The risk sentiment got a lift on the upbeat Chinese activity data and the above headlines, as S&P 500 upside bias continues beyond 3400 levels and jumped back in a bid to re-test 3450 levels. Note that China’s compliance with buying the US products under the Phase 1 trade agreement is about to reach just 50% of the target.

Key Levels

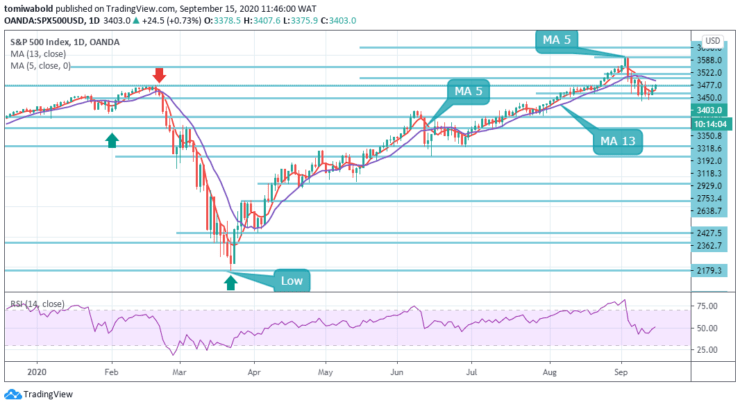

Resistance Levels: 3588, 3522, 3450

Support Levels: 3350, 3318, 3192

Looking at the chart, the price has bounced off the moving average 5 support level at 3375 levels, and now all eyes will be on the moving average 13 resistance zone at 3435-3450 range. If the price can break the 3450 levels by the time the market closes maybe it will give the bulls some hope.

On the downside, if the aforementioned support level is broken, it may resume the sell-off which might continue leading into the next session. The Relative Strength Index indicator has moved beyond its midlines into the bull territory. This does not necessarily mean the price will bounce further but the market might take a small breather before continuing lower.

On the 4-hour time frame, although the S&P 500 index is looking ready to recoup previous losses, buying exposure may not increase unless the price overcomes the 3450 barriers. In the event, the market pulls back below the 4-hour moving average 5, and the 3375 levels may open towards the 3318 floors.

The RSI has posted higher lows, indicating an improving short-term bias. However, any additional upside correction may not be attractive enough unless the index jumps past the 3450 levels. However, if the bears win the battle at this point, a more aggressive sell-off may prevail.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.