Bears’ pressure increase in S&P 500 market

S&P 500 Price Analysis – 03 October

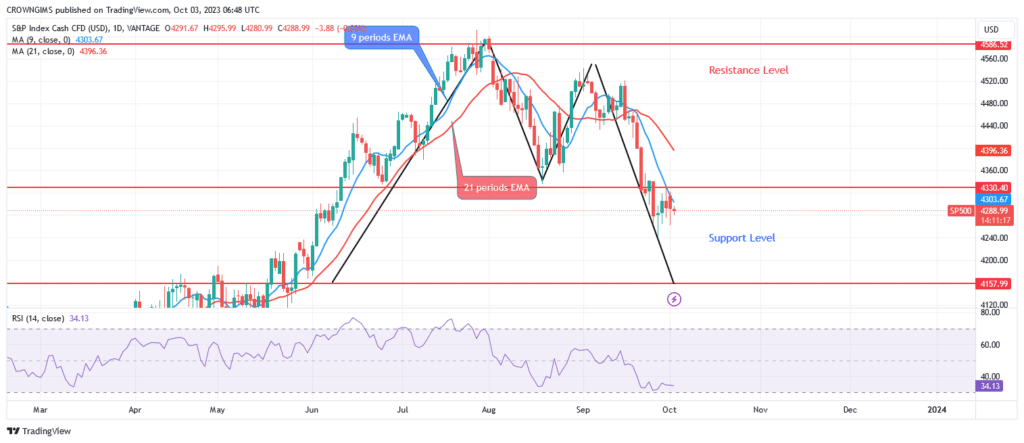

S&P 500 may continue to move in the direction of the support levels of $4157, $3909, and $3775 if the $4330 level is held. If the $4330 resistance level is broken, price may increase to the $4586 barrier level and then keep rising until it reaches $4529 level.

Key Levels:

Resistance levels: $4330, $4586, $4529

Support levels: $4157, $3909, $3775

S&P 500 Long-term trend: Bearish

The S&P 500 is going lower on the daily chart. Last month, the pricing of the S&P market was in the hands of the purchasers. When there was buying pressure, the bullish trend broke through the $4157 resistance level and reached its peak at the $4586 level. The sellers’ defense of the $4586 resistance with the formation of the “M” chart pattern and tempered the bulls’ excitement. The sellers’ pressure is effective at that point and the $4330 level was broken downside. The market is currently being driven toward the $4157 level by the bears.

S&P 500 may continue to move in the direction of the support levels of $4157, $3909, and $3775 if the $4330 level is held. The period 14 relative strength index rating of 34 and the downward trend of the signal line both indicate selling. If the $4330 resistance level is broken, the price may increase to the $4586 barrier level and then keep rising until it reaches $4529 level.

S&P 500 Medium-term Trend: Bearish

The S&P 500’s 4-hour chart reveals a trend of decline. The formation of the Double Top chart pattern triggered a bearish movement. The sellers were able to prevent the S&P 500’s price from sharply rising over the previous three weeks. Consumer demand increased and the price started to decline as soon as it passed the $4330 barrier level. The psychological ceiling of $4157 was in sight as the price fell. Price may decline below the recently mentioned threshold.

The S&P 500’s price is currently lower than both its nine-period and twenty-one-period exponential moving averages. The Relative Strength Index period 14 displays a bullish signal at level 33 that may portend a pullback.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.