S&P 500 Price Analysis – April 14

Guarded optimism that the global coronavirus pandemic may have begun to nosedive pushed the S&P 500 higher in the European session on Tuesday past the 2800 psychological mark during Asia session. Steady growth is likely to continue, as the COVID-19 impacts the majority of businesses.

Key Levels

Resistance Levels: 3139.0, 3000, 2900

Support levels: 2800, 2600, 2445

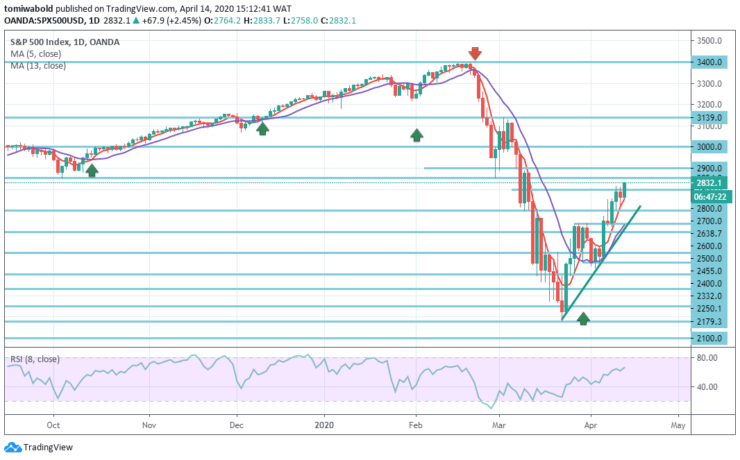

S&P 500 Long term Trend: Ranging

S&P 500 had a spike on the daily chart with lower intensity on account of a demand tail, indicating that supply is limited and demand comes in after breaking past the psychological level of 2800.

S&P 500 will get up to edge before supply develops. It is also worth noting that this rally is being held under the backdrop of a few sellers. Before indications of such an increase in bears become visible, the S&P 500 may climb to the next level of resistance, at 2854.0 and 2900 respectively.

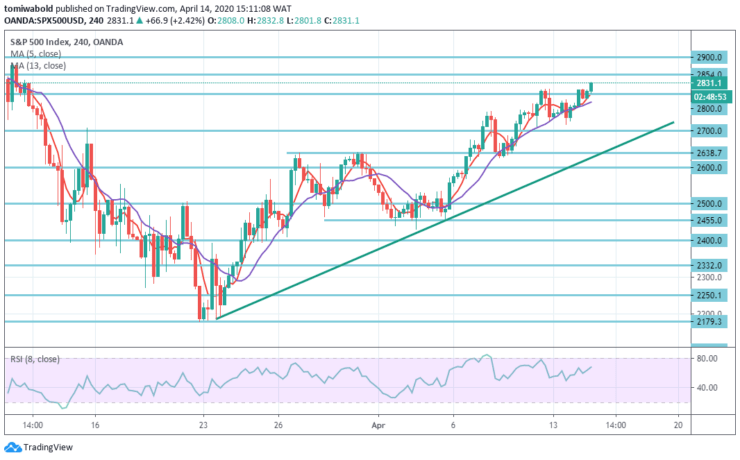

S&P 500 Short term Trend: Bullish

In the 4-hour chart, the price had a successful bounce off the supporting trendline, while the technical indicators are moving sideways, with the moving average 5 crossings above the moving average of 13 towards the horizontal resistance line and the RSI flattening above the 50 levels indicating a bullish advance.

Displaying that If price action leaps between 2854.0 and 2900 levels, there is potential for the testing main level of 3000. Breaching this main level may demonstrate further advances over the channel towards the resistance area of 3139-3400 levels. It is viewed as a powerful area of resistance, resisted many times in the past.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.