S&P 500 market may pull back at $5500

S&P 500 Price Analysis – 02 July

If the $5414 level holds, the S&P 500 may rise and split into the resistance levels of $5500, $5578, and $5600. The price may test the $5265 and $5199 support levels if the $5414 support level is broken.

Key Levels:

Resistance levels: $5500, $5578, $5600

Support levels: $5414, $5265, $5199

S&P 500 Long-term trend: Bullish

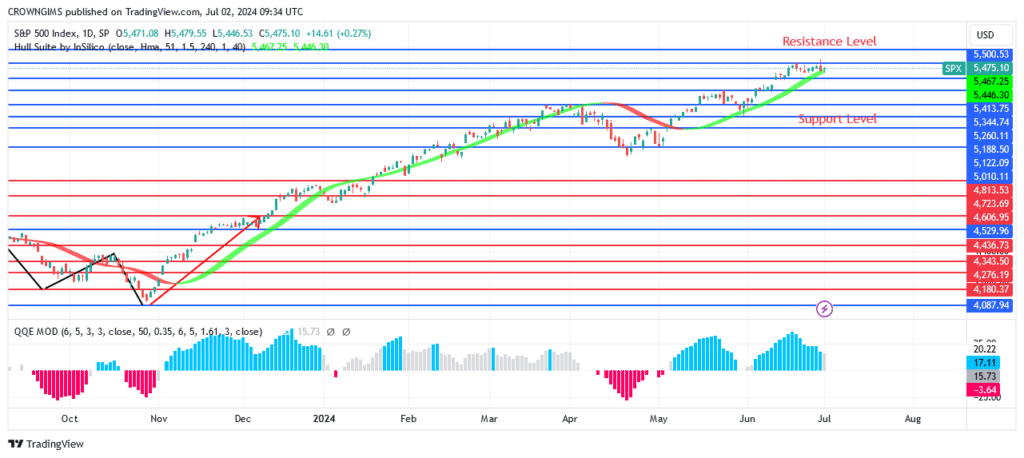

S&P 500 Index daily chart indicates an increasing trend. Since October of last year, the S&P 500 index has been mostly driven by acquisitions. On April 1, there was another attempt to breach the resistance level of $5265, which had just been overcome. By maintaining the predetermined prices, the sellers are averting additional price increases. The cost increased until $4968, at which time it increased. Because buyers are rushing to surpass the previously set threshold, the price is currently testing $5500 level, which is higher than its previous top.

If the $5414 level holds, the S&P 500 may rise and split into the resistance levels of $5500, $5578, and $5600. The price may test the $5265 and $5199 support levels if the $5414 support level is broken. Both the Hull Suite crypto signals and the QQE MOD histogram suggest a buy. Maybe it will keep going in the right direction.

S&P 500 Medium-term Trend: Bullish

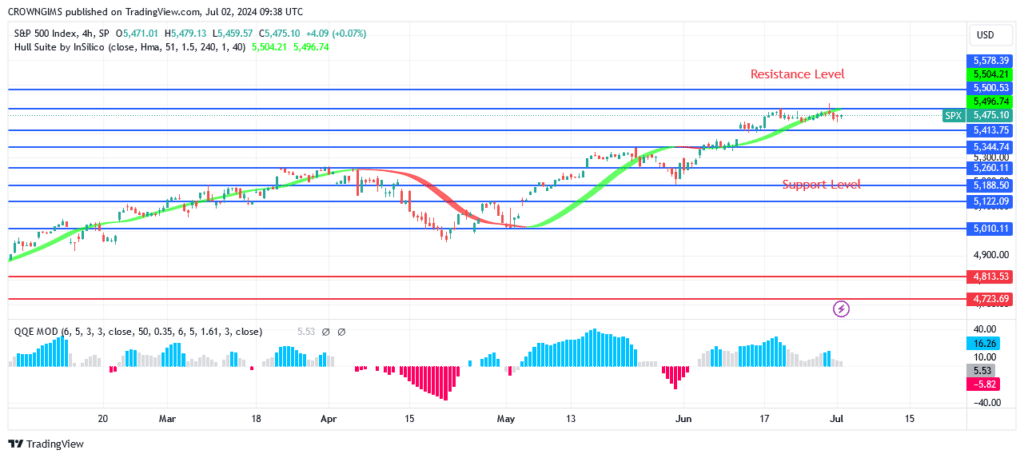

The 4-hour chart of the S&P 500 shows trends in inclination. Because of the extreme aggression of the bulls during the last two weeks, the price has broken above the $5265 barrier level. As the price has risen, the bulls have held fast to the previously established level. A bullish engulfing candle last week sent the price up to $5414. The $5500 pricing goal was accomplished. At present, bulls are trading above the $5414, the previous high.

The Hull Suite indicator is less expensive than the S&P 500. There is a buy signal when the QQE MOD indicator is higher than zero.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.