SNXUSD Market Analysis – Market Experiences a Change of Direction on SNXUSD

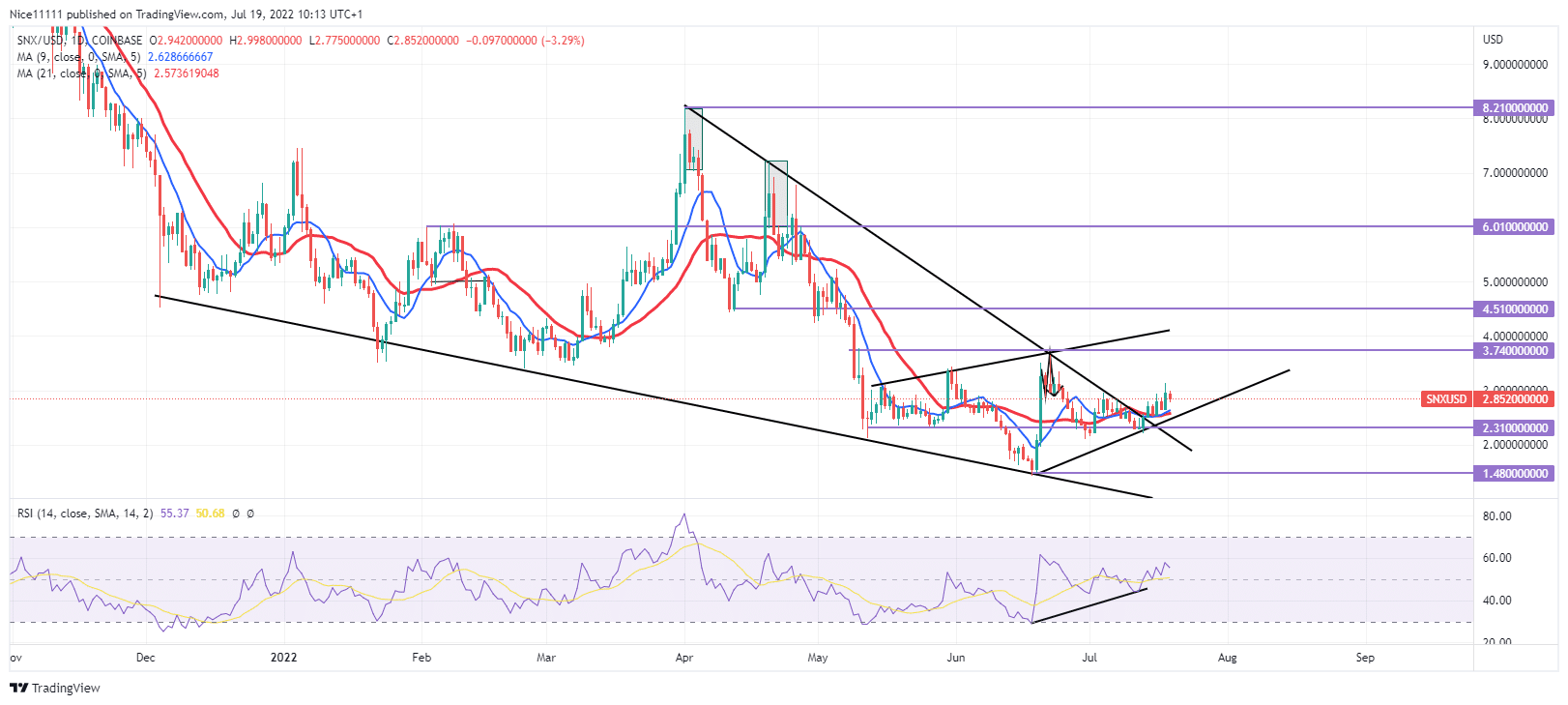

SNXUSD experiences a market direction change with the current structural shift in the market. A bullish reversal is currently playing out on the daily timeframe.

SNXUSD Key Zones

Supply Zones: $8.2100, $0.6010, $3.740.

Demand Zones: $1.480, $2.310, $3.710.

SNXUSD market experienced a market reversal during April. The current year high was formed during April at $8.210, just before the change in direction. The market formed double tops during the month of April to signify a bearish reversal. The RSI (relative strength index) signified that the market was oversold.

