S&P 500 Price Analysis – August 4

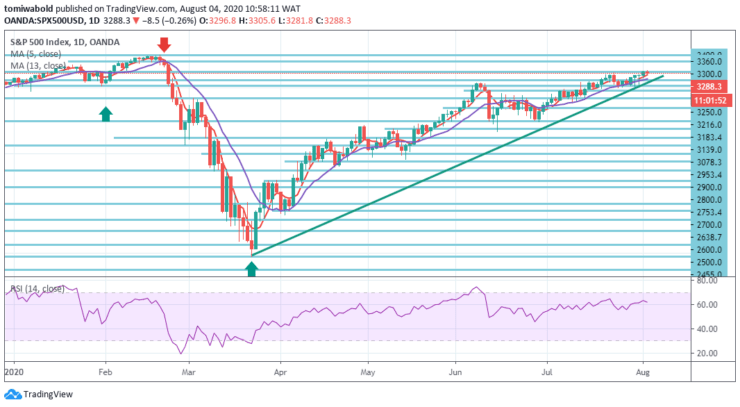

The main US stock index opened on Tuesday in the positive territory. As of writing, the S&P 500 Index (SPX) has been at its highest level since late February at 3288 levels, losing 0.25 percent per day. The futures upside momentum tones down beneath the high level of 3300 after hitting a fresh high of 3305 early in the European session.

Key Levels

Resistance Levels: 3400, 3360, 3300

Support levels: 3216, 3183, 3139

S&P 500 pushed sharply higher on Tuesday as the market yet again kept 3300-level main price resistance, as well as its rising moving average of 5, presently at 3285 levels. However, given this intensity, the index dropped beneath the level of 3300.

Beyond the recent level, it is appropriate to bring an end to this high-level consolidation phase with resistance seen next at 3360 levels and then, more significantly, at the top of the price range at 3400 levels in February, which is anticipated to stay a major obstacle.

The above chart indicates a higher level of the transition in this session. As we head towards closing the price while still hanging beyond the 3250 levels’ main support level. There’s a level nearby at the 3300 levels which might provide some resistance in the near term.

Since a switch is to be lower, then the horizontal lines beneath the market price at 3289 level at 3250 and 3216 levels respectively may be the main support areas. All the indicators are distinctly bullish. The Relative Strength Index also moves in the direction of the overbought zone but there is still space for a higher shift.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.