S&P 500 Price Analysis – April 7

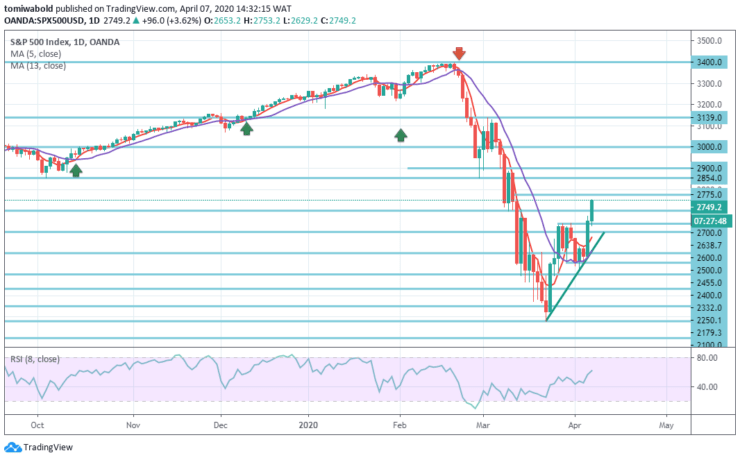

S&P 500 rose through last week’s high level of 2638.7 pushing further past the level of 2700 in today’s session as a slowdown in new infections suggesting that the epidemic may have hit a peak and that investors and markets could have better days ahead.

Key Levels

Resistance Levels: 3139.0, 2900, 2775

Support levels: 2600, 2445, 2250.1

S&P 500 Long term Trend: Ranging

Nevertheless, the S&P 500 ranges appear fragile beneath the resistance level of 2775 as the new week kicks off.

Its support can be seen at 2600 former resistance turned support level, under which the current moving average of 13 base low at 2445 level may add momentum to the reversal further, with more support afterward.

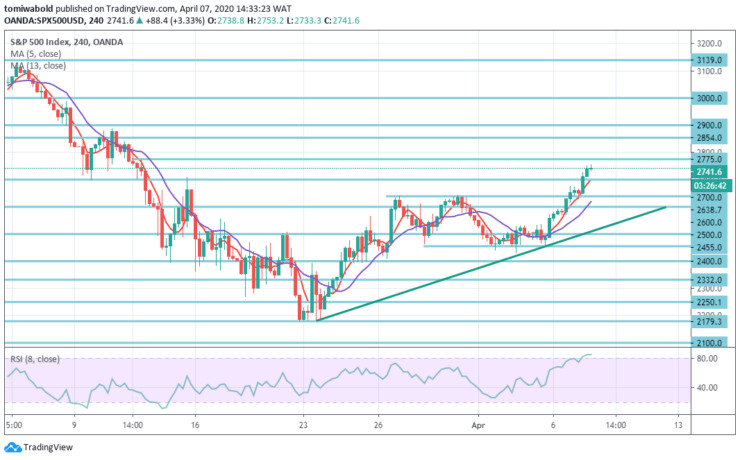

S&P 500 Short term Trend: Ranging

S&P 500 may boost its progress in the short term as New York indicates more evidence that the crisis is reducing. In the short term, the momentum indicators point to a neutral to positive bias, indicating the likelihood of an upside reversal in the RSI’s overbought region.

On the other hand, any further break up beyond the level of 2775.0 may proceed to a level rebound at 2854, alternatively underneath the level of 2600 may lead to a further downside with the target levels of 2445 and 2400.

Instrument: S&P 500

Order: Buy

Entry price: 2638.7

Stop: 2600.0

Target: 2775

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.