At $4.510, the market fell below the neckline of the double top. The daily candles dropped below the moving averages for periods nine and twenty-one. The market crashed rapidly until it reached the bearish trend line at $2.310. May was faced with market consolidation. The price eventually fell further to $1.480. Upon reaching the demand level at $1.480, there was a bullish surge which cleared the highs in the month of May. This was a clear sign of a change of direction from bearish to bullish.

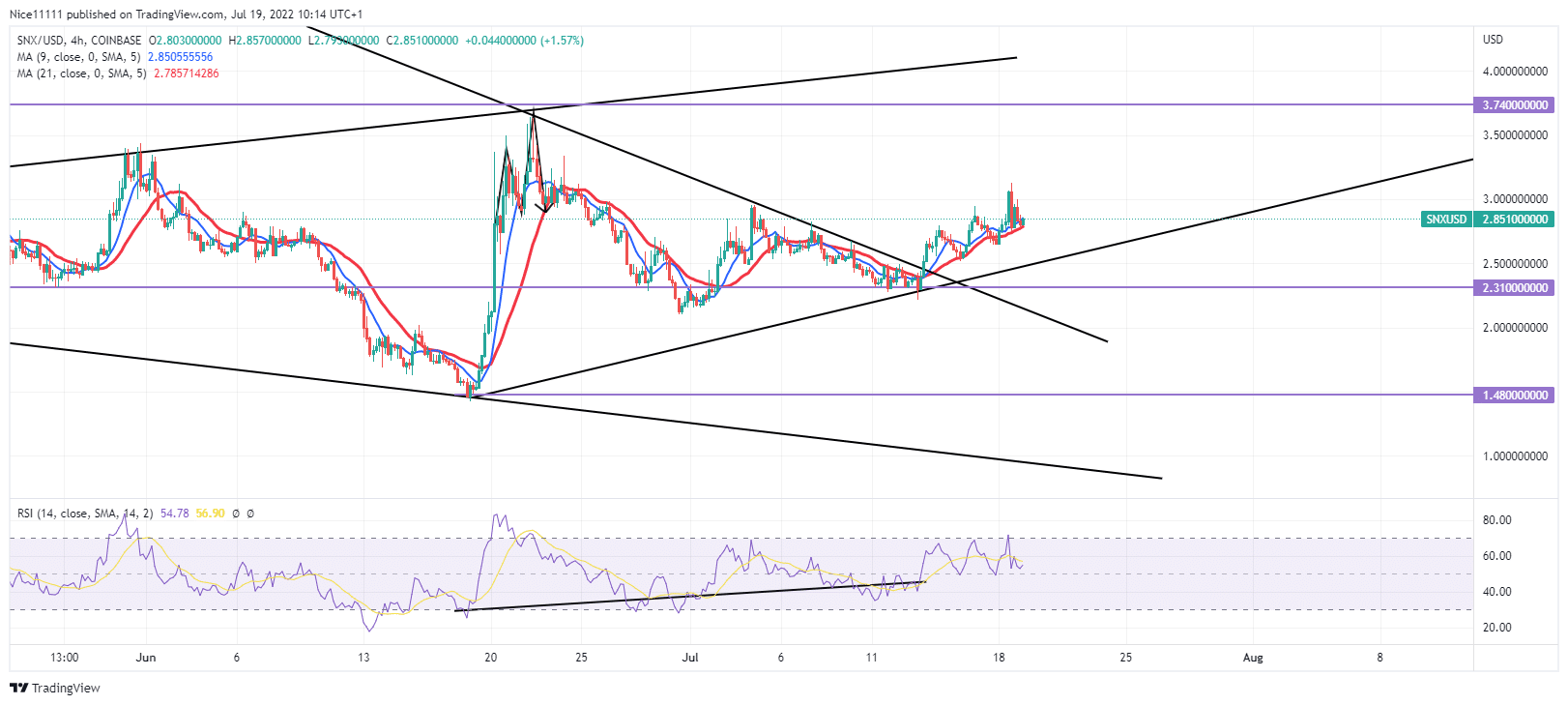

SNXUSD Market Anticipation

SNXUSD market has formed a new rising wedge on the four-hour chart. The bullish pattern has violated the bearish trend line, acting as resistance in the market. The moving averages of periods nine and twenty-one are resting below the candles to support the bullish motion. The confluence of the demand level at $2.310 and the bullish trend line is expected to foster the upward movement of the market. The stochastic indicator also shows the market is bullish. The market’s structural shift at the demand level of $2.310 is expected to send the market to the next key zone at $3.740.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.