Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Introduction

In 2018, Circle launched USDC, a stablecoin, to tap into the transformative potential of open blockchain networks. USDC, pegged to the US dollar, fuses the stability and trust of traditional currency with the agility and innovation of the internet. This report delves into the macro perspective of the USDC economy, highlighting its global reach, growth, technological integrations, regulatory landscape, and its impact beyond speculative trading.

Global Reach of USDC

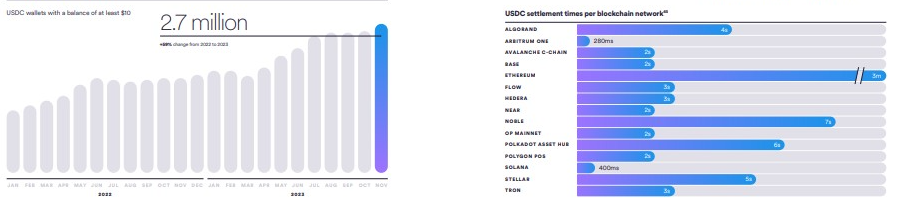

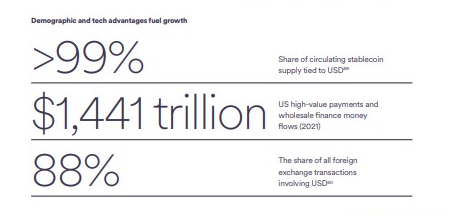

USDC has rapidly expanded its footprint since its inception, bridging geographical gaps. Available in over 190 countries and held in nearly 3 million on-chain wallets, USDC facilitates the seamless access, holding, and transaction of digital dollars worldwide. The US dollar’s hegemony in international trade invoices, particularly in Latin America, Asia Pacific, and the rest of the world, highlights its crucial role.

Blockchain Transaction Volume

USDC’s exponential growth is evident in its usage of approximately $12 trillion in blockchain transactions since 2018. This surge in transactions indicates a broader acceptance and utility of digital dollars on the blockchain, encouraging developers to build new applications and strengthen the USDC ecosystem.

USDC as a Dollar API

Positioned as a dollar API on the public internet, USDC serves as an open-source building block, fostering easy integration into fintech, banking, and digital currency projects. This facilitates nearly instant, low-cost transactions denominated in the world’s most widely used currency, opening avenues for innovation in the evolving financial technology stack.

Technological Integration and Blockchain Interoperability

USDC’s native availability on 15 blockchain networks underscores its commitment to interoperability. The Cross-Chain Transfer Protocol (CCTP) further reduces friction, enhances safety and security, and lowers costs when transferring USDC across different blockchains. This strategic approach aims to make blockchain complexity fade into the background, ensuring a seamless experience for users.

Support for Developers

With the growing community of developers building on blockchain networks, Circle provides programmable wallets, smart contract templates, and other services to support ecosystem growth. This simplification process empowers enterprises and developers to integrate digital assets like USDC into existing customer experiences without extensive redevelopment.

Regulatory Landscape

USDC operates within a well-regulated framework, aligning with evolving global regulatory trends. Notable regulatory advancements in major jurisdictions, such as Singapore, reflect a commitment to overseeing stablecoins like USDC. The imminent implementation of Europe’s MiCA regulations and ongoing legislative developments in the United States and the United Kingdom further signal a maturing regulatory landscape.

Beyond Speculation: USDC’s Impact

USDC has transcended its initial purpose as a medium for digital asset trading. Accepted as currency by the Federal Reserve, the coin has developed into a flexible tool for trade, remittances, cross-border transactions, general-purpose payments, and even charitable contributions. Its ‘moneyness’ is evident in its evolution into a stable store of digital value.

Empirical Evidence

Empirical evidence supports the shift in USDC’s use, with charts illustrating its role beyond speculative trading. From facilitating remittances to reducing payroll frictions and serving as a store of value amidst inflation concerns, the coin has established itself as a form of digital money with real-world utility.

USDC Macro Perspective: Looking Ahead

As the regulatory landscape matures and digital assets become more integrated into traditional financial systems, USDC is poised to further embed itself in the global economy. Its adherence to responsible financial innovation, promotion of financial inclusion, and commitment to global financial integrity norms position the coin as a key player in the ongoing evolution of digital currencies.

For the best Forex insights and signals, join the Learn2Trade Telegram channel today.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, presented product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.