The Dip Defines Trading

The Dip is not just a book title. It is the painful reality every trader eventually faces: the stagnating equity curve, the losing streak that feels personal, and the creeping suspicion that your edge has disappeared.

Seth Godin’s The Dip explains a timeless truth—success does not come from endless persistence, nor from chasing every shiny system. It comes from knowing when struggle is worth enduring and when it is simply wasted effort.

In trading, this difference matters more than anything else.

The Dip Is the Path to Mastery

The Dip Is the Path to Mastery

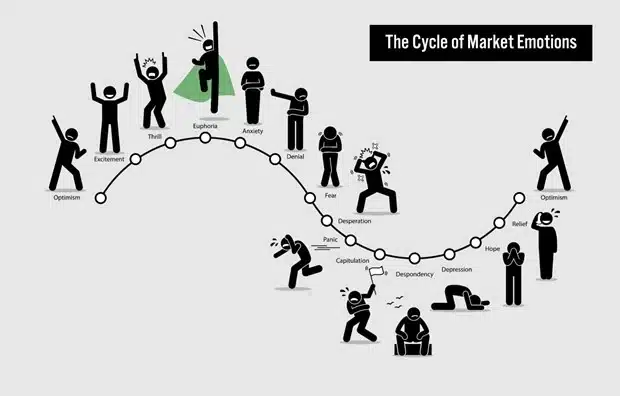

Every trading strategy begins with excitement and quick wins. But soon, the Dip arrives.

The novelty wears off.

The system underperforms.

Your confidence cracks.

This is where most traders walk away, assuming the system has failed—or worse, that they have failed. Yet, in many cases, this is exactly where competence begins to compound.

In practical terms, the Dip might look like:

- A six-week drawdown after three months of steady growth

- Backtesting inconsistencies as you refine a model

- The frustrating work of learning patience during live trades

The Dip exists to filter mediocrity. It rewards only those who endure difficulty long enough to reach rare excellence.

Great Traders Quit — But They Quit Smart

Blind persistence is costly. Great traders quit all the time, but they quit strategically.

They walk away from bad systems.

They abandon weak setups.

They discard distractions that drain mental energy.

The real mistake is quitting the Dip while clinging to dead ends. Strategic quitting means stopping only when a system proves it has no edge—not merely because it feels uncomfortable.

- Is this drawdown still within historical norms?

- Am I changing my plan, or just reacting under pressure?

- Is this short-term pain or a sign of structural decay?

When the evidence says your edge is gone, quit without hesitation. But when it’s only a valley—a temporary Dip—then persistence is the price of entry.

Don’t Mistake a Dip for a Dead End

Don’t Mistake a Dip for a Dead End

Godin highlights a crucial distinction:

- The Dip is temporary struggle that leads to growth if you persist.

- The Cul-de-Sac is a loop that never improves, no matter how long you stay.

In trading, a Dip is a drawdown within statistical expectation. A Cul-de-Sac is, for example:

- Scalping in thin markets with wide spreads

- Trading headlines without a defined edge

- Using a discretionary style that underperforms year after year

Learning to separate the two is one of the trader’s most valuable survival skills.

The Dip Protects Opportunity

The Dip Protects Opportunity

The Dip is a moat. Most traders drop out when conditions get tough, leaving a smaller field for those who remain. That scarcity of persistence creates outsized rewards—both financial and psychological—for those who push through.

Godin urges readers to be the “best in the world.” In trading, your world is your niche:

- Best in the world at timing mean reversion in AUD/JPY

- Best at spotting trend-following setups in copper futures

- Best at knowing when to step back and preserve capital

You don’t need to outperform everyone, everywhere. You only need to dominate your chosen space.

Quit Fast, Stick Hard

The clearest lesson is this: quit ruthlessly, but only the right things. Stick relentlessly to what matters.

Quit unnecessary indicators.

Quit chasing contradictory advice.

Quit toxic forums and endless strategy shopping.

But stick hard to:

- Clean, tested setups

- A process-first mindset

- Discipline in execution and review

- Risk management as non-negotiable

The Dip isn’t there to punish you. It’s there to test whether your process is worthy of survival.

Conclusion: The Dip Is a Trader’s Rite of Passage

Conclusion: The Dip Is a Trader’s Rite of Passage

Most traders never survive their first Dip. They abandon their strategy, implode emotionally, or take shortcuts that eventually cost them everything.

But those who succeed? They diagnose the Dip with precision, quit what is unworthy, and endure the painful stretches that forge mastery.

Godin’s warning is sharp: “If you can’t make it through the Dip, don’t start. But if you start, don’t stop just because it’s hard. Stop only because it’s wrong”.

In the end, trading is full of noise. The Dip is where clarity emerges—and where traders discover their truth.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

Don’t Mistake a Dip for a Dead End

Don’t Mistake a Dip for a Dead End The Dip Protects Opportunity

The Dip Protects Opportunity Conclusion: The Dip Is a Trader’s Rite of Passage

Conclusion: The Dip Is a Trader’s Rite of Passage