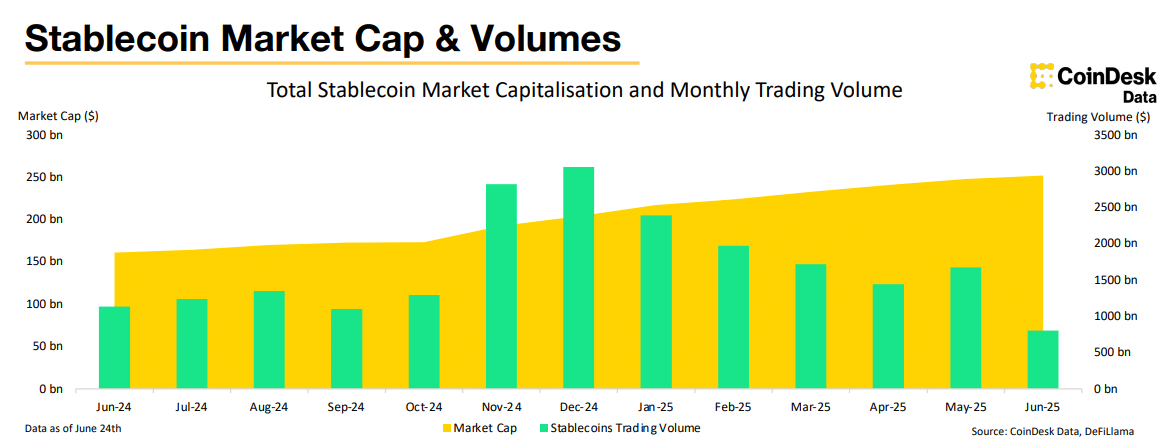

The stablecoin market reached an unprecedented milestone in June 2025, with total market capitalization climbing to $251 billion—a 1.58% increase that marks the 21st consecutive month of growth.

This sustained expansion reflects growing institutional confidence and regulatory progress that’s reshaping the digital currency ecosystem.

Market dominance for stablecoins also increased to 7.59% from 7.47% in May, as investors sought stability amid escalating Middle East tensions. The flight to digital dollar equivalents demonstrates how these assets now serve as crypto’s primary safe haven during periods of uncertainty.

GENIUS Act Drives Market Enthusiasm

The regulatory landscape shifted dramatically when the U.S. Senate passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act with strong bipartisan support in a 68-30 vote.

This landmark legislation establishes comprehensive federal oversight for payment stablecoins while imposing a two-year ban on algorithmic variants.

The regulatory clarity sparked a surge in corporate interest. Major corporations, including Amazon, Walmart, and JPMorgan, are now exploring their own stablecoin initiatives. This corporate adoption signals a fundamental shift from experimental technology to mainstream financial infrastructure.

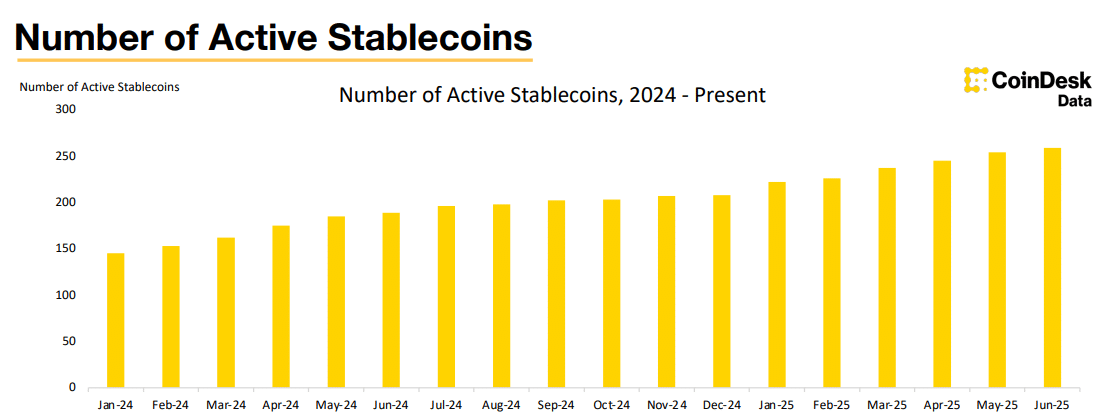

The number of active stablecoins nearly doubled from 136 at the start of 2024 to 259 by June, demonstrating the sector’s rapid expansion following regulatory guidance.

Circle’s Public Market Debut Creates Valuation Benchmarks

Circle’s June 4 IPO generated significant market attention, with CRCL stock rallying 750% from $31 to $263, reaching a market capitalization of $58.6 billion.

This valuation nearly matches the $61.3 billion circulating supply of USD Coin (USDC), creating an interesting parallel between equity and stablecoin values.

The company’s extraordinary P/E ratio of over 2,700 far exceeds Coinbase’s 69.5 multiple, reflecting investor optimism about stablecoin revenue models. Circle generated $1.89 billion in revenue over the past 12 months by earning yield on cash-equivalent collateral backing its tokens.

Stablecoin Market Trading Volumes and Leadership

Tether (USDT) maintained its dominant position with $156 billion in market cap, representing 62.1% market share. However, its trading dominance decreased to 73.1% of centralized exchange volume, while USDC captured 14.1% and First Digital USD (FDUSD) held 11.8%.

European players are gaining traction, with Societe Generale announcing plans for USDCV, a USD-denominated stablecoin launching on Ethereum and Solana. Their existing euro-pegged EURCV reached a $41.8 billion market cap with record trading volumes of $59.8 million.

The stablecoin sector’s maturation from experimental tokens to regulated financial infrastructure represents one of crypto’s most significant developments, positioning these assets as essential components of the evolving digital economy.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.