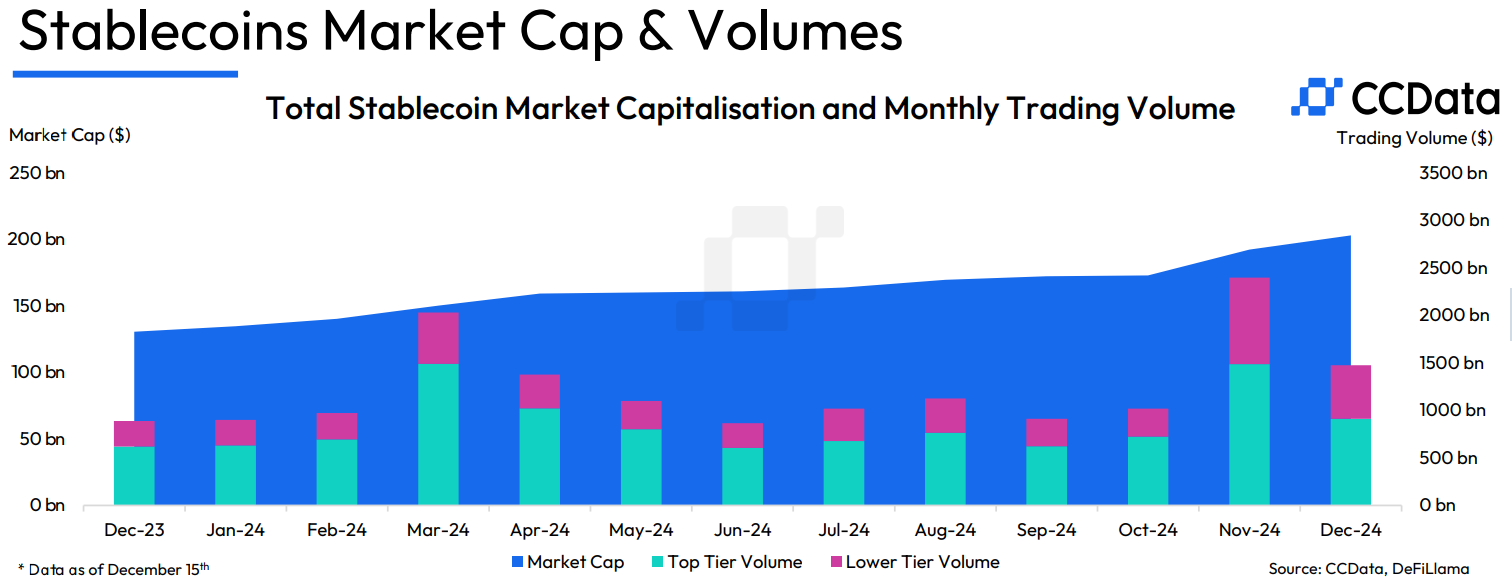

The stablecoins market has reached a significant milestone, surpassing $200 billion in total market capitalization for December 2024. This 5.51% increase marks the fifteenth consecutive month of growth for the sector, highlighting the growing importance of price-stable cryptocurrencies in the broader digital asset ecosystem.

Market Leaders and Key Developments

Tether (USDT) continues to dominate the stablecoin landscape, reaching a new all-time high of $140 billion in market cap, representing a 4.51% monthly increase. USDT now commands 69.1% of the total stablecoin market. Meanwhile, USD Coin (USDC) has shown impressive growth, with its market cap rising 6.7% to $42.4 billion—its highest level since December 2022.

A notable development is the strategic partnership between Circle and Binance, aimed at expanding USDC’s global reach. The collaboration will introduce more USDC trading pairs and special promotions on the world’s largest cryptocurrency exchange.

This move comes at a crucial time, as USDC currently accounts for only 119 trading pairs on Binance, compared to USDT’s 465 pairs.

European Regulatory Impact on Stablecoins

The European Union’s Markets in Crypto-Assets (MiCA) regulation is causing significant changes in the stablecoin ecosystem. According to CCData, Coinbase has announced the removal of six non-MiCA-compliant stablecoins, including USDT, from its European platform by December 30. The affected tokens include popular options like DAI, PYUSD, GUSD, GYEN, and PAX.

In a related development, Tether has discontinued its Euro-pegged stablecoin (EURT) citing strict MiCA compliance requirements and declining demand. EURT’s market cap dropped 0.47% to $26.9 million, marking its thirteenth consecutive monthly decline.

Instead of maintaining EURT, Tether is shifting its European strategy by investing in MiCA-compliant firms like Quantoz Payments and StablR.

The stablecoin trading landscape remains dynamic, with centralized exchanges recording $1.48 trillion in trading volume by mid-December, per the CCData report. USDT pairs dominate trading activity with an 86.3% market share, followed by First Digital’s FDUSD at 6.85% and USDC at 6.72%.

Despite the overall market cap growth, stablecoin market dominance has decreased to 5.45%, its lowest level since March, primarily due to the surge in broader cryptocurrency prices, with Bitcoin reaching new heights above $108,000.

These developments suggest a maturing stablecoin sector that’s adapting to regulatory requirements while maintaining its crucial role in the cryptocurrency ecosystem. The continued growth in market capitalization, despite regulatory challenges, indicates strong underlying demand for stable digital assets.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.