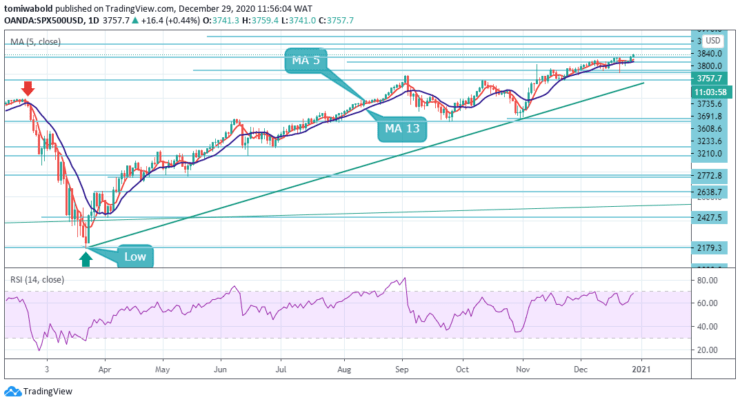

S&P 500 Price Analysis – December 29

S&P 500 index increases by 0.41% while posting fresh all-time highs past 3750, currently adding up at 3757 levels, during early Tuesday. US coronavirus (COVID-19) stimulus package signing by President Trump came as a surprise. The House members backed the $2,000 paycheck demand but turned down the veto over the defense bill.

Key Levels

Resistance Levels: 3900, 3840, 3800

Support Levels: 3735, 3691, 3546

At the moment, the S&P 500 is moving with increasing momentum towards the 3800 zone trading at its highest. As for the future, the index is likely to continue to surge within the upside channel. Bullish traders could target the 3800 area within this session.

The 3800 is the next resistance level. We should see the breakout and the price will go higher. However, if the price drops we might see fresh buyers. Positional trades come around 3691 to 3700 levels while breakout trades happen above 3800. Targets are 3840, 3900, and 4000. Break below 3700 should target lower levels 3608 and 3546 levels.

The S&P 500 surged by 19 pips or 0.41% during the early Tuesday trading session. The index is trading above the moving average 5 at the upside channel pattern at the 3757 levels. Technical indicators demonstrate that the index is likely to edge higher during the following trading session. The potential target for bulls would be at the 3800 levels.

However, the horizontal resistance at 3800 could provide resistance for the currency index within this session and the next. On the other hand, if the S&P 500 returns lower, it is supported on dips by the 4 hours moving average of 13 around the 3735 levels where buyers may re-emerge.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.