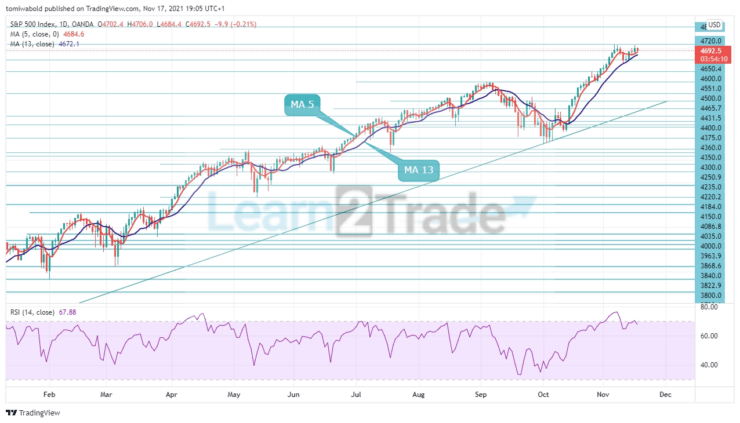

S&P 500 Price Analysis – November 17

The S&P 500 has had a turbulent start to the week, fluctuating within the range of 4,650/4,720 zone amid the market sentiment. The index is now trading flat on the day, about in the midpoint of this range, a little under 4,700. Positive US macroeconomic data fueled a stock market boom, as Retail Sales increased to a seven-month high, more than tripling the September number.

Key Levels

Resistance Levels: 4800, 4750, 4720

Support Levels: 4650, 4600, 4551

On Tuesday, the S&P 500 rose substantially as the market maintained its key price resistance of 4720, as well as its rising moving average of 13, which is currently at 4670. However, as a result of this ferocity, the index fell below 4690 during the present session.

Beyond the recent level, it’s time to call for a cautious action to this high-level consolidation phase, with resistance next indicated at 4800 levels and, more importantly, at the top of the price range at 4720 levels in November, which is expected to remain a big roadblock.

On the 4-hour time frame, the technical analysis context of the S&P 500 index is currently in a very fascinating zone. A break above the 4720 levels would be bullish, but a break below the 4650 levels at the horizontal support line would keep the uptrend unstable.

Examining the signs from the previous session, they showed a bullish push forward. Though dropping, the relative strength is staying past 50. Both 5 and 13 moving averages have turned neutral and may be approaching a crossover under the 4680 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.