Sellers are dominating S&P 500 market

S&P 500 Price Analysis – 04 March

The S&P 500 may rise and enter the resistance levels of $5875, $6019, and $6144 if the $5758 position holds. The price may test the $5667 and $5578 possibilities if it breaches the $5758 support level.

Key Levels:

Resistance levels: $5875, $6019, $6144

Support levels: $5758, $5667, $5578

S&P 500 Long-term trend: Bearish

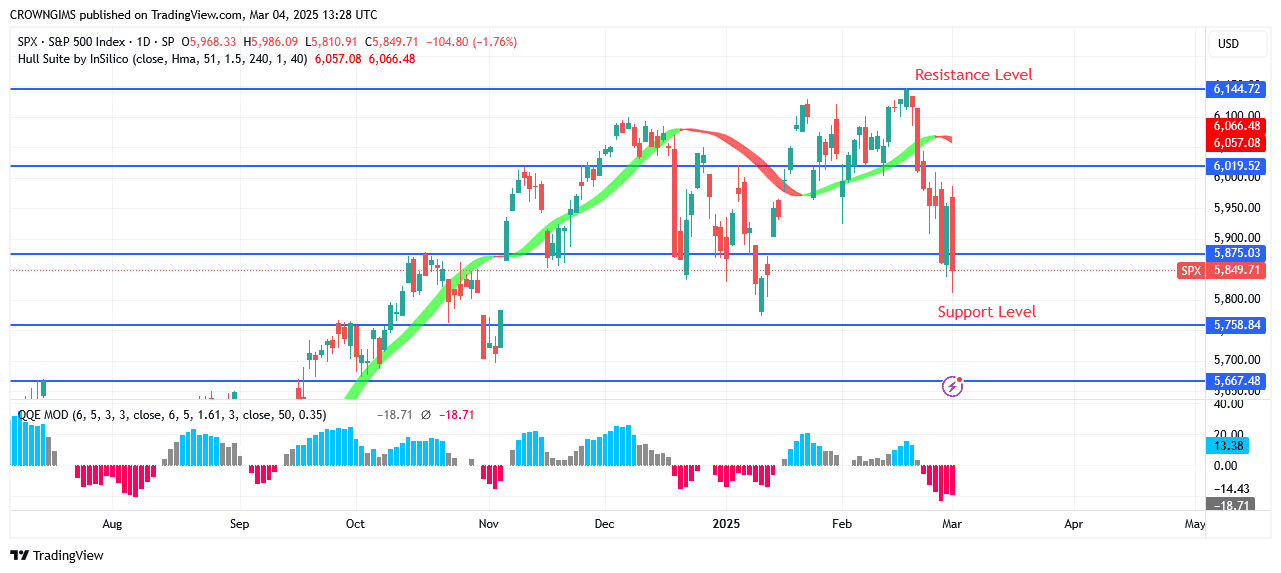

For over two months, the S&P 500 Index’s daily chart has been trending upward. Since August 5, additions have been the indicator’s main mover. On December 6, there was another attempt to reach the $6144 milestone; if the request is approved, more visitors are anticipated. By keeping the fixed price at the first location designated, the suppliers were able to temporarily halt additional price increases, and the performance double-top bearish reversal map pattern held up over time. From its $6019 position, the S&P 500 jumps to the $6144 barrier level. At the moment, the price is dropping toward the $5758 mark.

The S&P 500 may rise and enter the resistance levels of $5875, $6019, and $6144 if the $5758 position holds. The price may test the $5667 and $5578 possibilities if it breaches the $5758 support level. Both the Hull Suite crypto signals and the QQE MOD histogram indicate a sell. Everything might proceed as planned.

S&P 500 Medium-term Trend: Bearish

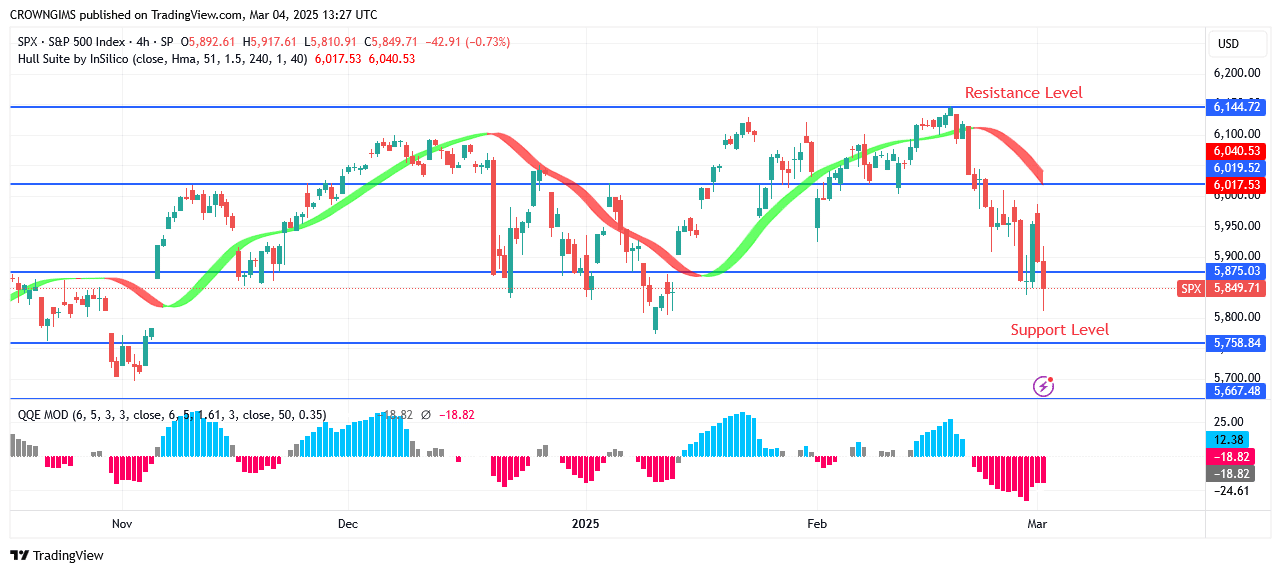

The 4-hour plot of the S&P 500 shows a decreasing trend. For the first week, the price has been unable to break above the $6144 hedge position due to the bears’ strong resistance. As the price has been falling, the bears have been steady at their assigned positions. At the moment, an engulfing candle pattern caused the price to drop towards $5758. Since the S&P 500’s most recent peak of $6146, its price has been declining.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.