ADA Price Analysis – January 19

In case the bulls increase their momentum and push the price above the resistance level of $0.38, then, $0.42 and $0.50 may be tested. If the price is rejected at the $0.38 level, price consolidation may commence. The support level can be found at $0.34, $0.27, and $0.24 levels.

ADA/USD Market

Key Levels:

Resistance levels: $0.38, $0.42, $0.50

Support levels: $0.34, $0.27, $0.24

ADA/USD Long-term Trend: Bullish

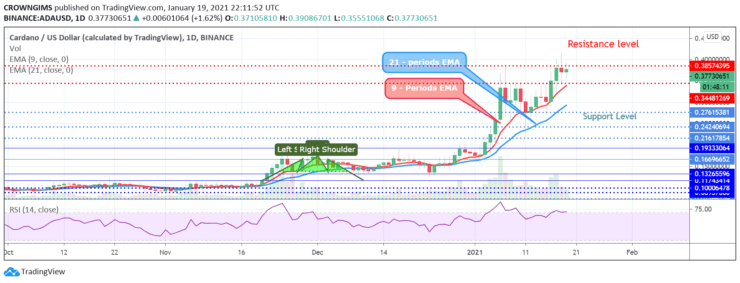

ADA is bullish in the long-term outlook. The currency pair pulled back last week to retest the support level $0.24. On January 12 the bulls gained more pressure and the price increases towards the resistance level of $0.37, later extends to $0.38 level. The price is testing the $0.38 level at the moment.

The 9 periods EMA is above the 21 periods EMA and the price is trading above the two EMAs which indicates a strong bullish movement in the ADA market. Should the bulls increase their momentum and push the price above the resistance level of $0.38, then, $0.42 and $0.50 may be tested. In case the price is rejected at the $0.38 level, price consolidation may commence. The support level can be found at $0.34, $0.27, and $0.24 levels.

ADA/USD Medium-term Trend

ADA/USD is bullish on the 4-hour chart. The price bounced at the support level of $0.24 with the formation of the Pin bar candle on January 11. The price steadily increases towards the resistance level of $0.34. The bullish strength is increasing and the mentioned resistance was penetrated. The price reached the resistance level of $0.38 on January 17. The price commenced consolidation at the $0.38 level due to low bears’ and bulls’ momentum.

Cardano is trading between the 9 periods EMA and 21 periods EMA which indicates weak bullish and bearish momentum. The Relative Strength Index period 14 with its signal line pointing up at 50 levels connotes a buy signal.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.