S&P 500 Price Analysis – January 19

The S&P 500 extend prior days upside run amid a quiet European session early on Tuesday staying unrelenting towards the 3800 levels. The risk barometer rises for the second consecutive day as global markets prepare for fiscal relief goals up to $1.9 trillion.

Key Levels

Resistance Levels: 4000, 3900, 3840

Support Levels: 3735, 3691, 3546

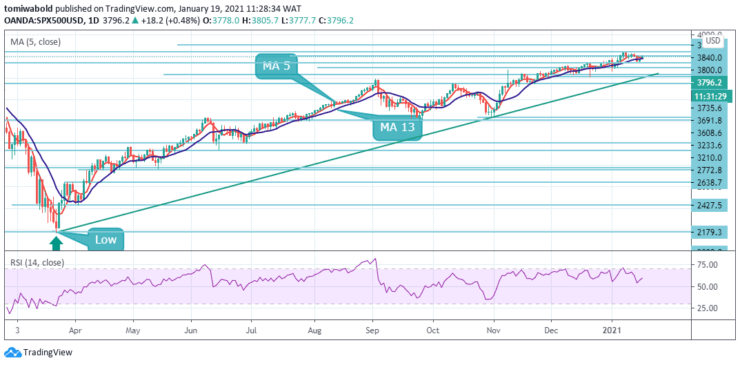

On the daily charts, the bulls have gone ahead moving positively with effort away from sideways trading and the index may attempt to sustain the breach of the resistance level at 3800. Meanwhile, if the bulls cannot take back the reins at this juncture, then there is scope for a retracement towards the next support at the 3735 levels.

The longer-term bias stays cautiously higher with further resistance seen beyond 3800 initially, above which is required to clear the path for a further advance towards 3840 levels. In due course though we may see a tougher test of a cluster of projection levels in the 3900 band and beyond.

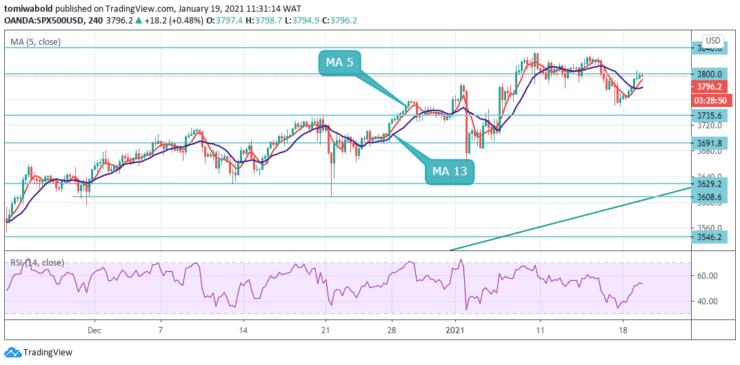

The S&P 500 surged higher during the early Tuesday trading session. The index is trading above the moving average 5 at the upside channel pattern at the 3800 levels. Technical indicators demonstrate that the index is likely to edge higher during the following trading session. The potential target for bulls would be at the 3840 levels.

However, the horizontal resistance at 3840 could provide resistance for the currency index within this session and the next. On the other hand, if the S&P 500 returns lower, it is supported on dips by the 4 hours moving average of 13 around the 3780 levels where buyers may re-emerge.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.