S&P 500 Price Analysis – October 6

During Tuesday’s American session, S&P 500 alternates around 3400 marks, down 0.07 percent intraday. In doing so, the risk barometer separates paths from the upbeat output of Monday that analyzed the highs of mid-September. The speech of Fed Chair Powell, Trump’s update to COVID-19 to decide subsequently.

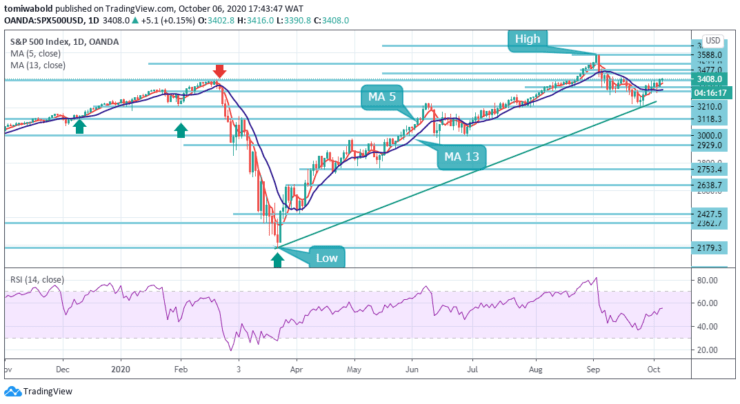

Key Levels

Resistance Levels: 3522, 3477, 3400

Support Levels: 3318, 3210, 3118

The S&P 500 index rebounded on the 3311 Level and the moving average of 13 areas, shifting back to the upside. Currently, the price is found resistance at the horizontal line at 3400 and the price is moving horizontally. The RSI is also heading sideways failing to support the upside movement.

If the index fails to close the day above the moving average 5, which is currently seen beneath the level at 3400 levels, the buying pressure could remain intact. To the upside, emanating pressure over the last couple of days has denied upside moves beyond the 3400 area.

In the short time frame, If buyers manage to jump hold beyond the horizontal resistance at 3400 levels, a revisit of the all-time high of 3588.24 level could unfold. Overcoming these constrictions could see resistance develop at a higher level.

Otherwise, if sellers drive the pair below the key 3400 levels and the 4-hour moving average 5 and 13 it may increase the risk of a move lower towards the 3350 levels. In the event selling interest persists, the key support region of 3210 and the 3118 levels, which overlaps with the ascending trendline from March could halt the decline.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.