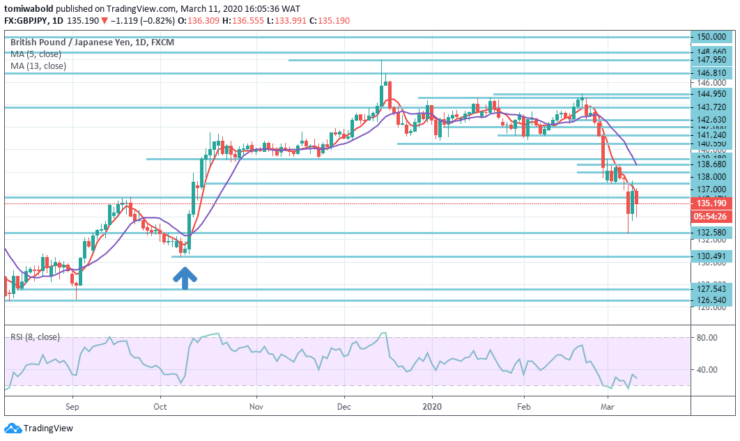

GBPJPY Price Analysis – March 11

GBPJPY struggles to carry out the turnaround moves of the previous day while declining to a level of 135.40, down 0.7 percent, during Wednesday’s initial Asian session. Prior market bounce on Monday to current levels eased but revived coronavirus worries (COVID-19) seem to weigh on the risk-tone, traders are also wary ahead of key events in the UK.

Key Levels

Resistance Levels: 148.66,144.95, 138.68

Support Levels: 132.58, 130.49, 126.54

GBPJPY Long term Trend: Ranging

In the larger structure, a 148.66 resistance level rejection suggests that the 126.54 level advance is just the third leg of the 122.75 (low) consolidation trend.

At the initial, the long-term pattern is modified as neutral. The break of the support level of 126.54 can continue a larger downward trend from level 195.86 (high) to level 122.75 low.

GBPJPY Short term Trend: Bearish

The intraday bias in GBPJPY stays neutral past the level 132.58 for consolidation. The upside of recovery may include a resistance level of 138.68 to usher in another decline.

Under the low level of 132.58, however, the decline may extend from level at 147.95 to low-level retest of 126.54. Nonetheless, a break of 138.68 level may suggest a short-term bottoming and lead to a stronger rebound back to the level of resistance of 140.55/144.95.

Instrument: GBPJPY

Order: Sell

Entry price: 135.75

Stop: 137.00

Target: 132.58

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.