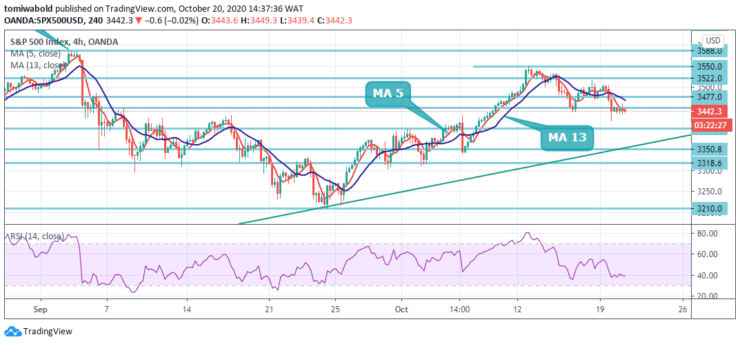

S&P 500 Price Analysis – October 20

The S&P 500 is fixing a correction from the 5th consecutive daily low level of 3419 while raising rates around 3440, up 20 points, or 0.60% during the day during the Tuesday trading session. Uncertainty about fiscal stimulus, US elections, and the pandemic could mean the adjustment is not over yet.

Key Levels

Resistance Levels: 3830, 3650, 3588

Support Levels: 3400, 3350, 3210

The S&P 500 declined in the prior day, however, its price today moved to 3460 levels, above which it should now be confirmed that the pullback is over for momentum back to 3522 levels, then 3550 levels, above which would trigger a move back to 3588 high levels.

However, a breach beneath the long-term moving averages will invalidate the bullish perspective. In this scenario, we anticipate price action to rebound and test the ascending trend line from the March lows. However, if the price retreats beneath the trendline, it may look for support around 3350 levels.

Technically, the short-term bias may shift back to bullish again as price tries to consolidate beyond its moving average 5, while the RSI is also struggling to gain traction beyond its neutral levels.

The S&P 500 is cutting its most recent decline in the four-hour chart after it touched down again in the horizontal support zone at 3450. Beneath 3450 levels, a critical contention appears beyond the base, followed by support at 3400. A price decline may reduce risks within the range and may suggest further consolidation.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.