Sellers’ momentum may increase soon in S&P 500 market

S&P 500 Price Analysis – 16 May

When buying pressure picks up, the S&P 500 may break through the $4160 resistance level, and further buying could drive the price up to the $4330 and $4586 levels. The price may revert and fall in the direction of the support levels of $3909, $3775, and $3651 if the $4160 resistance level is held

Key Levels:

Resistance levels: $4160, $4330, $4586

Support levels: $3909, $3775, $3651

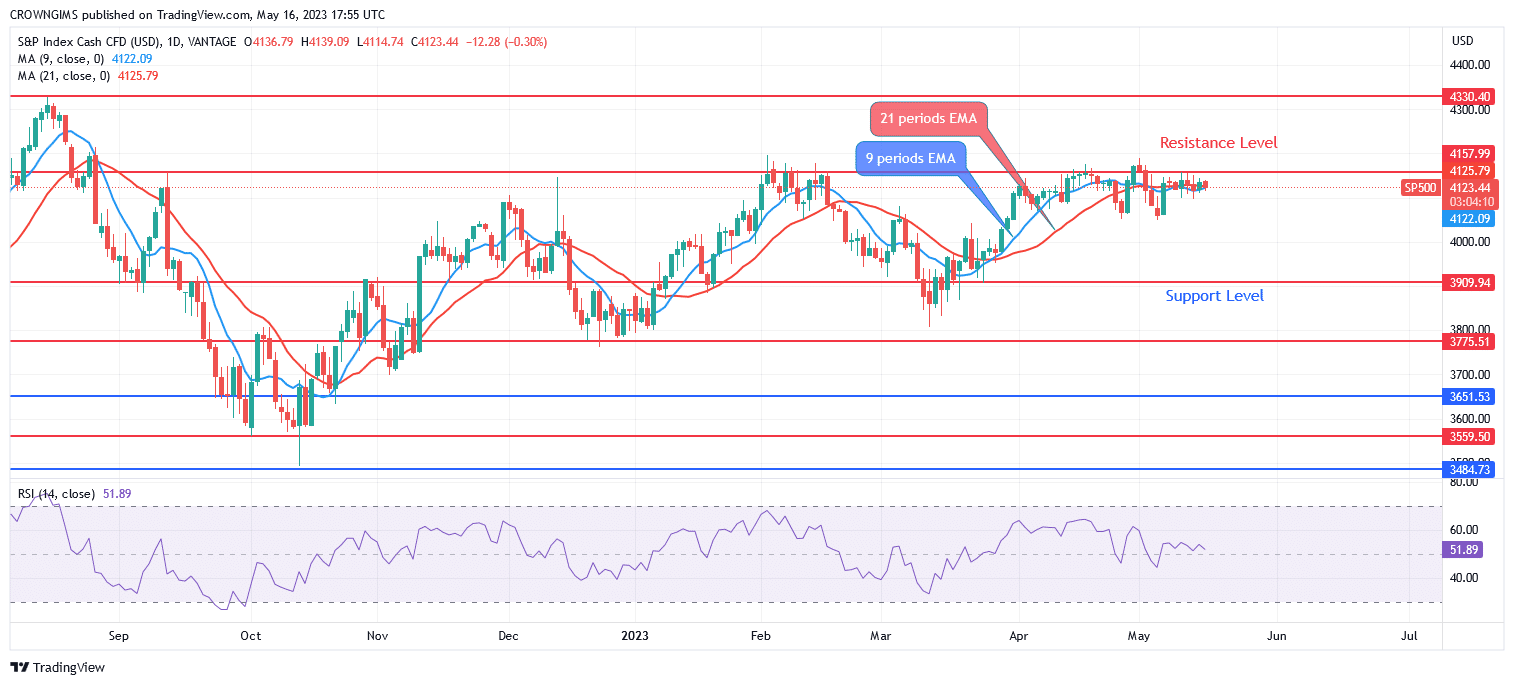

S&P 500 Long-term trend: Bullish

S&P 500 is moving in a bullish direction on the daily chart. On March 9, a support level of $3909 was breached. As there was little to no selling pressure, it was unable to reach the $3775 support level. When the client requested it, it cooperated with the increased pressure on pricing. The price started to go up on March 16 and peaked at $4160. Past the dynamic resistance level, the price rises. Increased buying pressure led to an increase in the $4160 barrier level. Price is consolidating around $4160 presently trying to break through.

