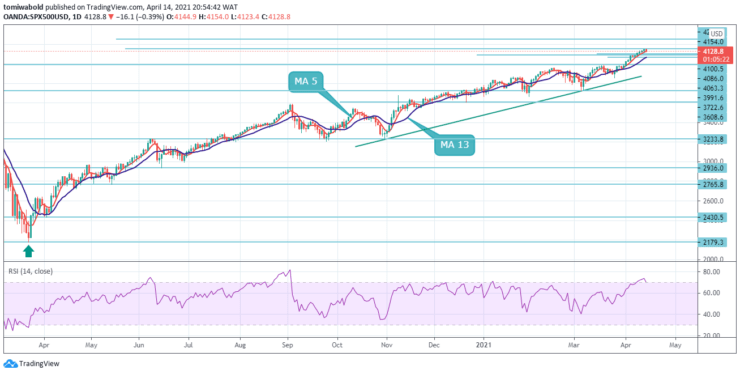

S&P 500 Price Analysis – April 14

The S&P 500 updated the record highs during the day at 4154 levels, gaining 0.02% before retreating lower. The bond market sell-off will restart in due course, capping stock market gains. Since mid-March, the 10-year Treasury yield has been relatively steady.

Key Levels

Resistance Levels: 4250, 4200, 4154

Support Levels: 4100, 4063, 3991

On a daily basis, the uptrend is expected to falter and remain below the 4154 daily peaks, while the market is trading above support level 4086 and consolidating further into the next session, until hitting the resistance level at 4200.

The RSI is currently going away from the overbought threshold, while the price has turned lower after retracement from the 4154 marks, confirming the ranging outlook. In the medium-term outlook, the moving average 5 and 13 holds its location and can shift marginally higher.

The S&P 500 index has a bullish outlook in the short term since breaking through the consolidation region of 4063-4086 levels the previous week. With the price breaking through the 4100 barriers, traders are expecting a retest of the record high at 4200 levels before finally retreating.

However, rising bearish momentum and a south-trending 4 hour Relative Strength Index point to more weakness, bringing bears completely into play on a firm break of the pivots at 4100. Until another turnaround, the expected scenario is located under 4100 levels, with targets at 4086 and 4063 levels extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.