Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

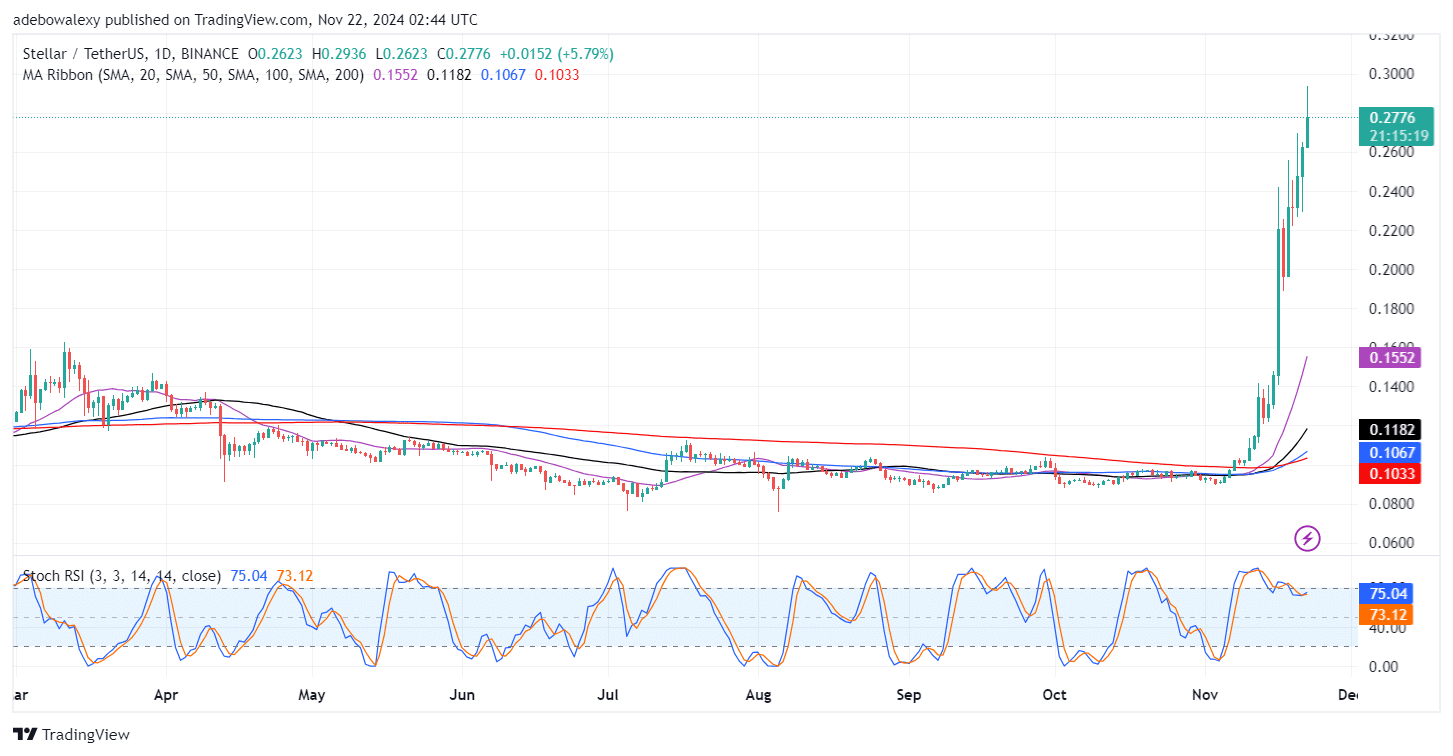

The Stellar token has seen a price increase of over 11% in today’s trading activity. This token began experiencing a surge in bullish activity on November 10th, pushing the market through multiple resistance price levels. Currently, upside forces are still very much in control and may keep the market on its current upward trajectory.

XLM Statistics:

Stellar Price: 0.2776

XLM Market Capitalization: 8.44B

Stellar Circulating Supply: 29.99B

XLM Total Supply: 50B

Stellar CoinMarketCap Rank: 19

Key Price Levels:

Resistance: $0.3000, $0.3500, $0.4000

Support: $0.2500, $0.2000, $0.1500

Stellar’s Upside Correction Seems Largely On

The XLM token has been quite bullish recently. The appearance of the recent price candle suggests that upside forces have maintained significant dominance. Furthermore, the last price candle is still green with a long upper shadow.

