Buyers’ pressure is increasing in S&P 500 market

S&P 500 Price Analysis – 25 July

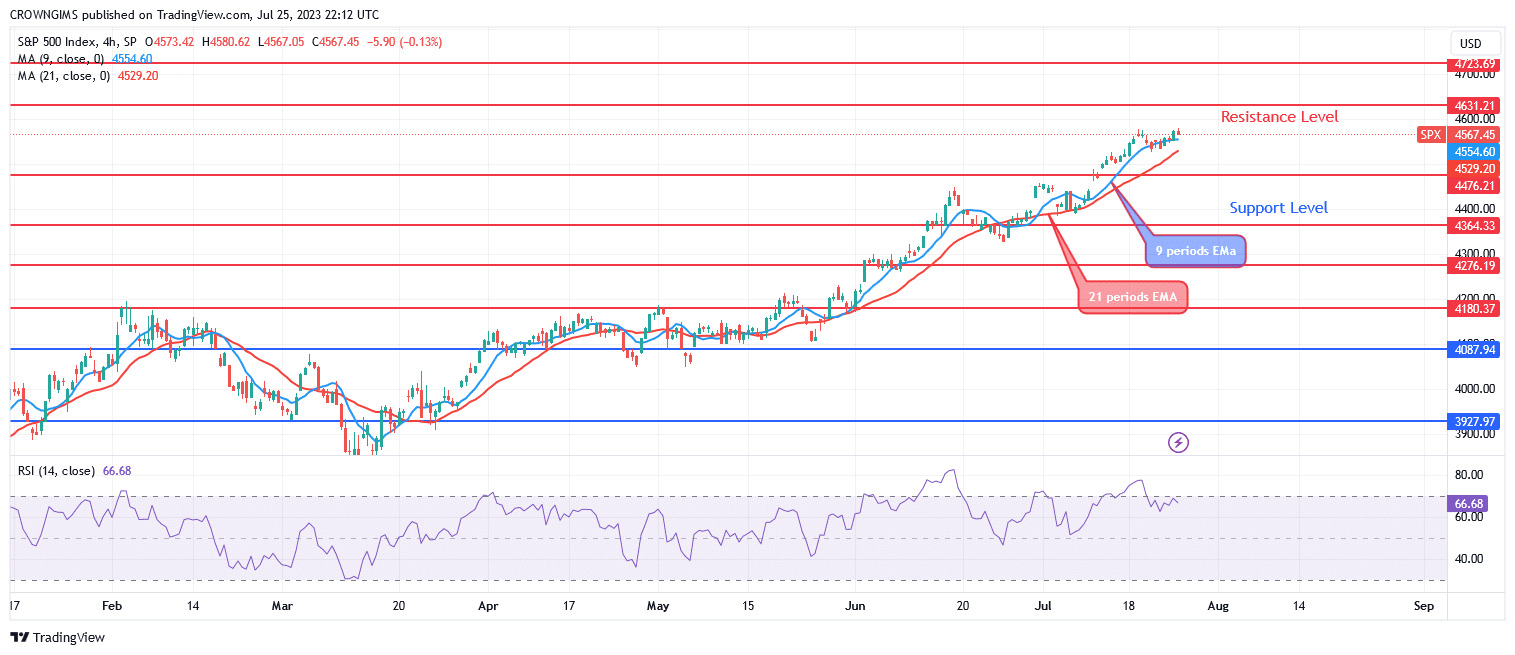

S&P 500 may surpass the $4631 resistance level, and further buying could drive the price as high as $4723 and $4813. The price may revert and fall in the direction of the support levels of $4476, $4364, and $4276 if the $4631 level is retained

Key Levels:

Resistance levels: $4631, $4723, $4813

Support levels: $4476, $4364, $4276

S&P 500 Long-term trend: Bullish

On the daily chart, the S&P 500 is moving in the bullish direction. The support level of $3927 was broken on March 9. It was unable to reach the $3740 support level since there was little to no selling pressure. On March 16, bullish pressure increases until it reaches a peak at $4476. The price increases past the dynamic resistance level. It attempted to break through the $4476 level before because of intense buying pressure, and it is now aiming for the $4631 resistance level.

As buying pressure increases, the S&P 500 may surpass the $4631 resistance level, and further buying could drive the price as high as $4723 and $4813. S&P 500 may revert and fall in the direction of the support levels of $4476, $4364, and $4276 if the $4631 level is retained. The relative strength index period 14 being at 74 and the signal line pointing higher indicate a buy signal.

S&P 500 Medium-term Trend: Bullish

On the 4-hour chart, the S&P 500 is trending upward. By maintaining the $3927 barrier level, the purchasers were able to stop the price of the S&P 500 from falling much. The price began to soar as soon as it over the $4087 barrier level as consumer demand increased. The psychological ceiling of $4631 was in sight as the price increased. When the buying pressure grew, the $4476 threshold level was crossed. It is currently targeting $4631 level.

The price of the S&P 500 is currently above the 9-period and 21-period exponential moving averages. The Relative Strength Index period 14 at level 66 displays a bullish signal.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.