S&p 500 tests $5483 level

S&P 500 Price Analysis – 18 June

If the $5414 level holds, the S&P 500 can rise and split into the resistance levels of $5483, $5494, and $5523. The $5265 and $5199 support levels could be tested by the price if the $5414 support level is shattered

Key Levels:

Resistance levels: $5483, $5494, $5523

Support levels: $5414, $5265, $5199

S&P 500 Long-term trend: Bullish

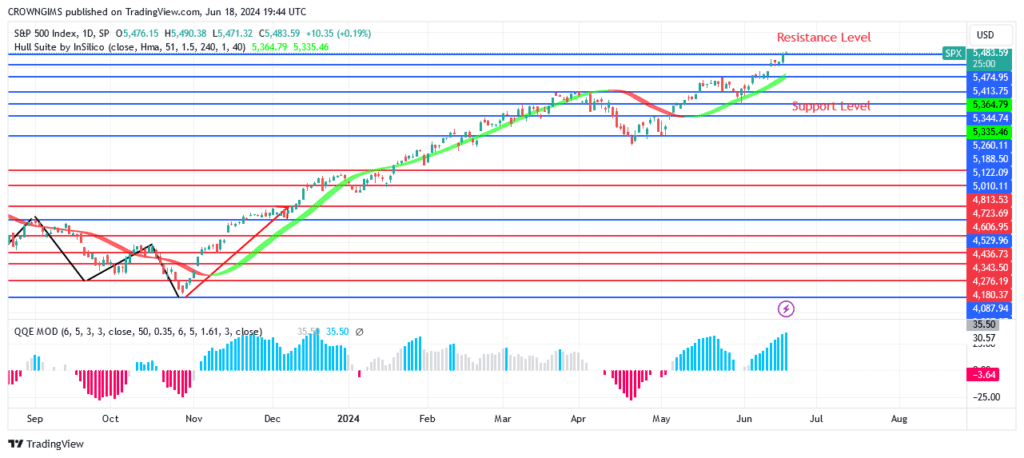

S&P 500 Index’s daily chart indicates an increasing trend. The S&P 500 index has been driven by acquisitions since October of last year. On April 1, an attempt was made to break through the resistance level of $5265, which had already been broken. By maintaining the predetermined prices, the sellers are averting additional price increases. The price decreased up to $4968, after which it increased. Right now, buyers are rushing to shatter the previously set level, which is driving the price over its previous top.

If the $5414 level holds, the S&P 500 can rise and split into the resistance levels of $5483, $5494, and $5523. The $5265 and $5199 support levels could be tested by the price if the $5414 support level is shattered. Both the Hull Suite forex signals and the QQE MOD histogram indicate a buy. Maybe it will keep going in the right direction.

S&P 500 Medium-term Trend: Bullish

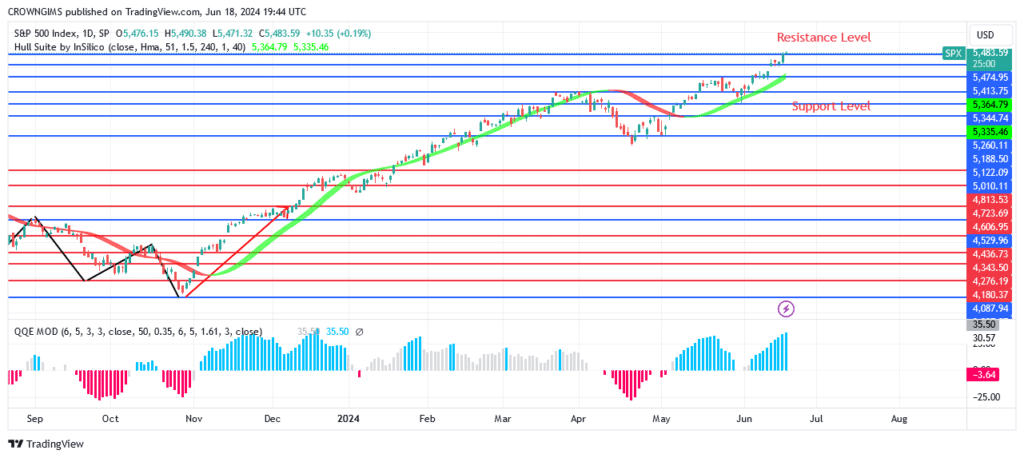

The 4-hour chart of the S&P 500 shows trends in inclination. The extreme aggressiveness of the bulls has caused the price to break above the $5265 barrier level throughout the past two weeks. As the price has risen, the bulls have held fast to the previously established level. A bullish engulfing candle last week sent the price up to $5414. The price target of $5483 was attained. Bulls are currently trading higher than the $5414 prior high.

The Hull Suite indicator is less expensive than the S&P 500. There is a buy signal when the QQE MOD indicator is higher than zero.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.