S&P 500 Price Analysis – March 10

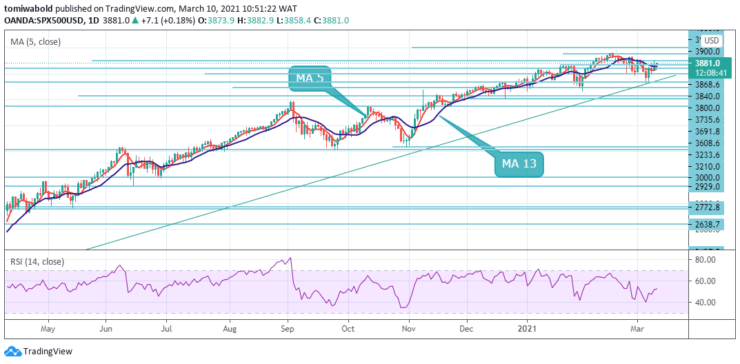

S&P 500 pullback from the all-time high of 3963 levels continues in a range as price hovers beneath the 3900 levels during early Wednesday. As of writing, the S&P 500 was up at 0.12% on the day at 3881 levels amid a softer US dollar index as market sentiment turns cautious ahead of the key events.

Key Levels

Resistance Levels: 4000, 3950, 3900

Support Levels: 3840, 3800, 3735

S&P 500 has surged higher again in the prior day to hit 3902 high levels with eyes at the resumption of the core uptrend back to the 3963 high levels and then for new record highs. However, the index upside move stalls beneath the 3882 intraday high level in today’s session.

Given the strength of the past four days, a knee-jerk pullback should be allowed for, but dips will stay seen as corrective, and while the index maintains its bullish outlook and look for strength back to not only the 3963 high levels but beyond in due course.

On the 4-hour time frame, the resistance lies around the high of yesterday at the 3900 levels next and eventually the 3963 high level. The all-time high of 3963 levels could be the next target, and if this gets violated, resistance could then develop around the 4000 barriers.

Support is seen at 3840 levels initially, then 3800, with the lower end of the channel now ideally at 3735 levels holding to keep the immediate risk higher. A break can see a deeper pullback to 3691 levels, but with fresh buyers expected ahead of stated lows.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.