This indicates that the market may have attracted the activities of bear traders, who are taking profits. Consequently, this has caused the market to contract downward. Nevertheless, trading continues above all Moving Average Ribbons, suggesting that upside forces will continue propelling prices higher.

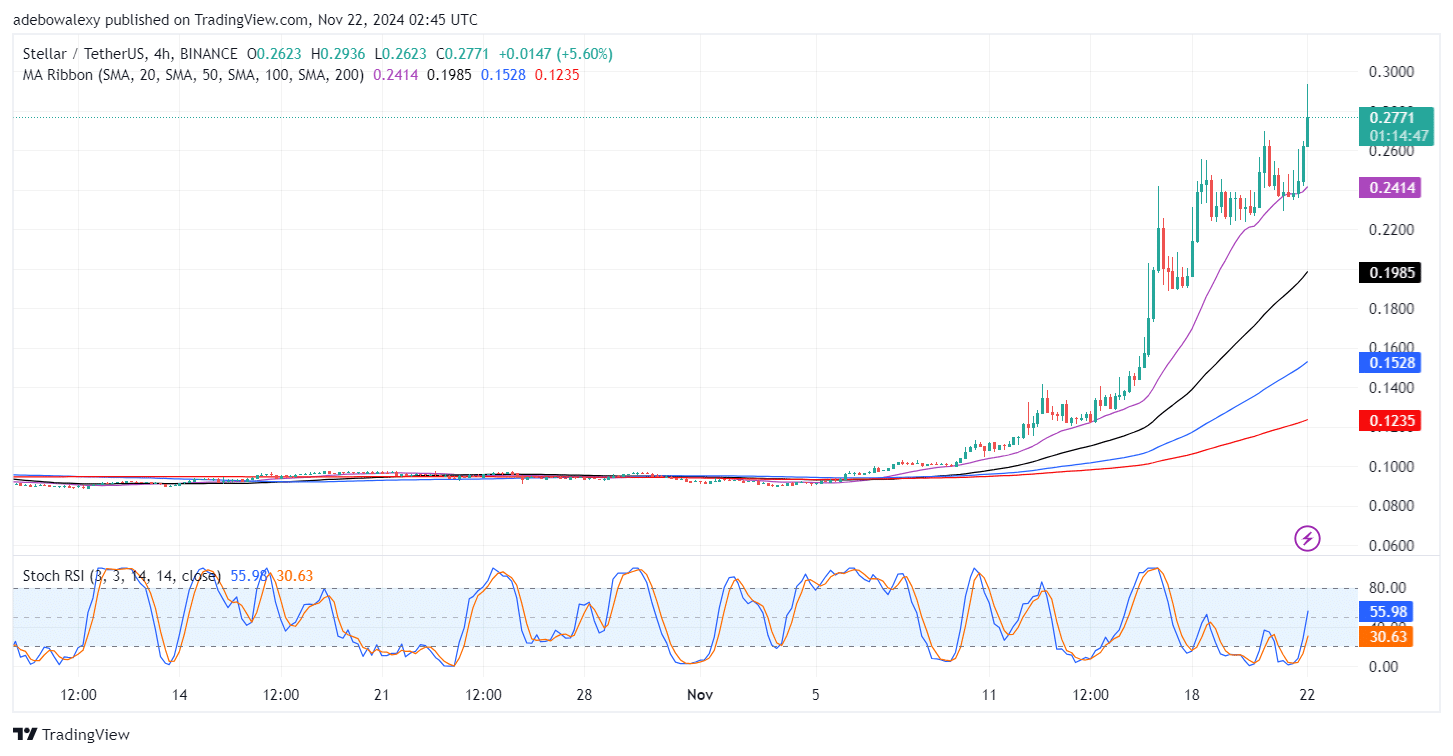

Upside Forces Are in Shape in the XLM Market

The Stellar 4-hour market reveals a clear uptrend. The market has been forming higher highs during periods of consolidation. Also, the last three price candles on this chart are green, indicating upward momentum. Similarly, the market remains above all MA lines, while the Stochastic Relative Strength Index (RSI) lines continue to rise.

The lead line of the indicator is already above the 50 mark, while the lagging line is still at approximately 31. Consequently, trading activity, even in this shorter timeframe, still suggests a trend continuation. Therefore, crypto signals targeting $0.3000 and price levels above are viable in this market.

Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.