S&P 500 Price Analysis – April 21

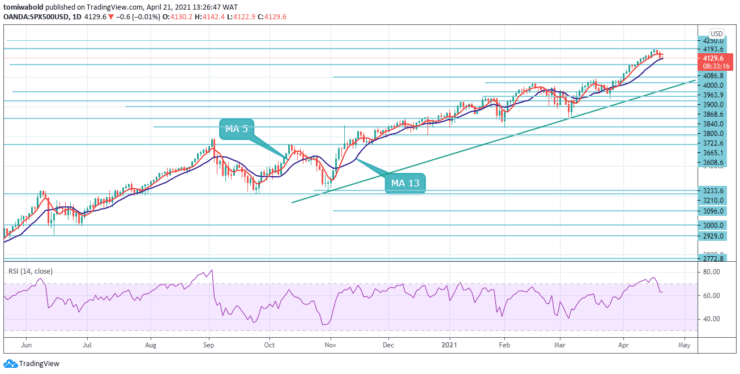

The S&P 500 Index has nearly reached the 4200 levels, as buyers pushed the price to register a temporary peak at the start of the week. The risk barometer tracks the stock market’s declines in the United States as a result of the coronavirus (COVID-19) concerns, thus ignoring recent vaccine improvements.

Key Levels

Resistance Levels: 4300, 4250, 4200

Support Levels: 4086, 4000, 3900

The barrier at moving average (MA 5) limiting price advance may remain intact, despite today’s bounce towards the resistance around the 4150 levels. A step below this level is needed to confirm that a corrective process has begun.

If seen, support will be found at the late April 6 high of 4086 at first, and then, as the pattern indicates, a cluster of supports lower at 4000 levels. A move back to the 4200 regions would require a move above 4150 levels and the limiting MA 5 to ease the immediate downside bias, with tougher resistance seen at 4250 levels.

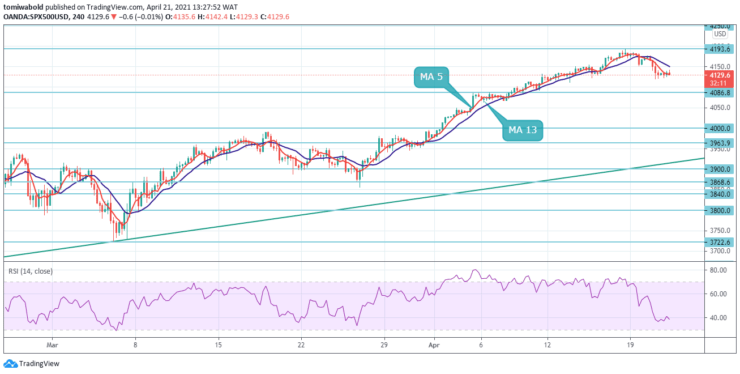

In the 4-hour chart, the S&P 500 index fell below the all-time peak of 4193 and slid marginally below the short-term moving averages of 13. Although the price remains in the positive zone around the MA 5, the relative strength index is staying below its midpoint of 50. If the bears gain power, horizontal support at the 4086 levels may provide immediate support.

On the other hand, an upside extension could push the index to its all-time high of 4193 and then to the 4250 resistance mark. Despite the current correction, the S&P 500 index is expected to continue to rise in the near term.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.