Tech companies are spending money at a higher rate than they have before, particularly in the AI industry. This has created an AI bubble that has everyone talking, and for good reason.

For context, we’re looking at roughly $400 billion in spending this year alone on AI infrastructure.

To put that in perspective, that’s more than the entire Apollo moon program cost. Except companies aren’t doing this every decade—they’re repeating it every 10 months. The math just doesn’t work.

Companies plan to pour over $500 billion into AI development in 2026 and 2027. That’s equivalent to Singapore’s entire economy.

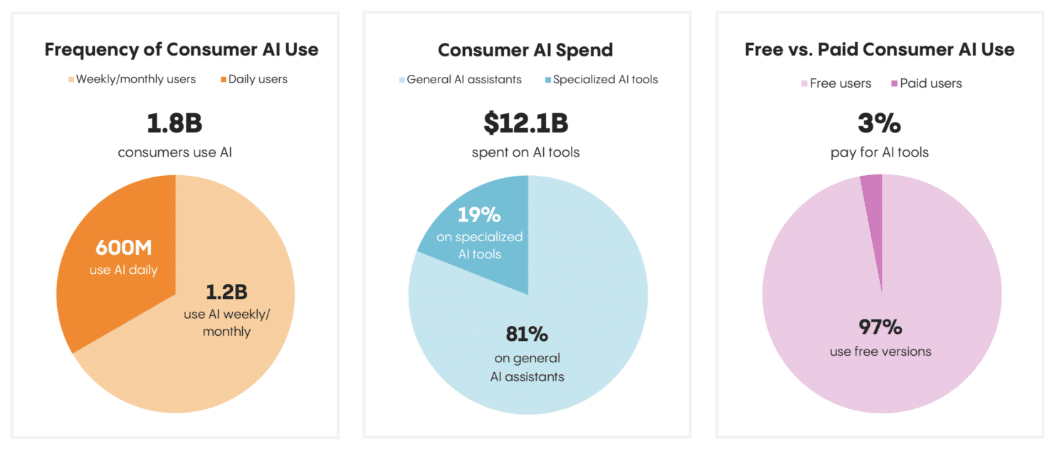

But here’s the problem: Americans only spend about $12 billion yearly on AI services. The gap between what’s being invested and what’s being earned is massive.

Why Smart Money Is Getting Nervous of an AI Bubble

Recent research shows that most companies aren’t seeing real returns from AI tools, and only 3% of people actually pay for AI services. Even worse, some reports suggest AI usage is dropping at major corporations.

For example, let’s look at OpenAI. The company brought in $4.3 billion in revenue during the first half of 2025, but Microsoft reported that OpenAI may have lost $12 billion in just one quarter.

Yet CEO Sam Altman says they’ll spend $1.4 trillion over eight years. That requires their revenue to jump from $20 billion to hundreds of billions by 2030.

I would like to clarify a few things.

First, the obvious one: we do not have or want government guarantees for OpenAI datacenters. We believe that governments should not pick winners or losers, and that taxpayers should not bail out companies that make bad business decisions or…

— Sam Altman (@sama) November 6, 2025

Another thing is that the red flags keep piling up. A startup called Thinking Machines just raised $2 billion at a $10 billion valuation without releasing any product. The founder wouldn’t even tell investors what they’re building. One investor described the pitch meeting as “absurd.”

Occurrences like these have happened right before other bubbles burst.

The Circular Money Game

Here’s where things start to get weird. Nvidia recently invested $100 billion into OpenAI to bankroll data centers, and OpenAI will then fill those facilities with Nvidia’s chips. Nvidia is basically funding its own customer.

This creates artificial demand that looks impressive on paper but doesn’t reflect real market needs.

This circular financing shows up everywhere. Microsoft owns 27% of OpenAI while also being a major customer of CoreWeave, another AI company where Nvidia holds equity.

Meanwhile, Microsoft accounts for nearly 20% of Nvidia’s revenue. It’s a web of companies investing in each other, which makes it hard to know what the real demand actually is.

CoreWeave’s story is telling. They started as a crypto mining company, then pivoted to AI data centers when that became hot.

OpenAI has deals with CoreWeave worth tens of billions where CoreWeave rents out chip capacity in exchange for stock, and OpenAI can use that stock to pay its rental fees.

This kind of arrangement works great when everyone believes in growth, but it falls apart fast when doubts creep in.

Historical Warnings Nobody’s Heeding

We’ve been here before. The dot-com bubble in the late 1990s saw companies pouring billions into fiber-optic cables for a future that hadn’t arrived yet. Sound familiar? The 2008 financial crisis featured fancy financial instruments that hid the real risks.

Today’s AI companies use special purpose vehicles (SPVs) to move spending off their books and accounting methods that make their profits look bigger than they are.

Private credit is funding much of this buildout, with assets under management hitting $1.6 trillion by early 2025. The deals being structured show major mismatches between asset life cycles and payback periods.

As one former congressional staffer put it, “We have sealed the deal on another financial crisis—the question is size.”

Stock market behavior is getting strange too. Traditional rules for sensible investing can’t explain current prices. The market is driven by momentum—people buying because they think others are buying.

By late 2025, 30% of the S&P 500 was held by just five companies, the greatest concentration in half a century. The S&P 500 trades at 23 times forward earnings, levels not seen since the dot-com days.

Is There an AI Bubble: The Bottom Line

Not everyone agrees we’re in a bubble. Federal Reserve Chair Jerome Powell argues that unlike the dot-com era, today’s AI companies have actual earnings and business models.

Goldman Sachs estimates AI could add $8 trillion to $19 trillion in economic value. Some analysts point out that current companies have triple the cash flow of dot-com era firms.

But here’s what we know for sure: spending is outpacing revenue by enormous margins, companies are using circular financing to boost valuations, and the math requires impossible growth rates.

History shows that when investment and reality diverge this far, corrections happen. Whether AI eventually changes the world doesn’t matter if you lose money in the crash first.

The question isn’t whether AI has potential. It’s whether today’s prices make sense. Right now, they don’t.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.