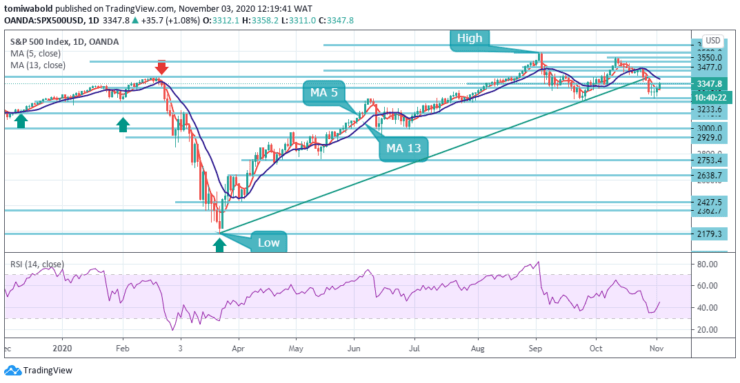

S&P 500 Price Analysis – November 3

S&P 500 extends upside advance beyond 3350, up 0.5% on a day, during early Tuesday. The index went higher at the start of the week as investors get ready for the US presidential election. After the strong negative sessions in the preceding month, the index is trying to gain some ground.

Key Levels

Resistance Levels: 3522, 3450, 3400

Support Levels: 3210, 3000, 2929

After the strong negative sessions in the preceding month, the S&P 500 is trying to gain some ground with the RSI indicator turning up and creating a bullish crossover towards its midline territory. The above 3350 levels are needed to ease the immediate downside bias for strength back to the price gap from last week.

A close above 3400 remains in the picture to suggest a better low has been formed. Meanwhile, the upside move is likely to find resistance at the 3450 levels. Rising above this area would help shift the focus to the upside towards the 3550 levels. Breaking this level could see a re-test of the all-time high of 3,588.24 and turn the current neutral bias back to bullish.

S&P 500 Short term Trend: Ranging

On the 4 hour chart, price action has breached the resistance line at the 3350 levels. Bullish breakouts could confirm the uptrend whereas a break below the bottom invalidates the bullish bounce. To the downside, failure to overcome the 3400 levels could see the S&P 500 falling back towards the 3318 levels.

The S&P 500 is only bullish while trading beyond the 3350 levels, key support is found at the 3233 and 3210 levels. The S&P 500 is only bearish while trading beneath the 3233 levels, key resistance is found at the 3400 and 3450 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.