S&P 500 Price Analysis – January 26

The risk sentiment took a fresh on S&P 500 as it probes recent lows in the 3830 vicinity deepening losses to the tune of 0.60% while heading towards 3800 levels. US Senate Majority Leader Chuck Schumer raised doubts over the swift approval of President Joe Biden’s $1.9T fiscal stimulus.

Key Levels

Resistance Levels: 4000, 3900, 3868

Support Levels: 3800, 3735, 3691

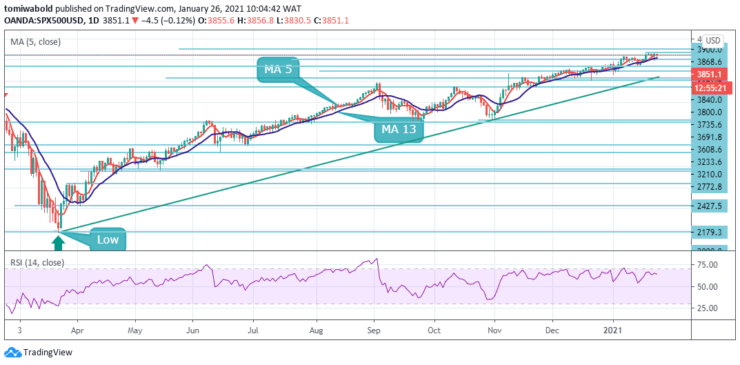

The S&P 500 pullbacks ideally hold support at 3830 marks around the moving average 13 to maintain thoughts of a bullish rebound and strength back beyond 3840 levels. The next immediate support is seen at 3800 levels, below which can see a fall to 3735 levels. After the prior day’s rally in the S&P 500 which coincided with a positive move to the 3862 levels, it later retreated to start a consolidation beneath the 3800 levels.

The technical indicators are currently endorsing the ranging outlook as the RSI is heading away from the overbought threshold, while the price turned lower after retracement from the 3856 marks. The upside break of the 3900 levels will confirm the resumption of the long term uptrend.

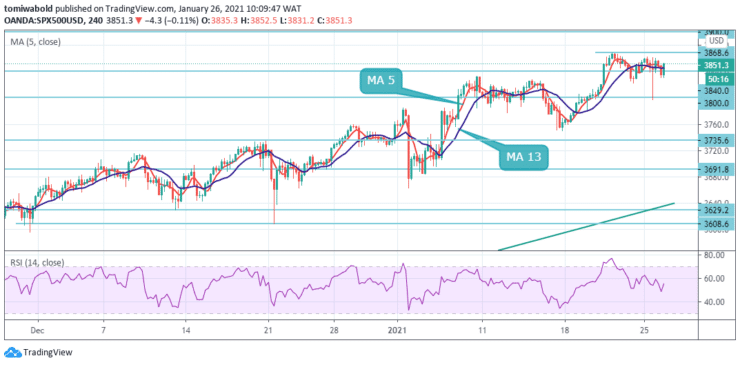

In the short-term, the S&P 500 index has been in a bullish outlook after it penetrated above the consolidation area of 3735-3800 levels in the preceding week. As the price jumped above the 3840 barriers, the expectation is a retest of the record peak at the 3868 levels before retreating.

However, an increasing ranging momentum and south heading 4 hours Relative Strength Index warn of further weakness which would bring bears fully in play on a firm break of 3800 pivots. The anticipated scenario is positioned beneath 3800 levels with targets at 3735 and 3691 levels extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.