S&P 500 may pull back at $5200 level

S&P 500 Price Analysis – 19 March

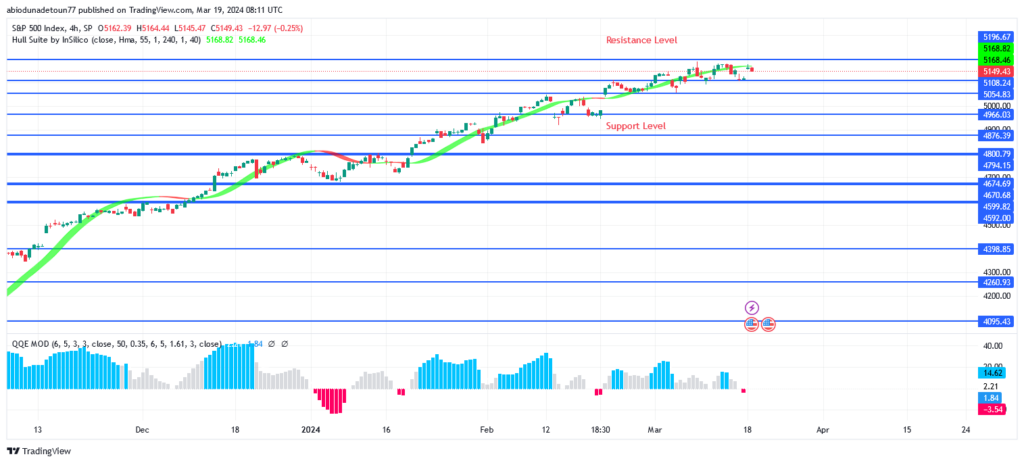

If the $5108 level holds, the S&P 500 can go fast into the resistance levels of $5200, $5266, and $5300. A purchase is indicated by the QQE MOD histogram as well as the Hull Suite signal. Spending more than $5200 in total is feasible

Key Levels:

Resistance levels: $5200, $5266, $5300

Support levels: $5108, $5054, $4966

S&P 500 Long-term trend: Bullish

The S&P 500 Index is rising, according to the daily chart. Sellers forced the price down to the $4095 support level on October 27. A bullish engulfing candle signaled the start of the bullish trend. The S&P 500’s market values are higher than the $4800–$4966 range. After then, it starts to ascend northward. The pattern of the “W” chart indicated a bullish reversal close to the $4800 barrier level. The desire to purchase caused the price to approach and surpass $4966 on February 7. Currently, purchasers were able to cling onto the recently constructed support level near the $5200 barrier level, where the S&P 500 is attempting to surge to all-time highs.

If the $5108 level holds, the S&P 500 can go fast into the resistance levels of $5200, $5266, and $5300. A purchase is indicated by the QQE MOD histogram as well as the Hull Suite forex signals indicator. Spending more than $5200 in total is feasible.

S&P 500 Medium-term Trend: Bullish

The four-hour chart of the S&P 500 shows encouraging signals. Price is rising above the $5108 resistance level due to the bulls’ strong momentum above the $5053 support level. The bulls have clung to the previously set level as the price has increased. Yesterday’s bullish engulfing candle increases the likelihood of reaching the $5200 price goal.

Compared to the S&P 500, the Hull Suite indication is less expensive. The QQE MOD indicator is above zero, indicating a buy signal.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.