S&P 500 Price Analysis – February 4

The S & P 500 rose strongly in a temporary pullback to a higher zone on Tuesday as the risk-on mood is dominating the market. Buyers have gathered significant momentum, and a breakout past 3300 could retest an all-time high near 3338.50 level.

Key Levels

Resistance Levels: 3400, 3350, 3338.5

Support Levels: 3280.8, 3250, 3182

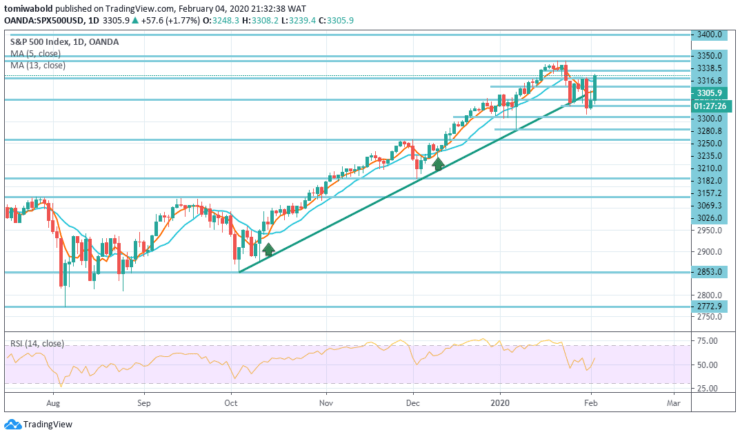

S&P 500 Long term Trend: Bullish

The S & P 500 is trading in an uptrend past the major daily moving averages 5 and 13. After about a week of consolidation, the market is regaining its strength and defying the 3300 resistance level.

Given that buyers have gathered a lot of momentum, a breakout beyond the above-mentioned resistance could return to retesting an all-time high near 3338.50 level. Support appears near 3250 and 3210 levels respectively.

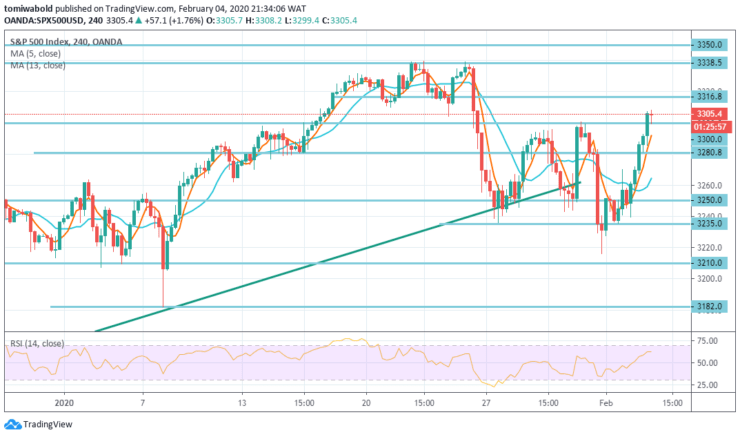

S&P 500 Short term Trend: Ranging

The S & P 500 started falling from 3338 levels, as the movement from the horizontal resistance restricted its movement upwards and found a peak. This drop could form part of the corrective movement towards the fourth consecutive downtrend, which could look for support/uptrend at the level at 3182.

On the other hand, the price remains past the 3280.80 level with targets at 3316.80 and 3338.50 levels in the extension, while the S&P 500 remains bullish. In an alternative scenario beneath the 3235.00 level, the price may approach the decline with the levels of 3210.00 and 3182.00 as targets.

Instrument: S&P 500

Order: Sell

Entry price: 3300

Stop: 3280.8

Target: 3338.50

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.