When buying pressure picks up, the S&P 500 may break through the $4160 resistance level, and further buying could drive the price up to the $4330 and $4586 levels. The price may revert and fall in the direction of the support levels of $3909, $3775, and $3651 if the $4160 resistance level is held. The relative strength index period 14 is at 51 and the signal line heading downward represents a sell signal.

S&P 500 Medium-term Trend: Bullish

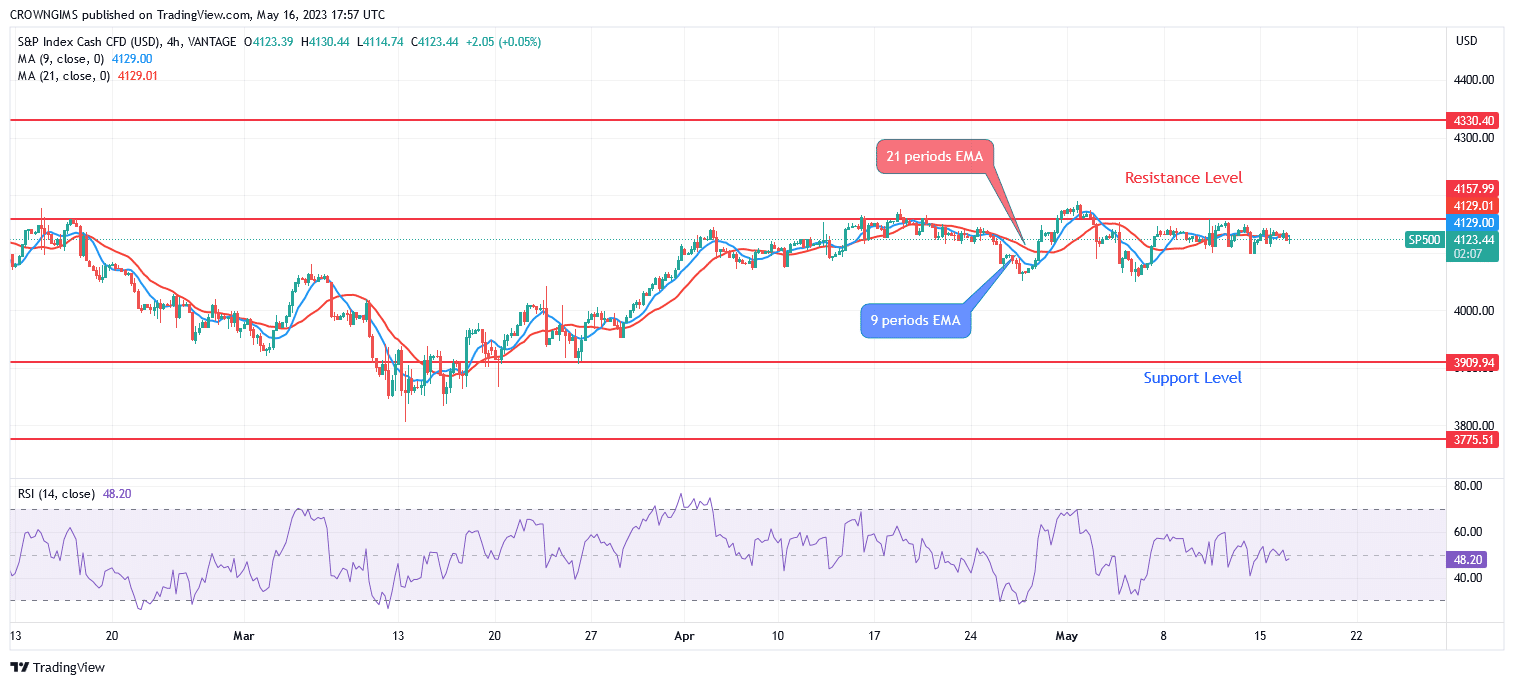

On the 4-hour chart, the S&P 500 is in the bullish direction. The sellers kept the S&P 500 price from sharply rising by holding the $4160 barrier level. Once it passed the $3909 support level, selling pressure caused the price to decline. Following the success of the $3775 that hold, the price was moving toward the resistance level of $4160. The price is currently ranging between the $4160 barrier level and the $3909 level.

The S&P 500 price is currently trading around both the 9- and 21-period exponential moving averages. On the Relative Strength Index period 14, at level 47, a bearish signal is discernible.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.