S&P 500 Price Analysis – April 21

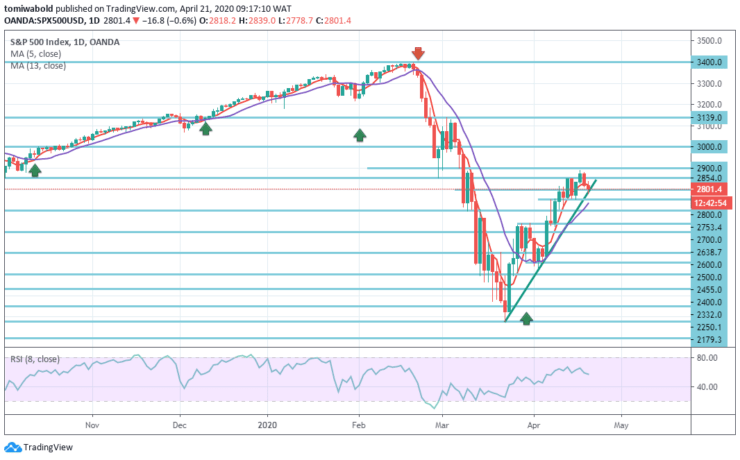

S&P 500 depicts the return of suspicion in the early Asian session on Tuesday, following a recent risk-on. The S&P declined 0.64 percent to 2.778.7 level and the S&P 500 upside rally lost momentum during the European session as market declines beneath 2800 level.

Key Levels

Resistance Levels: 3139.0, 3000, 2854

Support levels: 2753.4, 2638, 2500

S&P 500 Long term Trend: Ranging

The indicators are becoming gradually low on the daily readings, with both MA and RSI struggling to keep from flipping over. RSI’s overbought readings would potentially take longer to flash its upcoming sell signal than is the case with MA’s. Such an outlook is increasing the chance that the S&P 500 may take a breather early.

While the S&P 500 remains in a variable role when posting higher highs and higher lows as price drops beneath support level of 2800. The market is slightly stepping back but remains skewed to the upside with investors targeting the round figure of 2900 and 3000 levels. The support level of 2800 may create a barrier, on the contrary, should the price fall further below.

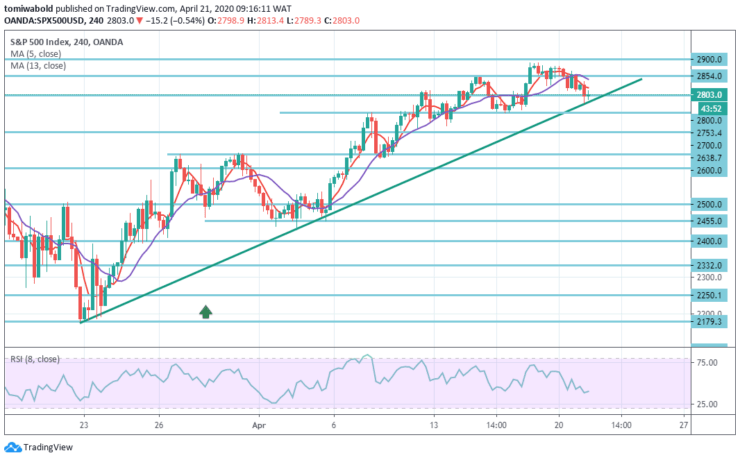

S&P 500 Short term Trend: Bullish

Throughout the near term, as seen in the 4-hour time frame, investors may perceive the current low price of 2778.7 level in the S&P 500 as a significant reversal supported by the upward trendline, reflecting a 50 percent retraction of the all-time highs and lows in March. The inability to hold above this level can induce some risky bearish momentum just as the season of earnings continues to evolve.

However, the bulls will have to rise above the 5 and 13 moving averages and more specifically run above the near-term level of 2.854 and the horizontal lines of resistance ahead to validate a sustainable upward push.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.