemic risks from materializing. This could lead to further US dollar weakness, but it’s all part of the rollercoaster ride that is forex trading. So buckle up and enjoy the ride!

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.